Archive for the ‘discretionary’ Category

today – open iif

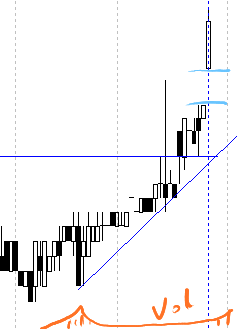

iif open

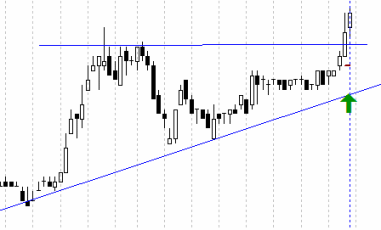

IIF: Opened a position with the ING Industrial units today at 0.325.

This is the second trade in IIF over the last few months – the lat one just before I started this blog. I found it originally from a heat map scan in April when it was showing a very good volume in the market at that time. The volume was down a little over the last 2-3 week s, with a good increase over the last two days, spiking nicely on friday. The entry was effected during the days trade when the price traded over 0.325 after noon (set the trade night before as I am doing a lot lately).

The graph is not really a true ascending triangle as there is really only one bounce off the top resistance line, rather than the two I would prefer. Still, a strong looking pattern, so will ride this one through.

System A: Did the weekend scan this afternoon – the system still is not firing, so will carry on discretionary trading.

Portfolio tracking:

So here’s a question for anyone who reads this – I’m after suggestions for tracking my portfolio on this blog… as you can see on the link buttons I’ve made a start, but it seems like it will take a while for me to keep it updated – I’m looking for an easy way to do this. I’ve got ideas… but…

Anyway, the bulls seems to be taking a breather – but my graphs think they are still running. Lets see what this week has in store for us!!

today – open mcc, wsa, fxj

mcc open

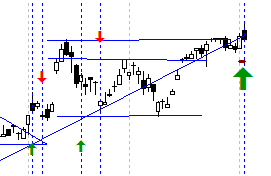

MCC: Pyramided into my position in Maccarthur Coal. I had an entry set before the market to enter when the resistance line was penetrated. In this case it looks like resistance held, and this may prove to be a poor entry. Time will tell.

WSA: Opened a new position in Western Areas – agin bought on finding new highs just to drop back in later trade. There is an uptrend in place with this share, however it comes off the boil a bit.

wsa open

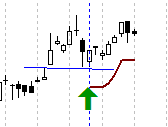

FXJ: Opened a new position in this share. The longer term graph looks like a solid base has been formed over an extended period, and now the share seems to be climbing out of it. The recent rounded bottom was mirrored in the volume (sketched in green below), with increasing volume as the price pressed through the last most higher high in mid-June. I expect this to be a better longer term performer.

fairfax open

All in all, not really happy with my entries today – the first two triggered based on a very strong market opening today, but now the trades are in – trade the plan!!

today – close aru

aru close

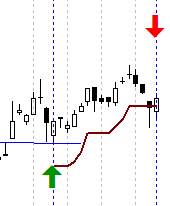

ARU: closed the position today for a 18% loss (ouch!!). That hurt, but within the bounds of the plan – just.

According to the normal plan I exited relatively well. I had an exit set after yesterdays (well – fridays) close. I set a close on opening at 0.57, thinking I’d stem the loss if the share opened down – well, it opened much further down than I expected. When I hadn’t seen the close go towards the end of the day, I did an exit at the market price so as not to let the loss get larger.

So the trade didn’t go well. Looking at the graph there are two circled areas that could be used as exits – the one that I took, and the earlier one about three days ago where the share fell through the uptrend – a preferable exit I’d suggest.

Looking at my entry from the trade opening I note my main stated reason against the trade: “I have entered just shy of an earlier area of resistance, so may have limited potential”. To that I should really have also added: “and the share is in a short term downtrend”.

I am ok with this trade, as I did stick to the plan – but in future I should keep an eye out for other trendlines – not just the first one I see.

(Edited post – I don’t know why – must be tired – I have switched ROC for ARU a few times in this post – updates to symbol made, not values!)

today – close MML, open MRE

mml close

MML: Closed this morning for a 7% profit. Followed my stop loss, exited nicely today on market open order set last night. Planned the trade – traded the plan. I was fortunate for the last price increase yesterday!

mre open

MRE: Opened today at $1.03 at market open. I chose the share based on a recent strong uptrend that was in place, to be replaced by this trading range that has been in place for the last couple of months. Yesterday the price came out the top of the range triggering an entry for me.

