Archive for the ‘discretionary’ Category

today – close MOL

mol close

MOL: Closed my position in Moly Mines at 1.17 for a 10% loss.

Maybe this time I’m being overly strict in cutting my losses – I have taken a dip below my support line stop to exit intraday, rather then wait for the end of day close. Normally I would hold this position for an end of day close below the support, or a fall below the trailing stop loss line (the lower brown line).

I note the drying up volume as we get to the tip of this pennant, normally a good build up for a breakout of some find. Will continue to watch.

today – open ALL – close IFM

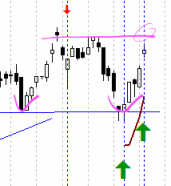

ifm close

IFM: Closed my position in Infomedia today at 0.38 for a 2.5% loss. And this is annoying. Small loss, but this one frustrates me.

This is my worst exit in a while – 3 clear exit signals where given to me, but I held on thinking I might at least close out even. BIG MISTAKE.

The price fell through my trailing stop loss (first circle in the picture), then on the third day hit the uptrend line I had on my chart – and fell through that too. The price then tracked along the bottom of the trendline before taking a dive again yesterday.

Yes I still reckon the share may recover – but that is irrelevant – I didn’t stick to the plan….I should exit, observe from the sidelines and jump back in when the conditions are right.

I have been lucky actually – if this was the market about a year ago, a break below that trendline and the buyers would have been heading for the exits leaving me with a rapidly falling stock price and the commensurate hole in the pocket. It must be a bull market – they reckon anyone can make money in a bull market – and I got out lightly here.

Repeat … trade the plan … repeat … trade the plan …

all open

ALL: Opened a position in Aristcrat Leisure today for the first time in years, at 5.06.

I was drawn towards the share from the market heat map, which showed higher price movement than usual. A review of the daily chart showed:

- break through downwards trendline yesterday

- new mid term high today

- 200 day SMA turned up about a month ago

- good volume

On top of this the share was in a consolidation pattern for some time – so lets see if it shakes off the shackles of the bottoming process.

Whatever happens – follow the plan!

today – open shv

shv open

SHV: Opened a position today in Select Harvests Limited today – in fact opened twice – at 4.09 and 4.55.

Entered this share because it crashed though its medium term high, making highest sales in just under a year. It made itself known to me from the share heat map I like to review sometimes – and has served me well for finding active points in the market, at least in the short term.

It certainly is encouraging on the graph anyway – however looking at market depth, there is a bit of a ‘hole’ under the current market price, so lets see how this opens tomorrow.

btw- if you are interested in any of my trades – feel free to make comments!

friday – wan open

wan open

WAN: Opened a position in West Australian News at 7.00 on friday.

This increases my exposure to media, a sector I expect to see some movement in over the next few months. Don’t know whether it’ll be bullish or bearish, and I have long since decided that I am often wrong in picking a market direction based on my views of the economics of a market. What I know is that I am long WAN and FXJ, and with the news about the breaking up of Telstra in the papers last week there is bound to be some volatility and leveling taking place.

As I run only on charts this is all just by the by. Lets see how this one plays out.

As an aside – System A still not returning candidates – I might have to review that system… or maybe it is telling me something!

today – open pna – extend aqa – close ipl

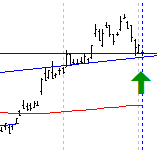

open pna

PNA: Opened a position in Pan Australian again today at $0.50.

This share has been good to me in the past, and whilst that is no reason alone for an entry, the volume is good, and the share is making higher highs – gotta be happy with that. The blue horizontal line is a long term resistance line, which has been firmly bounced off. trigger was yesterdays big white candle on strong volume.

ipl close

IPL: Closed my slow moving Incitec Pivot position today at $3.06 for a 4% gain.

The share failed to make a higher high on the recent rise, and was again flat today – not a good sign when the market as a whole has been very bullish this last couple of days. Incitec was a good earner prior to the GFC, but looks like it has lost the gloss, and so not apparently attracting enough buyers to drive the price up.

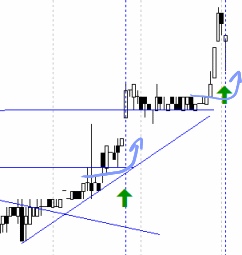

aqa - pyramids - 4 of!

AQA: Pyramided into my Aquila resources position today at $7.53.

This is my fourth entry into Aquila resources, based firmly on the strong consistent uptrend that the share price is exhibiting. I originally entered the position with a small size as I considered it a risky entry, but after increasing 3 more times after that this is now a significant holding.

So lets see what the market holds for us tomorrow as we go into Fridays trade. the market in the US has opened strongly. Volatility is good – I have some short duration options to close in the next week, and as I’m into the last 7 days, tomorrow is the day for it.

Ciao

today – close riv, okn – buy fxj

riversdale exit

RIV: Closed position in Riversdale Mining today at 5.9 for a 10% loss. This has not been a great trade – so I’ll write it up first and hopefully learn from errors. Riversdale has historically been fairly volatile, and one that I like to follow. Thinking it would break through resistance some time ago I entered a position in the share – which subsequently did break out for a whole two days. Anyway, share bounced off resistance twice after that and I didn’t exit…

I don’t have a decisive non-performance exit target for these trades, which I really should have – I tend to be very arbitrary when it comes to stagnant shares. Anyway, I’ve exited this now, so lets watch it take off 😉

oakton close

OKN: Closed my position in Oakton today at 2.92 for an 8.6% gain. Reason for exiting this position was based on the following two factors:

- Share bounced off recent resistance / not making new highs

- Share market very strong today, and relatively so for the last couple of sessions – several shares making new highs – but not this one

Note that the share did not trigger my stop loss, but considering the rest of the market was rising, I thought it best to drop the position for now. Drive my collateral to better positions… like….

fairfax - extending

FXJ: Is print media dead? Don’t know but I pyramided into my Fairfax position today at 1.665.

