Archive for May, 2012|Monthly archive page

recent – open btr (short), close sxy

BTR: I opened a short position in Blackthorn Resources on friday at $1,11 using a CFDs. The trade came from System B. The share has broken lower from an equilateral triangle. Favourable factors for this trade – dominant downward pressure on the market at present, System B flagged the trade. Against the trade – well I can’t see much a volume confirmation. As noted before I don’t usually get too fussed about volume, so maybe I am jumping at shadows. Lets see how the position plays out.

BTR: I opened a short position in Blackthorn Resources on friday at $1,11 using a CFDs. The trade came from System B. The share has broken lower from an equilateral triangle. Favourable factors for this trade – dominant downward pressure on the market at present, System B flagged the trade. Against the trade – well I can’t see much a volume confirmation. As noted before I don’t usually get too fussed about volume, so maybe I am jumping at shadows. Lets see how the position plays out.

SXY: I closed my position in Senex Energy today on System B at $0.84 for an overall 15% loss. (This is a blend of the initial and pyramid positions). Not a good trade at all.

SXY: I closed my position in Senex Energy today on System B at $0.84 for an overall 15% loss. (This is a blend of the initial and pyramid positions). Not a good trade at all.

This trade is a great example of ‘doubling down’ on a losing trade. Enough of the trading books I have read say not to do this – and there’s a reason: It’s a BAD idea. Writing this is my attempt to program this into my brain… I haven’t done it in a while, and its to be avoided.

Only pyramid into winning trades!

today – close brg, cmj, open bhp (short)

BRG: I closed my position today in Breville at $4.26 for a 6% profit under System B. The exit is unfortunately well off the peak about 3 weeks ago (these are weekly charts for System B), giving up a nice bit of the profit – remember it’s not about picking tops and bottoms though..

BRG: I closed my position today in Breville at $4.26 for a 6% profit under System B. The exit is unfortunately well off the peak about 3 weeks ago (these are weekly charts for System B), giving up a nice bit of the profit – remember it’s not about picking tops and bottoms though..

Anyway, taking into account the original entry, and the pyramid entry, this is a very nice trade! Note that the 6% profit does not include the original entry, as that was taken before I returned to my blog – so that would be cheating.

CMJ: I closed my position today in Consolidated Media Holdings at $3.20 for an 8% profit under System B. If you look closely at the few bars prior to the close the share appears to be forming a broadening triangle, so I suspect there might be a significant move here shortly. I might keep this on the radar, and see what comes next for this one.

CMJ: I closed my position today in Consolidated Media Holdings at $3.20 for an 8% profit under System B. If you look closely at the few bars prior to the close the share appears to be forming a broadening triangle, so I suspect there might be a significant move here shortly. I might keep this on the radar, and see what comes next for this one.

Again, as for the BRG transaction above, this is a very nice trade, taking into account the original breakout followed by the pyramid entry. I’m very happy with this one also 🙂

As for the one above, the 8% profit does not include the original entry.

The exit is unfortunately well off the peak about 3 weeks ago (these are weekly charts for System B), giving up a nice bit of the profit – remember it’s not about picking tops and bottoms though.

BHP: I have opened a short position in Broken Hill Pty Ltd today based on a System B entry. I have entered this position when BHP was at a price of $32.17 using a short option position for leverage. Similar to my warrant positions, it’s quite small in order to manage the risk.

BHP: I have opened a short position in Broken Hill Pty Ltd today based on a System B entry. I have entered this position when BHP was at a price of $32.17 using a short option position for leverage. Similar to my warrant positions, it’s quite small in order to manage the risk.

The option expires in about a month so if should track closely to the actual value of the trade. The value is in the money, but only just. Lets see how we go.

today – open gnc (re-entry)

GNC: I opened a long position in Graincorp today at $9.50 in System B. The share dropped sharply towards the end of the last trade, however my system triggered a buy in it again last night. The share didn’t drop as much as others in the market did, so there may be some strength in the share.

GNC: I opened a long position in Graincorp today at $9.50 in System B. The share dropped sharply towards the end of the last trade, however my system triggered a buy in it again last night. The share didn’t drop as much as others in the market did, so there may be some strength in the share.

As I look at the european market tonight, its again taking a hit. This might again be a fairly short trade.

end of week – open sxy, short ago, stopped out whckob

The damage to the portfolio continues. On friday I had an entry found on a current position, and had another warrant position go pop! Commentary below.