Both orders were placed out of market hours.

today – close ewc, open ifm

ewc close

EWC: Closed today in two peices as the price fell after the first sale – my tweet said a lightening in position, but soon after I closed the full position – for a gain of 3%. Note the similarity of the last few days to the graph in yesterdays post for the closing of the CHC position. Anyway, did not quite break the stop loss, but considering the acceleration of some parts of the market, combined with the ‘lower low’, I thought it prudent to cut the trade.

ifm monthly

IFM: Opened a position in Infomedia today at 0.37 – just look at the monthly graph to the right. From the monthly graph the telling signs that have caught my interest are the low and declining volume over the last 6 months, combined with a volume spike just prior to the share price pushing aggressively through the down trend. Below is the daily graph.

The share was located on a heat map by my broker with high volume today. I have sketched in the volume on the bottom of the graph.

ifm (Infomedia) today

Reasons for entry:

- volume spike about a month ago to start uptrend

- volume spike today

- gap up

- impressive break of monthly downtrend

The factors I can see against this entry are:

- I’d expect a retracement after this level of run-up

- Possible H&S bottom over the last months indicating that I have entered just short of the standard price projection expectation of a H&S bottom formation.

Anyway, lets see how we go.

today – chc

chc close

CHC: closed the position today, for a small 4% loss – not exactly according to the plan either.

I have noticed the general ‘positivity’ of the markets over the last few days, and in my chart scan tonight I noticed 2 things:

- A number of my shares are under performing the market in the last 5 sessions

- A number of them have the same pattern for the last few days – that which can be seen in this CHC graph.

If the market is taking off , and this is only known with hindsight, I appear to be backing a few shares that haven’t taken this last weeks spurt. Trimming CHC is a move to limit my exposure to the particular graph formation you can see above – even though it hasn’t actually hit the stop loss.

So, I came to a couple of conclusions over the weekend – if the markets are taking off, I need to focus more on which shares I trade (ie: limit the number of open positions) and target the moving parts of the market. Over the last few months, and obviously the two months I have been documenting some of my moves, I have been discretionary trading – going off ‘hot spots’ in the market from a heat map, combined with general chart formations. I must say its been treating me well – the last few months have nearly got me back my losses for the last financial year (no – not since the start of the dive yet!).

When System A (my own coded system in c++ so I don’t need to think) is running, it manages my number of positions to an extent, so issues like that above don’t happen too often when the bulls are running.

On another note – System A scan on the weekend – still nothing!

today – pna – roc

pna entry

PNA: Made a pyramid entry into PNA today at $0.39.

As you can see from the pic I have an open position from whilst the share was falling – this is because I previously closed my PNA position, but took up the offer to buy additional shares from teh company via a placement offer. As the placement offer was small, I held them figuring I would sell in time when I could increase the parcel size. Either way, nice break through short term descending trendline, but can expect resistance only a short way up.

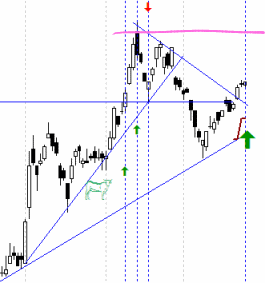

roc entry

ROC: Entered again at 0.79 on an encouraging break of the short term downtrend. This is actually a setup I am seeing in a number of my stocks I am following at the moment, all based off the general market sentiment.

In my inbox today I have a few articles of interest – This one from Casey Research – “The 20 year Bear Market“, and other ones talking about ‘shrugging off the ASX 4000 level’. The Casey report, which I’d encourage you to go read, has this inspiring (!) quote:

The summary outlook, according to Howe, is that we are in the very early stages of a 20-year period of economic and institutional upheaval – an era denominated by a crisis during which we’ll likely witness the tearing down and reconstruction of many aspects of society as we know it.

My personal indicator – in the last couple of days I’ve had 3 approaches from people – “you play with the stock market don’t you – should I buy something now… what should I buy”. Hmmmm…. people are thinking of parting with cash again, lets see how things go. And no – I don’t suggest anyone to buy anything – thats up to them 😉

Now, off to work…

today – cpb – updates on open positions

Campbell Brothers opening

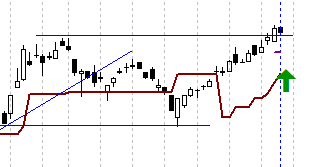

CPB: I set a trigger to enter Campbell Brothers over the weekend, on entry into the rectangle you can see in the attached diagram.

Campbell Brothers has been in an uptrend over the medium term, however ranging over the shorter term. The item of interest that peaked my interest in this share was the bounce off the upwards trend line, which I am looking for a continuation of.

