Archive for June, 2009|Monthly archive page

today – pyramid positions – okn – tap – mnd – aqa

Interesting action in todays market. I have taken the opportunity to extend my investments in some currently open positions, whilst keeping an eye on the overall market to not over extend myself at present.

okn - pyramid in

OKN: despite the funny action I saw recently, I have increased my position here. With a gap up on open this is looking strong. I note that the next significant resistance is at 3.00, however there are some minor resistance points before then.

TAP: The recent purchase appears to have successfully bounced off the support line for now, so am looking to strengthen my position. The morning opened well but the share seems to have formed a spinning top, so will keep an eye on it in the morning.

MND: Since entering with my first parcel, MND has subsided along a smooth short term down trend to marginally above my stop loss, at which point it has started rising again. I have taken the opportunity to increase the position on this break through the lesser downtrend, assuming that the uptrend is now to resume.

aqa pyramid entry

AQA: another share continuing to build upwards. Increased my position size, however I can see I am relatively close to a line of resistance at the top of the big white candle about 12 days ago. Lets see how we hold up.

Tomorrow – end of the Australian financial year. whta fun – then I’ll have to think about another tax return! arrgh – more paperwork 🙂

weekend update

Quiet day last friday, but on the whole good for my portfolio.

Ran System A scan for next week, and still nothing. However running through the charts at the moment, there are a few good trading patterns formed and in the process of forming. Definitely some nice trends developing, however the swings are quite wide, so position sizes are small to manage the risk. Will sit out of the market for the first few hours tomorrow to see how the weeks trading starts. I’m on leave from my real job this week so hope to finsh the mods to System A.

Best trade at the moment seems to be my open position in EWC, and I’m keeping a close eye on that.

comment – funny action on OKN

definitely saw some funny action on OKN transactions today as alluded to in my earlier post. Look at the course of sales figures for the stock on the ASX today … here is an excerpt below

| Time | Price | Volume |

| 11:41:04 AM | 1.77 | 289 |

| 11:41:04 AM | 1.775 | 1 |

| 11:41:04 AM | 1.785 | 1 |

| 11:38:39 AM | 1.79 | 1 |

| 11:35:39 AM | 1.79 | 1 |

| 11:32:09 AM | 1.79 | 1 |

| 11:29:54 AM | 1.79 | 1 |

| 11:26:39 AM | 1.79 | 1 |

| 11:23:09 AM | 1.79 | 1 |

| 11:19:08 AM | 1.79 | 1 |

| 11:16:08 AM | 1.79 | 1 |

| 11:13:23 AM | 1.79 | 1 |

| 11:10:24 AM | 1.79 | 1 |

| 11:05:54 AM | 1.79 | 1 |

| 11:02:08 AM | 1.79 | 1 |

| 10:57:23 AM | 1.79 | 1 |

| 10:57:14 AM | 1.77 | 30 |

| 10:57:14 AM | 1.77 | 1560 |

| 10:52:23 AM | 1.77 | 1 |

| 10:50:03 AM | 1.76 | 35 |

| 10:50:03 AM | 1.76 | 12 |

| 10:50:03 AM | 1.76 | 959 |

| 10:49:08 AM | 1.76 | 1 |

This is of interest to me because my broker tells me that I cannot make purchases of shares in less than $500 lots. Now I know small lots go through, but if I look at the days trades, there are an awful lot of ‘single share’ transactions going through – always at the ask, and seemingly pushing the price higher. This stocks fairly lightly traded today so this does change the appearance of a tick graph. If anyone was watching the days transactions, without noting volume, they may have thought there was a lot more activity than there really is.

Then again – maybe this is entirely normal – I just haven’t seen it before. I’m the first to admit that looking at intraday data is something I generally don’t do. Any comments anyone?

disclaimer – I bought this stock today, and its fair to say that the existance or not of these transactions would not have changed my view of the market, as the decision was based on yesterdays close. That doesn’t change the fact I find it interesting.

today – tap – okn

tap entry

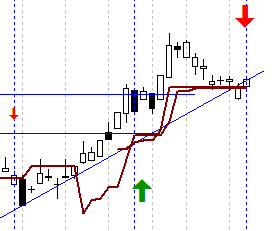

TAP: Opened a position today. I am looking to catch a bounce from the rising trend line, which is forming the lower side of a rising wedge (orange lines). Further to this I am looking for earlier resistance to become support from about a month ago. The recent rise looked like it was breaking upper resistance, so I expect this to simply be a replacement. Due to the closeness to the support the current market weakness may help the trade to fall out the bottom.

okn entry

OKN: Opened a position in OKN also, entered as the share broke through the resistance line drawn from the peak about 6 weeks ago. Oakton has strong resistance around $2 to $2.20 so will watch how this proceeds from that area.

I did something today I don’t normally do – I looked at the actual transactions on OKN – and they look … unusual – but I’ll put that into another entry.

So – for developing traders, the Traderfeed blog asks an important question in his entry today – “How well are you mentoring yourself”. Now thats something for me to ponder. As I think I said the other day, I’m happy to buy almost anything – I just have to really manage those exits. That said, I do try to pick entries, but it doesn’t stop my activity as it used to.

today – pan

pan exit

PAN: today closed position for a 2.5% gain. Entry was triggered by close above resistance line, with exit triggered on fall below stop loss line as well as the upwards trend line. Overall, happy with the trade.

I had an open in the market today for OKN which was missed. Lets see what happens tomorrow.

today – mre

mre trade

MRE: today closed position for a 22% loss. Not a great exit – the price closed above my stop loss line, however I had a stop loss in the market which triggered during the day closing the trade. I was looking to close the position anyway as the price had fallen through the trend line I had selected.

