Archive for the ‘discretionary’ Category

today – close shv, all

shv close

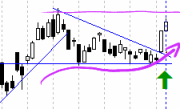

SHV: Closed my position in Select Harvests today at $4.10, for a loss of 3.53%. Due to the double entry on the day the share took off, I had an average entry price of $4.22.

This trade got off to a belting start, and took off just nicely. Unfortunately it formed a rather obvious double top, which has been completely formed with todays close, so got out.

A better exit may have been to call the double top when it as clear, which was roughly mid last week, however I held in there for the stop loss to be hit.

Reviewing the graph I suspect there is still a trade to be had here, but I’ll go back to observing, and make another entry if the condition arises.

Still – happy with the entry, and I am on the fence as to whether I should have taken the earlier exit, as I would have at least exited with a small profit. Not to worry – I stuck to the plan, so thats good enough for me.

Aristocrat close

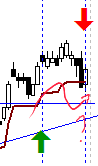

ALL: Closed my position in Aristocrat leisure today at $4.75 for a 6% loss. Like the one above, I am a bit disappointed in this one – I thought the chart had it all (see the entry write up here) but it was not to be.

The stop was triggered in fridays trade, with the exit taken mid morning today, missing the open as I just hate market orders. Gapping down on a Monday opening is not good for an exit.

Note the high volume today, and the bearish doji today. This does look like a typical reversal signal, and funnily enough (even though I have never mentioned fibonacci here before) the doji close is pretty much on the 0.618 retracement.

In this case I actually think that this share is at a bounce point and may well recover from here… so I may well enter again shortly.

The month so far…

Remember analysis is neither right nor wrong at the time of entry – only well reasoned. The market tells you when you close the trade whether you were right or wrong. That’s because, well, the market is NEVER wrong.

This means I have a month of only losing trades at the moment, with another 3 sitting within in bee sting of their stop loss points – but some that are open are hanging in there nicely.

today – open aqa (again!)

aqa 22-10-09

AQA: Opened a position in Aquila Resources today at $8.25.

As usual I’m not that fussed about the shares I enter – its what I do when I’m in there that makes me money. So in this case you can see I just drew a new trendline to use as an indicator. I’ll of course use this with my usual ATR based stop loss.

My last trade in AQA rewarded me financially as you can see here. The exit last time was due to falling through my stop loss – in a trade I was quite happy with because of the nicely planned execution. I trust I will be able to execute as elegantly again.

As for changing my trendline – I don’t get too fussed about trendlines. I have read a lot about ‘how to draw a trendline’ by many authors, and some are sticklers for detail. Me, I like to draw one, and stick with it for that trade, occasionally changing it if its a longer term trade and the chart warrants it – just never drop the stop loss that it may be indicating!

ATAA

On another note, I’m off to my first real trading conference tomorrow at the ataa event in Melbourne. Hopefully I will learn stuff, and keep the right filters in so I learn to learn what I need, without getting carried away by talk of ‘whats hot’.

Signing off – after my first trade in a while. Not because I’ve been holding off, but my stops haven’t been firing, and the cash reserves are at the limits I am comfortable with for now.

end of week – close sgx

SGX close

SGX: Closed my position in Sino Gold on Friday at 7.02 for a 3% loss.

Exit taken as the price fell to close the gap on Friday, which had existed for the last two weeks or so. The price is appearing to form a double top, however this is not confirmed yet as the price hasn’t closed below the lower valley. This share may be worth following further as the price may bounce on the upwards trend line, or may form a nice double top – either way, my automatically triggered stop loss based on %-age loss has been hit, so this transaction is closed for now.

Ultimately a quiet week for me – I monitored my open positions for the week, and only had this one close to deal with all week – its been a while since I’ve had a single transaction week!

All capped off with a wonderful weekend in the Victorian high country – Beautiful!

(minor text edit 19-10-09)

end of week – open ozl

Oz Mineral open

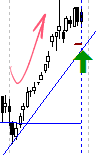

OZL: Opened a position in Oz Minerals on friday at 1.285.

A nicely defined upwards triangle has formed over the last 3 months or so. As you can see I basically decided it wasn’t going to form at the end when it dropped out the bottom of the formation, breaking the upwards trend line – however (benefit of 20-20 hindsight and looking more carefully) you can see that when the price came out the bottom of the formation the volume all but dried up.

