Archive for September, 2009|Monthly archive page

today – open HST, REH

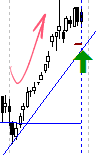

Reece 29-9-09

REH: Opened a position in Reece at $23 which makes me the recent high – hope I am not the one caught out in the wind! The risk with this share is that the market might be a bit thin if I need to exit, so only a small position.

I’m able to set a fairly tight stop here due to the closeness of the trendline.

Looking at the market depth there are very few buyers in the market, but there are a fair number of sellers. In fact until a trade went through at market close, I was the only buyer today in this share.

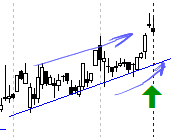

Hastie 29-9-09

HST: Opened a position today in Hastie group today at $2.25, which as you can see is climbing nicely – although yesterday was a day of weakness. Again not far off the trendline so easy to set a stop

The market today took off early but really only held the position during the day, with no real movement after the first 30 mins – at least not for my portfolio, which at the moment I can say covers many of the market segments.

Au revoir,

today – close aqa

Aquila Resources close

AQA: Closed my position in Aquila Resources today at 6.71 for a 12.8% profit.

What can I say about this trade? I’m happy with it. I pyramided in 3 times – however if I had it over again the fourth entry (3rd pyramid) was a bit too eager and should have been held off.

The only shame is the price collapse at the end of the day taking my 20% profit to ~13% in a day – too bad – followed the plan though.

On top of this I closed a few positions today in my non documented trades – for the record I followed the plans correctly. Did a scan of the market, and not seeing any strong entry signals in the last day – in general things didn’t go well on the ASX today.

Apparently the market doesn’t give a sh!t about me – I read it at Chart Shark. He seems to write very clearly a number of things I keep repeating to myself, and post about here. From the entry:

- What Can You Control?

- The only thing you can control is yourself. You can not control the market, but more importantly, the market can not control you. Only you control when you enter and exit the market.

I recommend you go read his article and absorb it. I will leave with this closing comment from Chart Shark – “The market will do what the market will do, with or without you.”

today – close MOL

mol close

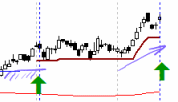

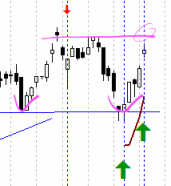

MOL: Closed my position in Moly Mines at 1.17 for a 10% loss.

Maybe this time I’m being overly strict in cutting my losses – I have taken a dip below my support line stop to exit intraday, rather then wait for the end of day close. Normally I would hold this position for an end of day close below the support, or a fall below the trailing stop loss line (the lower brown line).

I note the drying up volume as we get to the tip of this pennant, normally a good build up for a breakout of some find. Will continue to watch.

today – open ALL – close IFM

ifm close

IFM: Closed my position in Infomedia today at 0.38 for a 2.5% loss. And this is annoying. Small loss, but this one frustrates me.

This is my worst exit in a while – 3 clear exit signals where given to me, but I held on thinking I might at least close out even. BIG MISTAKE.

The price fell through my trailing stop loss (first circle in the picture), then on the third day hit the uptrend line I had on my chart – and fell through that too. The price then tracked along the bottom of the trendline before taking a dive again yesterday.

Yes I still reckon the share may recover – but that is irrelevant – I didn’t stick to the plan….I should exit, observe from the sidelines and jump back in when the conditions are right.

I have been lucky actually – if this was the market about a year ago, a break below that trendline and the buyers would have been heading for the exits leaving me with a rapidly falling stock price and the commensurate hole in the pocket. It must be a bull market – they reckon anyone can make money in a bull market – and I got out lightly here.

Repeat … trade the plan … repeat … trade the plan …

all open

ALL: Opened a position in Aristcrat Leisure today for the first time in years, at 5.06.

I was drawn towards the share from the market heat map, which showed higher price movement than usual. A review of the daily chart showed:

- break through downwards trendline yesterday

- new mid term high today

- 200 day SMA turned up about a month ago

- good volume

On top of this the share was in a consolidation pattern for some time – so lets see if it shakes off the shackles of the bottoming process.

