Archive for August 4th, 2009|Daily archive page

trade idea bhp-12

well – lost out on the short trade today. The short trade was in a warrant with a hurdle at 29 which was clearly penetrated today, closing my position.

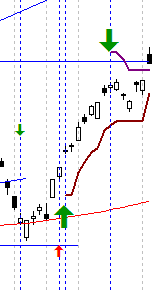

bhp today

But the long trade is still looking good. A definite penetration of resistance in early trade was quickly stopped in its tracks to stop around the resistance line.

Should resistance be penetrated it could be expected to become support, and the long trade will continue – otherwise we could be approaching its limit in a dip over the next day or two.

today – open mcc, wsa, fxj

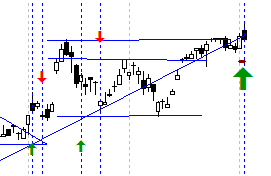

mcc open

MCC: Pyramided into my position in Maccarthur Coal. I had an entry set before the market to enter when the resistance line was penetrated. In this case it looks like resistance held, and this may prove to be a poor entry. Time will tell.

WSA: Opened a new position in Western Areas – agin bought on finding new highs just to drop back in later trade. There is an uptrend in place with this share, however it comes off the boil a bit.

wsa open

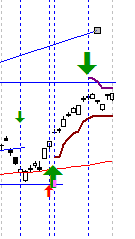

FXJ: Opened a new position in this share. The longer term graph looks like a solid base has been formed over an extended period, and now the share seems to be climbing out of it. The recent rounded bottom was mirrored in the volume (sketched in green below), with increasing volume as the price pressed through the last most higher high in mid-June. I expect this to be a better longer term performer.

fairfax open

All in all, not really happy with my entries today – the first two triggered based on a very strong market opening today, but now the trades are in – trade the plan!!

trade idea bhp-11

bhp - 3/8/09

At a point of hesitation.

Both positions are firmly within their relevant stop loss boundaries. The bulls appear at a slight advantage based on the rise late today.

Hold both short and long positions.

today – close aru

aru close

ARU: closed the position today for a 18% loss (ouch!!). That hurt, but within the bounds of the plan – just.

According to the normal plan I exited relatively well. I had an exit set after yesterdays (well – fridays) close. I set a close on opening at 0.57, thinking I’d stem the loss if the share opened down – well, it opened much further down than I expected. When I hadn’t seen the close go towards the end of the day, I did an exit at the market price so as not to let the loss get larger.

So the trade didn’t go well. Looking at the graph there are two circled areas that could be used as exits – the one that I took, and the earlier one about three days ago where the share fell through the uptrend – a preferable exit I’d suggest.

Looking at my entry from the trade opening I note my main stated reason against the trade: “I have entered just shy of an earlier area of resistance, so may have limited potential”. To that I should really have also added: “and the share is in a short term downtrend”.

I am ok with this trade, as I did stick to the plan – but in future I should keep an eye out for other trendlines – not just the first one I see.

(Edited post – I don’t know why – must be tired – I have switched ROC for ARU a few times in this post – updates to symbol made, not values!)

Leave a comment

Leave a comment