Archive for October 1st, 2009|Daily archive page

today – open cpb – again!

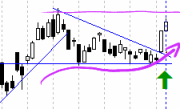

cpb - again!

CPB: Entered another position in Campbell Brothers today at 31.70, pyramiding my position.

The catch is that I am just off the top entry for the day, on a day of high volatility for the share. In fact the share fell through the stop loss today due to the high variation.

Rest of the portfolio took a bit of a pounding today, but no exits triggered – yet!

today – close pna, open amp

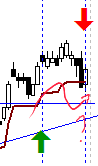

amp open

AMP: Opened a position in AMP today at a price of 6.50.

Made the decision to enter based on the big white candle yesterday combined with yesterdays healthy volume. Set a trigger entry for 6.50 (psychological choice). Not a full size position as I wont commit a standard position until I see a break of the previous high.

Up to now I have been right out of the financial sector, which is actually performing quite well in Aus at the moment. As an aside, I did see on the news there are rumours around that companies are looking to buy AMP at the moment. Don’t know (don’t care!) if there is any fact in the news – however todays stock price movement would indicate that someones listening to the rumours!

pna close

PNA: Closed my position in PAN Australian at 0.465 leaving me with a 7% loss.

This is a good exit – hit the stop and exited quickly. Reviewing the chart, I am just above two support trendlines (one rising, one flat) which would indicate that the price may bounce – however – best exit at a small loss and re-enter should the opportunity present itself.

Ok, Ok – a good exit technically – not good financially. However I see something on my portfolio statement here at the moment (not published till the weekend) but every position is now turning a profit! That is rare for a set of positions all in the black.. Helped of course by an extraordinarily bullish market combined with aggressive killing of non performing positions.

I have added a full chart view at chart.ly – have a look.

The plan is working!

Leave a comment

Leave a comment