So, I have a couple of trades that have been open for a few days, hopefully indicative of some trends setting in – not that I’ll know till I can look back and know. The writeups below are brief updates on a few of my open positions. you can find the entry conditions by looking of the relevant tags on the menu.

ARU: Only opened recently, strong increase on open – definite rejection of a higher high, but no stops hit.

aru

CHC: Charter Hall group, again only recently entered, and signs of stalling as the overhead resistance is approached. Keep a close eye.

chc

MCC: Continued to rise nicely since opening. Today looks like a push into, and maybe through upper resistance. Keep the trailing stop loss, keep watching.

mcc

MML: Medusa Mining also rose nicely. Another one to hit upper resistance, lets see if we press through. Hold position.

mml

OKN: Pyramided in to this trade based on the sudden increase in price, and the share promptly declined soon after. As it stayed above the increasing trend line I stayed in. In some cases I would have exited on the fall through the ATR based stop loss (brown line), however based on the strong uptrend I held in using the trendline as the ultimate stop due to the sudden spike which I missed capitalising on as I was working on end of day prices.

okn

For anyone interested – one more week to get into the ASX sharemarket game. I’m considering myself, but I don’t know if I can afford any more time, given I post this blog, consider my trades and hold down a job!

For tonights reading I trawled through some content from Tradergav – another Aus trader with a blog. I read his discussion on a tweets conversation that he has here which is around the risk / reward metrics. Since doing discretionary trading I have not been tracking my statistics as carefully as I was up to a year ago, as I normally tracked these for my System A (which had no triggers this week – again!) and other mechanical systems I have toyed with. Maybe thats my next project, as I have done enough in the last year to give some sort of finding. I had one -3R trade from memory last year and that hurt. If I go past -2R I pause trading and ‘have a good hard look at myself’ to determine why I ended up there. I must say I haven’t beaten 8R in over a year though, and you do (well I do) like to get one every so often, both for financial reasons, as well as to help with the psychology of this.

Signing off,

today – cey – chc

Another big day for the ASX all ordinaries.

cey - todays entry

CEY: Trigger on ASX fired on opening and placed me straight into the market. This was on my list based on the consistently strong volume over the last few months, combined with the size of the gap to the next resistance level.

CHC: good white candle today, so I’m in this one again. Better luck this time maybe? Well – just follow the plan.

General comment for the evening: I am interested in twitter, I use it – I post my trades via tweets so that I can justify to myself that I am sticking to my plan and to others that I’m not making this up. I am interested in some of the add on services to twitter (stocktwits anyone?) , but am concerned at the concept at sharing my passwords with anyone – now go read this article about the hacking of twitter. Having been a computer security consultant for a significant part of my career this concerns me. Anyway, what can you do? C’mon twitter, use some better practices. Individual users making errors is one thing – but companies?

Off for a sleep,

today – aru – strong day

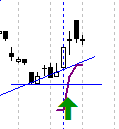

aru entry

ARU: I opened a position in Arafura today as tweeted earlier. From the diagram you can see I entered based on a bounce on the upwards trendline at the Green arrow. I picked the entry during last nights chart viewing, and its a share I traded recently after finding on my brokers live heat map. The volume has been high – especially around the time of the last trade.

Reasons for entry:

- bounce on trendline

- appeared to start recovery a day or so earlier than other comparable shares

- active sector

- high increase today

Reasons counting against entry:

- I have entered just shy of an earlier area of resistance, so may have limited potential

- Not very high volume today

- I’m unconvinced about market direction (however today was a good day!)

Lets see how this one plays out.

Onto other matters. Generally when trading, I have come to accept that I am not that good at correctly reading the interpretation of macro changes in supply and demand – I figure those much smarter than me do that, and many others really just have an opinion 😉 If its a fact, its not debatable – anything else is an opinion! Taking that into consideration I came away feeling educated after reading this article from MyStockVoice on the building of a massive oil pipeline across Europe.

Turkey and four EU member states have signed a historic deal in Ankara allowing work to start on the Nabucco natural gas pipeline, which is aimed at allowing the European Union to tap directly into non-European gas reserves.

Its when I read things like this that I become aware of my limitations regarding picturing the long term outcomes of such activity – yup I realise some observations are clear, but, again – just my opinion.

So why mention this? Really, thats why I revert to technical analysis of shares and other financial vehicles, because it simplifies my thinking process so I can make decisions, and move on those decisions.

Till next time…

Leave a comment

Leave a comment