trade idea bhp-13

bhp today

So, not a good day for my portfolio today, a few stops hit which I’ll have to deal with tomorrow – looks like a late fall in some stocks.

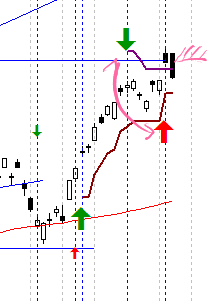

To review the position on this paper trade – as stated yesterday the short position closed out (at the upwards red arrow) for a loss of capital of ~50%, not too bad, as it was only a small position, so this still ~2% of portfolio loss.

The long trade is still open. Not looking good today due to the strong black candle falling from resistance, however I will not exit – I will wait for confirmation by closing below the stop loss line.

On another note, did some web surfing tonight and stumbled across some interesting posts.

I quite enjoyed this post about getting divorced from discretionary trading by the Milktrader – well written, and something on my mind. Since I started this blog I have been discretionary trading whilst I wait for my Systems to start generating signals.

Another article of his goes on to talk about ‘trading rules‘, and his thoughts on them (text from Milktrader):

There is personal stuff at stake. Anyone who preaches to you that you need to stop it and get a plan is really preaching to themselves. They are healing a wound, or trying to convince themselves that they no longer participate in the egregious activity of trading without one.

I find this very interesting, and I encourage you to read his article. Part of the reason for this blogs being is to assert a level of rigour over me and my actions. I lost a chunk of money a few years ago now, as well as a chunk with everyone else with the financial crisis over the last couple of years.

- My best trades (profitable, stress level) have been discretionary

- My most consistent returns over time have been system / rules related

- My worst trades have been either discretionary and system related when I have broken my portfolio allocation rules, and when holding losing trades.

As someone famous once said “Know Thyself”

Leave a comment