Archive for November 2nd, 2009|Daily archive page

today – close jbh

JB Hifi close

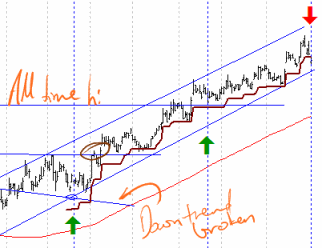

JBH: Closed my position in J.B. Hifi today at $20.40. This has given me a profit of 46% – that will help the stats.

When I look back at the entry from when I pyramided into the position I wrote at the time that this was a text book trade – which it seems to have been right until the end.

Happy with this trade – it ticks the boxes:

- Clear reason for entry (something not apparent in some of my trades)

- Followed a simple clean plan

- Broke through a downtrend, then an all time high to keep plowing into higher territory

- Good profit

And look at the smoothness of the red moving average (140 day) under the trend. A treat!

Anyway this is (was?) the longest position I have held since starting this blog that I’ve documented. Anyway its gone now – but who knows I may open it again in a couple of days…

Here’s to my dwindling portfolio, and increasing cash position!

Where are we at?

So where are we at?

All Ords last friday

To the right is a graph of the ASX All ordinaries from the close of trade last friday. Last thursday was a rough day on the ASX, and resulted in me getting kicked out of a bunch of positions, as seen in my previous post.

Friday itself was a nice up day, but a day when I sat on the sidelines and watched. (Well actually – I worked on my real job and wondered if getting out Thursday was the right thing!).

I now see Friday was a rough day on the US markets, and I liked the way The Fly wrote about it here – making the link with Halloween. He says he took on losses. I know last week cost me, but not nearly as much as it could have.

Anyway, back to the chart above. This whole business interests me because its about patterns… patterns that repeat, and patterns that don’t. I like these two curvy squiggles I have drawn. Can I trade them? Too early to say, but I do see repetition. Break to the up – go the bulls, break through the bottom, and I might get to see how the other half lives for a while.

Today is not a day for picking a direction. I see a setup. I wanna wait to hear which way everyone is going, so I can follow.

Mike at 5000trades, someone I might start to think of as the poet of the Australian markets and an interesting read because I have seen him take the opposing view to myself, is going for the sell this week.

Risk v Reward

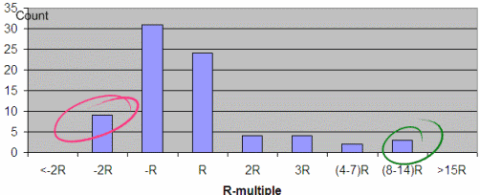

This is a graph of my R-multiples this year so far.

R multiples

I am particularly proud of one particular point of this graph. I have no losses or greater than 2R – then again, gotta love a bull market. I tend to get a loss of greater than 2R when I miss market days through travel, I have a position that crashes a stop loss or some other unplanned reason.

The -1R and +1R trades almost cancel out, which leaves me in a positive position due almost entirely to the existence of a few trades in the 10R range. They are the trades that make this all worthwhile. Without my 32 -R trades, I may not have taken those high perfomring trades.

I take the loss, so I get to keep playing to take the win.

As stated previously, not all trades get to this blog, but once opened here and twittered, I close them out here.

Monday market opens in 3 minutes – and I don’t care, coz I’m not watching today.

Au revoir!

Comments (2)

Comments (2)