Archive for September 17th, 2009|Daily archive page

today – close riv, okn – buy fxj

riversdale exit

RIV: Closed position in Riversdale Mining today at 5.9 for a 10% loss. This has not been a great trade – so I’ll write it up first and hopefully learn from errors. Riversdale has historically been fairly volatile, and one that I like to follow. Thinking it would break through resistance some time ago I entered a position in the share – which subsequently did break out for a whole two days. Anyway, share bounced off resistance twice after that and I didn’t exit…

I don’t have a decisive non-performance exit target for these trades, which I really should have – I tend to be very arbitrary when it comes to stagnant shares. Anyway, I’ve exited this now, so lets watch it take off 😉

oakton close

OKN: Closed my position in Oakton today at 2.92 for an 8.6% gain. Reason for exiting this position was based on the following two factors:

- Share bounced off recent resistance / not making new highs

- Share market very strong today, and relatively so for the last couple of sessions – several shares making new highs – but not this one

Note that the share did not trigger my stop loss, but considering the rest of the market was rising, I thought it best to drop the position for now. Drive my collateral to better positions… like….

fairfax - extending

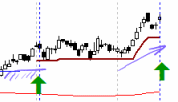

FXJ: Is print media dead? Don’t know but I pyramided into my Fairfax position today at 1.665.

Looking at the share from February to July this year I think I can see a cup n saucer shape with a strong drop off on the volume during the handle – then again you can see anything if you look hard enough!

Regardless of cup n saucer formations or other names, I feel like I can see a well defined bottom that the price is rising out of, combined with a 200 period sma that has only just turned up – hence the pyramided position.

This full picture can be seen on chart.ly.

Leave a comment

Leave a comment