Whatever happens – follow the plan!

today – open shv

shv open

SHV: Opened a position today in Select Harvests Limited today – in fact opened twice – at 4.09 and 4.55.

Entered this share because it crashed though its medium term high, making highest sales in just under a year. It made itself known to me from the share heat map I like to review sometimes – and has served me well for finding active points in the market, at least in the short term.

It certainly is encouraging on the graph anyway – however looking at market depth, there is a bit of a ‘hole’ under the current market price, so lets see how this opens tomorrow.

btw- if you are interested in any of my trades – feel free to make comments!

friday – wan open

wan open

WAN: Opened a position in West Australian News at 7.00 on friday.

This increases my exposure to media, a sector I expect to see some movement in over the next few months. Don’t know whether it’ll be bullish or bearish, and I have long since decided that I am often wrong in picking a market direction based on my views of the economics of a market. What I know is that I am long WAN and FXJ, and with the news about the breaking up of Telstra in the papers last week there is bound to be some volatility and leveling taking place.

As I run only on charts this is all just by the by. Lets see how this one plays out.

As an aside – System A still not returning candidates – I might have to review that system… or maybe it is telling me something!

today – open pna – extend aqa – close ipl

open pna

PNA: Opened a position in Pan Australian again today at $0.50.

This share has been good to me in the past, and whilst that is no reason alone for an entry, the volume is good, and the share is making higher highs – gotta be happy with that. The blue horizontal line is a long term resistance line, which has been firmly bounced off. trigger was yesterdays big white candle on strong volume.

ipl close

IPL: Closed my slow moving Incitec Pivot position today at $3.06 for a 4% gain.

The share failed to make a higher high on the recent rise, and was again flat today – not a good sign when the market as a whole has been very bullish this last couple of days. Incitec was a good earner prior to the GFC, but looks like it has lost the gloss, and so not apparently attracting enough buyers to drive the price up.

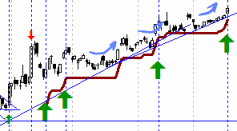

aqa - pyramids - 4 of!

AQA: Pyramided into my Aquila resources position today at $7.53.

This is my fourth entry into Aquila resources, based firmly on the strong consistent uptrend that the share price is exhibiting. I originally entered the position with a small size as I considered it a risky entry, but after increasing 3 more times after that this is now a significant holding.

So lets see what the market holds for us tomorrow as we go into Fridays trade. the market in the US has opened strongly. Volatility is good – I have some short duration options to close in the next week, and as I’m into the last 7 days, tomorrow is the day for it.

Ciao

today – close riv, okn – buy fxj

riversdale exit

RIV: Closed position in Riversdale Mining today at 5.9 for a 10% loss. This has not been a great trade – so I’ll write it up first and hopefully learn from errors. Riversdale has historically been fairly volatile, and one that I like to follow. Thinking it would break through resistance some time ago I entered a position in the share – which subsequently did break out for a whole two days. Anyway, share bounced off resistance twice after that and I didn’t exit…

I don’t have a decisive non-performance exit target for these trades, which I really should have – I tend to be very arbitrary when it comes to stagnant shares. Anyway, I’ve exited this now, so lets watch it take off 😉

oakton close

OKN: Closed my position in Oakton today at 2.92 for an 8.6% gain. Reason for exiting this position was based on the following two factors:

- Share bounced off recent resistance / not making new highs

- Share market very strong today, and relatively so for the last couple of sessions – several shares making new highs – but not this one

Note that the share did not trigger my stop loss, but considering the rest of the market was rising, I thought it best to drop the position for now. Drive my collateral to better positions… like….

fairfax - extending

FXJ: Is print media dead? Don’t know but I pyramided into my Fairfax position today at 1.665.

Looking at the share from February to July this year I think I can see a cup n saucer shape with a strong drop off on the volume during the handle – then again you can see anything if you look hard enough!

