Archive for November 18th, 2009|Daily archive page

today – open wor

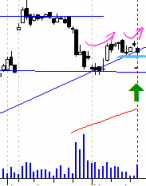

WOR: Opened a position in Worley Parsons today at $27.25. Looking for a bounce on the climbing trendline.

I intended to get in on the bounce about a week ago, but missed the chance. Entered todays position on the market open.

Its a down day and slightly below the trendline, so this might be a short trade. Also there is a resistance zone a little above. Lets see how this goes.

today – open mcc, close cpb

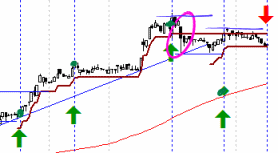

MCC: Opened a position in Macarthur Coal today at $10.20. The share made a new high for the year when I was entering, but has since subsided into the close of the day. Volume was good today (double yesterday), so all in all a reasonable looking entry.

Counting against this entry is the observation that this share looks to have lost some of its momentum over the last 3 months or so – maybe this new high will change that… maybe it wont.

CPB: Closed my position in Campbell Brothers today at 26.99 for a 15% profit by the time you take into account all the entries I made when pyramiding.

You can see in the pink circle the effect of the capital raising, which has stalled the price action in its tracks. The fourth entry, shown as the low down green blob is the entry point of the shares collected via the capital raising.

Fairly straight forward trade, stuck to the plan for the first bit, a momentary panic when I had to think how I would react to the capital raising, and then (new plan under the arm) I traded the second half according to my updated plan.

To date I have not updated my plan with how to deal with this situation, as I wont hit it too often, and looking at a few over the years, I have had some capital raisings that have treated me well – and some have been a disaster. You can see above the plan in this case simply involved resetting my ATR based stop loss when the price stabilised.

system A fires – first time in ages

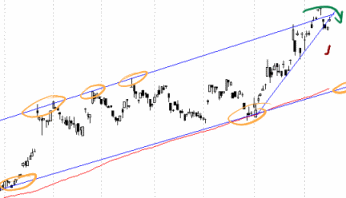

My trend following System A fired for the first time in ages today. And it only came up with the one – Centamin Egypt (CNT).

Looking at the chart, it is not what I’d call an ideal entry!

CNT is climbing a rising channel, and is just on the bounce from the top of that channel.

There are a couple of reasons I am going to skip this first entry from my system:

- I can’t get it on margin, and cash reserves are light

- It looks like its about to dip, so going short might make sense – but this stock seems unborrowable – so can’t short it.

Anyway – now that the system has fired, I expect a few more options to arise over the next week. For more about System A look here.

Leave a comment

Leave a comment