The price has now broken upward, effectively completing the original pattern, and busting the failed pattern – so enter long.

Good healthy volume, lets see where this goes.

today – open sgx – thoughts on cpb

sgx open

SGX: Opened a position in Sino Gold today at $7.25. Selected this position today based on the high movement causing it to show up on my heat map early in the day.

Quick analysis showed a share in a 3 month uptrend, and just below medium term resistance. There have been 3 touches with the trendline I have drawn, so I’ll use it as an indicator for this trade.

Volume has been dipping over the last month and I would like to see this improve. Looking at the moving average ribbon, the investors are holding strong, and the short term traders are starting to get involved in the share again. I don’t know the reason for the gap up today – but then again, there’s not enough time for me to keep up with the news.

Probably not my best entry in a while – but now I’m in, I’ll manage the trade. Selecting the share is not the major hurdle to me, its getting out the other side well that matters.

CPB continues

CPB: Campbell Brothers – comment on my position… I’ve been thrown that curve ball that I don’t like to get – something that my plan doesn’t really cover.

Campbell Brothers has fallen through the ATR based stop loss I set – but is still above the rising trend line by a tad. The reason seems to be that Campbell Brothers has joined the list of companies over the last few months that are asking for more money by fund raising from the markets. So – the price is artificially low, and looking at previous shares that have done this, holding seems to have been a wise move… ok, that’s not a detailed analysis and may well have to research that (doh – homework!).

So the new plan is to lower my stop loss price, which is certainly a potential hit to my profit on this trade. Technically my plan covers me if the share drops further, but it is a bit ‘grey’ at this specific point in time.

The real question here is – do I want to write a rule for how I respond to these situations? I’ll have to think how to test that.

… and look at that AUD …!

end of week – close hst – the noises you hear

HST close

HST: Closed my position in Hastie Group on friday at $2.05 for a 9% loss.

So – what can I say apart from – Quickly in, quickly out. You can see the entry I did when opening the position here. I note that I even said that the share has a sign of weakness on the day prior to me opening the position. Quick exit as both increasing trendline and ATR based stop losses triggered.

Given the activity in the Australian market in the latter part of the week, and the US (3.5% drop on the last 3 days of the week) I am tempted to reign in my R size a bit for this week, as this will move me into more of a cash position, as I am currently long stocks in many sectors in the Australian market – many of which you can see on my portfolio page.

XJO – ASX200.

ASX 200

Looking at the picture to the left you can see the graph finishing on friday for the ASX200. The trendlines are a collection of SMAs, a la the Guppy MMA. I don’t use these for triggering, but I do use them for a ‘market feeler’. Looking at the graph, there is a sharp drop through the short term MAs, but no effect on the longer MAs – there is still strength in the long term trend.

My take away from this is that we’ve hit October! The month of dismay at many times in history in the markets, the month the bears often tear up the prices. Will this happen this year? Don’t know – but I do know a lot of people seem to be expecting the bears to do their damage. So will the noisy crowd get it right or wrong? Looking at the graph above, the long termers are holding strong, and the short termers are stumbling. Look back at March this year – it took months for people to agree that the bulls were pushing things up.

To deal with this I’ll do what I always do – stick to the plan. Drop my R a bit as mentioned above, and take the exits that come my way.

I know one thing I will do this week – take out a market protective put option – I just have to choose one first.

The Noises

I did something this weekend I hardly ever do – I met with traders… I went to the Trading and Investment Expo in Melbourne. I only saw a few things – everyone just wanted to sell me another broking service, or some financial planning – neither of which I am after. There were some advisory services on offer – some with excellent results they can quote me – but until I see some of them in action, I still consider myself a sceptic.

Anyway – back to the noises. I actually ended up speaking to some traders. something I think I can say I have never done in my life before. So far I have read books, bought shares n other bits and pieces, skimmed magazines and looked at chart after chart after chart. I reckon I have had to talk to the kids, read books, watch tv since then – just to get some of their views out of my head. When I left the expo I was thinking – ‘they’re right, we’re all going down this week, I’m going to have to exit my longs, and take some shorts’.