Looking at the share from February to July this year I think I can see a cup n saucer shape with a strong drop off on the volume during the handle – then again you can see anything if you look hard enough!

Regardless of cup n saucer formations or other names, I feel like I can see a well defined bottom that the price is rising out of, combined with a 200 period sma that has only just turned up – hence the pyramided position.

This full picture can be seen on chart.ly.

today – close aoe, open okn

aoe close

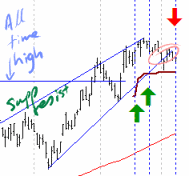

AOE: Closed my position in Arrow Energy today at $4.42 for a 2.7% loss.

In this case I have not waited for my stop loss because of ‘bad feelings’ which are based on what I am seeing on the daily price graph. Marked in the picture you can see the all time high marked. On breaching this barrier I would expect the price to stall before moving on – which it has. Looking however at the rising wedge, the top barrier is a line that was an upwards trending support line – however recently this line seems to have become a resistance line, which may hinder upward movement.

At the top of the wedge, the price seems to have come out to the downside, so for now I’m reigning this one in.

That said – it may move on, and I’ll keep an eye in case I choose to re-enter.

okn open

OKN: Pyramided into my Oakton position today at $2.94. Oakton has risen nicely in the few short days since I took an initial position. I am however sitting just below resistance so will need to see if we can push through that.

Looking over my last Oakton trade, its the same level of resistance that shook me out just a couple of weeks ago.

Anyway, off to watch the gold price that pushed through the $1000 barrier earlier today and is now trying to get itself pushed back beneath it!

today – open tol, iif

iif open

IIF: Opened a position again today in the ING Industrial Fund at $0.52. The share still seems to be climbing nicely, so re-entering to see if I can grab a few more $$ from its rising.

Looking at the picture to the right there appears to be bullish rejection over the last 3 days or so, hopefully forming support just below my entry -so a tight stop is in order for this trade.

tol open

TOL: Opened a position indirectly in Toll holdings today – indirectly taken out by using a warrant in Toll – tolwmb at 0.245. A warrant was taken because I want to leverage the position, and the warrants aren’t heavily enough traded for my liking.

Looking at the daily graph to the right, Toll has a reasonable short term uptrend in place.

Things actually get interesting for me though when I look at the weekly chart below.

Toll weekly

I’m looking at this as a fairly nicely formed inverse head and shoulders pattern, which sounds to me like a fairly solid bottoming formation. The share fell into the left side of the H&S during the GFC, so I’m looking to ride this up.

My biggest risk in this trade? That the warrant will expire before the real movement happens. I have paid a fair bit for time decay in the warrant, so the share does have to increase significantly by November for my strategy to be sound. For the purposes of risk determination, when entering warrants I consider the whole investment as R for my risk / reward calculations.

Anyway, off to bed, with happy dreams about $AUD/USD longs and Gold longs!

today – open okn

okn open

OKN: Opened a position in Oakton today soon after market open at $2.55.

Oakton has been good to me recently – not that thats a good reason alone to trade it. I entered coz there was a gap up on open, forming a bounce on a previous support line – which earlier was a resistance line.

In other markets, Gold is breaking out and the Aus dollar seems to have stalled against the USD.

Au revoir!

today – open ipl, ifm

ipl open

IPL: Opened a position in Incitec Pivot today at $2.95 on market opening this morning. Incitec has been a reasonably volatile mover over the last couple of years, and has been a reasonable earner for me in the past. The share has been at its highs for the year lately, and has just dipped to the previous medium term high.

I’m using this previous resistance as a potential support point – but I wont actually know for a while. This does allow a tight stop to be set however which is good from a risk management perspective.

ifm pyramid entry

IFM: Increased my position in Infomedia today by placing another buy at $0.415. The share actually took quite a dip during the days trade when the bears dragged it down in early trade, but it recovered healthily closing near the high.

Readings… Change on the Horizon?

Looking at Stockgawk, there is an interesting article where Andrew Finkle talks about his reasons why he thinks we’re about to see a reversal… a key item he mentions that I have observed is

The past few days have shown a lot of Dojis. … a Doji is a reversal day – where price gets rejected … This makes me think back to Ralph Block … who used to say “Volatility is the precursor to a change in trend.”

Looking at my recent trades (published here and my unlisted ones) I am seeing price fluctuations that, whilst bearish in the short term, seem ‘undecided’ when looked at over a slightly longer period of time. I listen to the talk at work, and its like everyone is waiting… this is not the increased excitement I was detecting just a couple of weeks ago.

So, as you may have noticed I trade more to the bull side of the market, but this is more affected by the sorts of trades I can comfortably pull off. As I have a full time day job I don’t tend to make trading decisions by day, I just act on earlier plans – but in my experience to play the short side of the market (with options / warrants / CFD’s) I need a closer contact with the market in order to maintain a chance of securing profits I might make – the speed of movement isn’t always in my favour in those areas.

So – why did his article resonate with me? Well, many have heard of the magazine front page effect, ie: when everyones talking about it, you are probably too late. I had one of those moments tonight – on the news here in Australia there was a commentator who said “Its a champagne moment for Australia” when commenting that we had effectively dodged a bullet as far as the economic crisis is concerned. I spose you had to see the gentlemans exhuberance. What I saw, combined with my recent views of the market, has me pulling my stops in on my plans, and keeping a close eye. Despite me having issues managing short trades – that doesn’t mean I don’t enact the plan!

Anyway, US market down looking undecided in the first 2 hours of trade, and I need to know how that goes before I set my entry trades for the open – if I do at all!

Leave a comment

Leave a comment