Regardless of cup n saucer formations or other names, I feel like I can see a well defined bottom that the price is rising out of, combined with a 200 period sma that has only just turned up – hence the pyramided position.

This full picture can be seen on chart.ly.

Book review – How to Make Money in Stocks

It’s been a while since my last book review – trading has been a bit quiet over the last week. In the next week I am looking to close down some of my stagnant positions – they looked good when I entered, but I am really only losing interest on the money by not being in cash – or better positions.

The run up in Gold made me a few dollars on the side, as did the movement in the AUDUSD, but I don’t profess to have much in the way of consistent results in those markets. As I get more used to those markets they may get more attention in this blog.

“How to Make Money in Stocks“, 3rd edition, by William J. O’Neil.

ok – so I am writing here about the third edition, a tad annoying as I had only had the book in my hands about two days before the fourth edition hit the stores (doh). Apparently the fourth edition is updated to take into account the 2008/9 financial crisis.

The subtitle to the book is ‘A Winning System in Good Times or Bad’, a good reflection of the content of the book. The author talks in terms of investment consisting of managing investments for the long term, by keeping a close eye on the markets in the short term and having a method to deal with it in its various stages.

The book has has the same basis as many books in the financial market – it talks about share selection and making money (seems pointless saying that really!) – but the book is really putting a share investment strategy in your hands. In other words, if you read the book and follow the instructions it contains you will have in your hands a full trading selection system for entries and exits. I must say there’s not as much about money management as I would have liked to see.

The book talks about the CANSLIM method of share selection and investment. Chase up the google searches above to find information about the methodology. The method involves combining fundamental investment ideas to select shares, with technical aspects to assist with your timing of entry or exit. The system is claimed to have been built from examining shares that have made dramatic increases over the last 100 years in the US market.

If you have trouble exiting stocks -read chapter 10 ‘When to Sell and Take Your Profit’. Then when you have done that – read it again!

Whilst the book is educational in its own right, and can be read by anyone wanting to get into share investment, it is largely a vehicle for promoting the services supplied by investors.com ‘Investors Business Daily’. The book tells you how to do calculations to determine the stocks they deem most likely to rise dramatically, and the website makes available to you the results of those calculations. In other words do the calculations yourself – or purchase the results of the calculations from the author by a subscription.

For those financially minded, and if you are not you probably aren’t reading the blog, I have to say its very reasonably priced ($12 USD on Amazon, which is terrific), and I’m off to buy the fourth edition to see what he has to say about the GFC.

In summary – inexpensive book, packed with information, suitable for beginning to intermediate level investors, and well worth a purchase. In fact you’d spend the $12 for the chapter on “When to Sell” alone.

(text updated 14-9-09, phasing only)

today – close aoe, open okn

aoe close

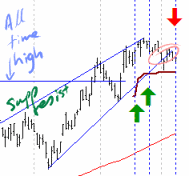

AOE: Closed my position in Arrow Energy today at $4.42 for a 2.7% loss.

In this case I have not waited for my stop loss because of ‘bad feelings’ which are based on what I am seeing on the daily price graph. Marked in the picture you can see the all time high marked. On breaching this barrier I would expect the price to stall before moving on – which it has. Looking however at the rising wedge, the top barrier is a line that was an upwards trending support line – however recently this line seems to have become a resistance line, which may hinder upward movement.

At the top of the wedge, the price seems to have come out to the downside, so for now I’m reigning this one in.

That said – it may move on, and I’ll keep an eye in case I choose to re-enter.

okn open

OKN: Pyramided into my Oakton position today at $2.94. Oakton has risen nicely in the few short days since I took an initial position. I am however sitting just below resistance so will need to see if we can push through that.

Looking over my last Oakton trade, its the same level of resistance that shook me out just a couple of weeks ago.

Anyway, off to watch the gold price that pushed through the $1000 barrier earlier today and is now trying to get itself pushed back beneath it!

Leave a comment

Leave a comment