Not good – another loss over 22% – really need to minimise those… however this does fit within the plan. I’m winding back position size due to volatility, as I aim to lose 1.5% / 2% of my capital per trade – fairly standard trading rule actually.

Have also placed some closes for tomorrow due to some instruments closing below my stop losses at the close of trade.

today – pna close – book review

PNA: closed my long PNA position today for a 1% gain. I entered this position nicely on 28/4/09 bouncing from a support line. I then pyramided in at a high price, only to see the position deteriorate. My exit was triggered last friday on a close below a support line, however my exit position was not filled – my fault really as I tried to be clever and tune the exit, when I was not in a position to actually do that – leaving me to sit through the weekend with a half open position.

When a stop is hit – EXIT!

As I look at the US market starting today, the S&P500 is down more than 2% and can’t help but be reminded of the recent losses – and yet I know from my records there’s been some good gains over the last couple of months. This article is a reminder – Its ok to lose money! I know I lost money when I started when around me others were making it. Over the last year I’ve lost money – but not as much as some others have. Come July I review the annual stats – then I’ll have to go read that article again!

Following is the next installment in my reviews of trading books from my library.

“Getting Started in Chart Patterns“ by Thomas Bulkowski.

The title suggests ‘Getting started’… this book can be picked up by a beginner who has an interest in the art of reading charts. Don’t confuse this comment as one that suggests the book is for a beginner – many beginner books talk about how to place trades, differences between types of instruments and so on – this book assumes you know that.

The book specifically talks about chart trading of equities, however the concepts are obviously portable to other markets – with some care, due to his use of probabilities as they relate to his research against equity charts. Thomas’ books are valuable to me because he has done A LOT of work analysing charts and quantifying what he sees. When he talks about (for example) a Head and Shoulders pattern, he talks about the expected profit, as well as the percentage chance of getting that profit in bull and bear markets – great information! Further to that, he gives a point form list of ‘requirements’ that a chart pattern must exhibit to be classifed correctly in a particular manner.

The author remains focused throughout the text on his trading via the use of charts. A couple of times he may mention an MACD divergence or other indicator related metric – but then suggest the reader refer to other books to follow that idea through – the book remains firmly focussed on charts.

The book is written a bit conversationally in places, as the author uses simulated discussions between two traders as a tool to convey points regarding trades. Looking at the price, I must say its one of the less expensive books of its type. Whilst not to the detail of his other texts (which I’ll review at some later date) this is an excellent beginner to intermediate text.

The best thing I learnt from this text? I’ve got to say looking at ‘busted patterns’. Whilst I have been aware of them for some time, looks at the statistics – I’ll be looking for ‘busted head and shoulders’ more often!

friday – aqp – chc – fmg – pna

Friday was a busy day for me at work, and as I got home friday night, I found my portfolio had changed shape due to some of the trades I placed earlier.

AQP exit - UGLY!

I closed my position in AQP for a 20% loss – OUCH! And the graph is ugly. When I look at it now, after the pain of the loss has past, the price was clearly ranging. When the share went through my stop loss at ‘1’ I should have exited immediately – instead I held thinking it might recover… big mistake… Never second guess the plan when its in place, take the exit signal when it comes, and re-enter if conditions suit. Now to go write that out 5 times! Anyway, learn from it – and move on.

CHC entry

Entered a long CHC position today, and as entries go, I am happy so far. Pushed through what looks to me like the upper line of a flag on Thursday close, and rose all day friday – and look at the volume.

Having done this for a while, I came to my own personal view some time ago that I can pretty much buy anything – as long as I manage my exit well. I can get out with a small loss if I enter badly – but keep it to a small loss. That said, I’m always happy with an entry like the one in the picture… I’ll see how this plays out.

Entered a long FMG position. On close the days trade looks like a spinning top which is disheartening, but does not trigger an immediate exit. Will keep a close eye.

Exited a long PNA position, but I’ll write this up when I fully exit, as I didn’t fill the order.

System A: Ran my scan – which is designed to run on weekends – still comes up blank! It still doesn’t like this market.

Final thought for the week – this was an active week, more transacions than I usually like to make in a week, which is making the management of the positions more time consuming. And it appears that even the professionals struggled with making anything of this week – read what The Kirk report had to say – he’s expecting a bit more to work with next week.

today – aqa

opened AQA long today on fallback to a trendline.

A few down days in a row now – lets see how we finish up for friday. I have a couple of long positions to open in the market for tomorrow, a bit off market, based on support lines. If support fails under the friday weight on these I can see me closing a number of positions come Monday.

My Plan A and B systems are based on end of day data and are supposed to be traded that way. Something I am noticing at the moment is that in my ‘discretionary trades’, which are largely pattern and or breakout related, I am getting stopped out during the day. I am then finding the prices are recovering by day end – meaning I would not have closed that position. Looks like I have some pattern testing to do to see the impact of that process on my results. My ‘real’ job has me very busy at the moment, including after hours… still, I have to find the time.

today – roc – mcc

Another down day, and my longs are getting picked off one by one.

roc

ROC signaled an exit on yesterdays close of day price, so closed long position that I pyramided into just the other day, for a 4% loss. (Actually not really true, loss is greater as I don’t take into account transaction costs for the purposes of the blog, and this had high costs due to the multiple entries). As I look at the graph (see to the right), it has fallen to the next support region…

mcc trade

MCC also signaled exit on yesterdays close, so exited on a tidy 23% gain. Again closed near support today. OK trade though this one. I am a bit disappointed in the entry, as I bought in ‘hoping’ to push through the resistance, rather than waiting for confirmation.

This could be short term weakness (likely to be?) but to trade well, cut the losses – go by the chart – and re-enter short or long when the next opportunity arises.

Leave a comment

Leave a comment