AGO: I opened a short position in Atlas Iron on friday at $2.14 using a short CFD position. The trade came from System B. I’ve held off short trades for a bit, based on a couple of factors.

AGO: I opened a short position in Atlas Iron on friday at $2.14 using a short CFD position. The trade came from System B. I’ve held off short trades for a bit, based on a couple of factors.

In Australia at the moment it can be tricky to put on short trades. The options for short trades come down to option positions, warrants, and shares that are shortable via a CFD – the usual short market seems to still be fenced from retail traders.

When my system comes up with a short trade, I then need to try to locate a mechanism to take the trade, and that is combined with my past history of some unsuccessful short trades. That said, when I did do short trades in the past, they weren’t based on a system. Let’s see how this one goes.

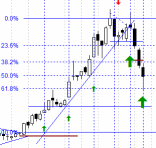

SXY: I opened a further position in Senex Enegy on friday at $0.75 on System B. This is actually pyramiding into a losing position, and generally not a good idea.

SXY: I opened a further position in Senex Enegy on friday at $0.75 on System B. This is actually pyramiding into a losing position, and generally not a good idea.

The entry was based on a decline of 61.8% from the recent high in SXY, so a bounce at this point is a reasonable expectation – it looks like it has taken quite a hit in the current market, so this is taken with the view that SXY has over-corrected. Will watch for a bit and see how this plays out.

WHCKOB: During the week I was stopped out of the Whitehaven Coal position, as this trade was done with a warrant that had an inbuilt stop loss.

Lets watch those stop losses this week.

update 5/6/12 – corrected my AGO entry price. Unfortunately the correct value is a smaller gain 😦

today – close gnc, prg

More positions being taken out today, and it looks that there will be more tomorrow.

GNC: I closed a position today in Graincorp at $8.85 for a 4% loss as a System B trade. This looks to be another trade cut unnecessarily short due to the currently falling overall market. This is a case of a well found candidate, and I followed the system to a T.

GNC: I closed a position today in Graincorp at $8.85 for a 4% loss as a System B trade. This looks to be another trade cut unnecessarily short due to the currently falling overall market. This is a case of a well found candidate, and I followed the system to a T.

PRG: I closed my position in Graincorp Limited today at $2.28 for a 10% loss. Again a System B trade.

PRG: I closed my position in Graincorp Limited today at $2.28 for a 10% loss. Again a System B trade.

Again I stuck to the plan, and have only taken a small loss.

For tomorrow it’ll be something I don’t do too often anymore. I’ll take a short trade that System B has signalled today. On my tests System B seems ok on the short side, however my statistics on real short trades do not reflect the expectations of the system. I’ll have to sit down and analyse that in detail at some stage.

recent trades, close mms, bptkmb, open mvp

So the impact of the Greeks is taking out my positions, slowly but surely. Been a busy week at work so I haven’t been posting my updates promptly, but I am seriously having to gauge whether I drop all positions, or hang in there. SXY seems to have fallen so far I would be entering again looking for a rebound… possibly a really bad idea though…

BPTKMB: I had my position closed yesterday in my warrant position Beach Energy at $1.20 for a 50% loss under System B. The stop was the exit price on the barrier warrant, which returns the intrinsic value to me in a week or so. As I bought in at a low price, and the warrant exit price aligned with my stop loss on a System A trade.

BPTKMB: I had my position closed yesterday in my warrant position Beach Energy at $1.20 for a 50% loss under System B. The stop was the exit price on the barrier warrant, which returns the intrinsic value to me in a week or so. As I bought in at a low price, and the warrant exit price aligned with my stop loss on a System A trade.

You can see how the price fell after exit day in the picture to the right so that stop loss worked well for me – noting that my position size was quite small so a 50% loss is not a significant cause for concern.

MMS: I closed a position recently in Macmillan Shakespeare at $10.51 for a 1% loss. This was a good trade in regards to a good clear entry, and the exit was clearly defined. MMS has been a good share in relation to strong moves, so I may be back in it shortly – let’s see how it pans out.

MMS: I closed a position recently in Macmillan Shakespeare at $10.51 for a 1% loss. This was a good trade in regards to a good clear entry, and the exit was clearly defined. MMS has been a good share in relation to strong moves, so I may be back in it shortly – let’s see how it pans out.

MVP: I opened a position in Medical Developments at $0.75 using System A. This is a risky position due to the greater market moves – although this share has been growing consistently and strongly for some time. You can see todays movement in the share price and the dip was fairly strong – however the price seems to have stalled at a resistance level.

