Archive for August 12th, 2009|Daily archive page

today – sell wsa, buy aqa

wsa closed today

WSA: My position in Western Areas was closed on market open today at a favorable price of 6.00, given I put it in to exit at 5.85 or so… giving me an 8% loss.

Exited well, exited quickly, managed the loss. Much of the market has been rising in the last couple of days, with this sticking out for not moving with the market.

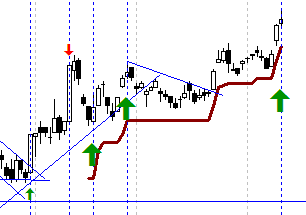

AQA: Pyramided into Aquila Resources today for a third time. Rising consistently and making new highs today.

aqa buy

Will continue to watch, and stick with a stop loss based model for now, as opposed to target picking for this one – it seems to be running nicely.

My nightly review says I was lucky not to lose another couple of positions today, but I have a few sitting slightly above stops – but definitely some running nicely in there. Just a tad disappointed that I didn’t get back in MOL a while ago!

Anyway, signing off – presentations to give in my real job tomorrow, and rest is important.

trade idea bhp-15 – closing

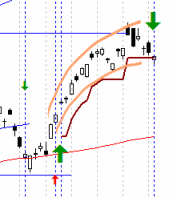

bhp - the close

Well, the BHP trade is stopped out today – see the graph to the right.

Given its a paper trade, I will assume I bailed on the fall through the stop loss line, at $37.60. Exited for a 7.7% gain.

Now – if this wasn’t a paper trade I would still be in, as the close was marginally above the stop loss (which was $37.50). So – don’t know if this is good or bad till tomorrow.

What is of interest is that todays trade has a long tail candle looking like rejection of the lower prices – so the longs may still be in the running.

all ords

The graph to the right here is the ASX all ordinaries showing the the steady rise since earlier this year, and the rapid rise coinciding with the rise I rode on the BHP trade. Its interesting that BHP appears to be at the bottom of its channel, and the All ordinaries appears to be at the top of its channel.

Transparency

Todays reading of the interwebbything covered this post from Howard Lindzon on transparency. I’d have to say I agree with him no end – I really struggle to take at face value what I read about various companies, be it in the press, the web or even the company reports. Thats why I work with charts and price movement – often with an indicator or two thrown in.

And as for the transparency provided by twitter…? I post my (public) trades on twitter more or less when they happen, and write posts here. Is it possible for me to rig my results? Yup – I’m sure I could diddle it, but for now there is no reason for me to do this – I am reporting on myself for my benefit. Over time I will start to compare my results with managed funds, and work out if I am ‘wasting my time’ – or then again – see if I can go work for a managed fund… or.. I’m sure there are other options. Its not like my day job is really stimulating me at the moment!

Leave a comment

Leave a comment