Fast forward to tonight. From the above – yes market weakness. Yes bearish signs. Yes history is against it. But from my charts – one stop loss hit. Some shares are in interesting buying positions. I’ll stick to my graphs, and my assessment.

Maybe next Sunday I’ll be writing about why I should listen to the crowd – but not yet 🙂 I’ll read their footsteps, but be cautious of their words.

I’ll leave with this… I watched a presentation by Daryl Guppy who talked about some setups he likes to hunt, and how to trade them. I did enjoy this, and its the first time I’ve seen him present – I’ve only read his materials in the past. What I got out of this was that he did not comment on the current market situation – everything was in terms of ‘so – what is the opportunity’.

So – What is the opportunity this week?

Please feel free to comment if you read this far 😉

today – open cpb – again!

cpb - again!

CPB: Entered another position in Campbell Brothers today at 31.70, pyramiding my position.

The catch is that I am just off the top entry for the day, on a day of high volatility for the share. In fact the share fell through the stop loss today due to the high variation.

Rest of the portfolio took a bit of a pounding today, but no exits triggered – yet!

today – close pna, open amp

amp open

AMP: Opened a position in AMP today at a price of 6.50.

Made the decision to enter based on the big white candle yesterday combined with yesterdays healthy volume. Set a trigger entry for 6.50 (psychological choice). Not a full size position as I wont commit a standard position until I see a break of the previous high.

Up to now I have been right out of the financial sector, which is actually performing quite well in Aus at the moment. As an aside, I did see on the news there are rumours around that companies are looking to buy AMP at the moment. Don’t know (don’t care!) if there is any fact in the news – however todays stock price movement would indicate that someones listening to the rumours!

pna close

PNA: Closed my position in PAN Australian at 0.465 leaving me with a 7% loss.

This is a good exit – hit the stop and exited quickly. Reviewing the chart, I am just above two support trendlines (one rising, one flat) which would indicate that the price may bounce – however – best exit at a small loss and re-enter should the opportunity present itself.

Ok, Ok – a good exit technically – not good financially. However I see something on my portfolio statement here at the moment (not published till the weekend) but every position is now turning a profit! That is rare for a set of positions all in the black.. Helped of course by an extraordinarily bullish market combined with aggressive killing of non performing positions.

I have added a full chart view at chart.ly – have a look.

The plan is working!

today – open HST, REH

Reece 29-9-09

REH: Opened a position in Reece at $23 which makes me the recent high – hope I am not the one caught out in the wind! The risk with this share is that the market might be a bit thin if I need to exit, so only a small position.

I’m able to set a fairly tight stop here due to the closeness of the trendline.

Looking at the market depth there are very few buyers in the market, but there are a fair number of sellers. In fact until a trade went through at market close, I was the only buyer today in this share.

Hastie 29-9-09

HST: Opened a position today in Hastie group today at $2.25, which as you can see is climbing nicely – although yesterday was a day of weakness. Again not far off the trendline so easy to set a stop

The market today took off early but really only held the position during the day, with no real movement after the first 30 mins – at least not for my portfolio, which at the moment I can say covers many of the market segments.

Au revoir,

today – close aqa

Aquila Resources close

AQA: Closed my position in Aquila Resources today at 6.71 for a 12.8% profit.

What can I say about this trade? I’m happy with it. I pyramided in 3 times – however if I had it over again the fourth entry (3rd pyramid) was a bit too eager and should have been held off.

The only shame is the price collapse at the end of the day taking my 20% profit to ~13% in a day – too bad – followed the plan though.

On top of this I closed a few positions today in my non documented trades – for the record I followed the plans correctly. Did a scan of the market, and not seeing any strong entry signals in the last day – in general things didn’t go well on the ASX today.

Apparently the market doesn’t give a sh!t about me – I read it at Chart Shark. He seems to write very clearly a number of things I keep repeating to myself, and post about here. From the entry:

- What Can You Control?

- The only thing you can control is yourself. You can not control the market, but more importantly, the market can not control you. Only you control when you enter and exit the market.

I recommend you go read his article and absorb it. I will leave with this closing comment from Chart Shark – “The market will do what the market will do, with or without you.”

Leave a comment

Leave a comment