MVP: I opened a position in Medical Developments at $0.75 using System A. This is a risky position due to the greater market moves – although this share has been growing consistently and strongly for some time. You can see todays movement in the share price and the dip was fairly strong – however the price seems to have stalled at a resistance level.

last friday – close sai, waa, nwh, bru

The last week has been flat to down, and my portfolio has taken a bit of a bit. I was kicked out of a few trades friday, as listed below. There are others that should be closed, however I don’t usually close too many positions in one hit as I have noticed that it leaves me too underexposed

The last week has been flat to down, and my portfolio has taken a bit of a bit. I was kicked out of a few trades friday, as listed below. There are others that should be closed, however I don’t usually close too many positions in one hit as I have noticed that it leaves me too underexposed

WAA: I closed my position today in WAM Active at $1.07 for a 7% loss under SystemB. The share fell rapidly following my entry, however I didn’t release immediately as it’s a weekly trading system. The exit was triggered at the end of last week, but under the rules I can exit anytime this week – I waited until friday to see if the market would increase at all. Funnily enough, the share recovered friday so my loss was slightly lower than expected.

BRU: I closed a position today in Buru Enegy at $2.69 for a 14% loss under SystemB. This was my second entry, looking for a bounce at the point of entry. The position didn’t play out as expected, so I exited quickly. Given the loss, not quickly enough – but within plan nonetheless. I really did miss a good move in Buru, which seems to have occurred slap-bang between my two trades.

BRU: I closed a position today in Buru Enegy at $2.69 for a 14% loss under SystemB. This was my second entry, looking for a bounce at the point of entry. The position didn’t play out as expected, so I exited quickly. Given the loss, not quickly enough – but within plan nonetheless. I really did miss a good move in Buru, which seems to have occurred slap-bang between my two trades.

NWH: I closed my position today in NRW Holdings at $3.58 for a 13% loss under SystemB. I seem to have picked a top again by buying into it!

NWH: I closed my position today in NRW Holdings at $3.58 for a 13% loss under SystemB. I seem to have picked a top again by buying into it!

This entry has actually disappointed me – looking at the entry point, there is no clear breakout – I really just bought in on a high volume and dominant candle. This is what I am supposed to be avoiding in System B, so I actually have to call this a poor trade – even though I executed my exit strategy correctly.

SAI: I closed part of my position today in SAI Global at $4.68 for a 10% loss under SystemB .

SAI: I closed part of my position today in SAI Global at $4.68 for a 10% loss under SystemB .

I was definitely more happy with this entry than the previous one (NWH above) as it was a breach of a longer term resistance line. A nice clean entry, but it looks like rejection of the higher prices was fairly sudden and strong. I snuck a look at market depth late friday, and I noticed almost all sellers leave the market, leaving lots of buyers, and almost no sellers – I was expecting the price to suddenly jump, so I moved the remainder of my position to a higher sell price. Just prior to close a lot of sellers re-entered, keeping the price down on close. Will look to exit the balance of the position shortly.

All up – a week of losses, and general erosion of the portfolio.

today – close lsa, open tel

So the last couple of days have been a bit hectic for me and it looks I have some stops to take out. Hopefully I can get online and transact them tomorrow.

So the last couple of days have been a bit hectic for me and it looks I have some stops to take out. Hopefully I can get online and transact them tomorrow.

LSA: I closed my position today in Lachlan Star under SystemB . The share touched my stop loss on the share and so I was exited. Looking at the remaining open positions this one may have been worth keeping, as some of the others are not looking at all healthy. Oh well – drop the losers, ride the winners. Today this one isn’t a winner.

TEL: I opened a position today in Telecom NZ today under System A, the longer term trending following system. I actually missed my entry yesterday and chased price overnight to enter. I haven’t logged in during the day for a bit and this can delay the transactions.

TEL: I opened a position today in Telecom NZ today under System A, the longer term trending following system. I actually missed my entry yesterday and chased price overnight to enter. I haven’t logged in during the day for a bit and this can delay the transactions.

This share really has a nice slow steady increase – and I just hope it keeps on going the same.

The last couple of days have been a bit unusual – the US and UK markets are not showing strength, but today the ASX made some new mid term highs – a good sign for the next short period of time. Also maybe even a divergence with these other western markets.

Leave a comment

Leave a comment