Archive for the ‘discretionary’ Category

friday – mcc – weekly summary

End of another week. A good way to end the week though – for music fans Australian radio station JJJ did the ‘Hottest 100 of all time‘ – was great to listen too – and the commentary provided by the DJs as great!

mcc entry, friday

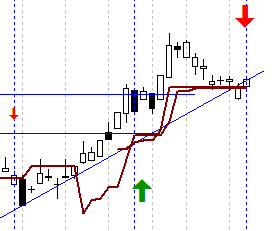

MCC: Macarthur Coal looks to have formed a small scale eve and eve double bottom. I entered this on friday with an entry target set in advance, which may have been a slightly risky entry – however it has closed above the mid point of the pattern, making this a valid double bottom formation. Based on this pattern I have an immediate target of ~$7.50. Over time I have seen resistance between 6.70-7.90. Lets see how this plays out.

Weekly scan for System A – No results.

On another note – what is the impact of negative interest rates? I found an article at the ‘Cumberland Advisors‘ website interesting regarding the Swedish central bank (the Equivalent of the Reserve Bank of Australia) moving to negative interest rates – read more here.

today – mml – chc

Market still choppy and a bit ugly at the moment. Driving me out – how long this lasts is anyone’s guess.

Before getting into tonights commentary, I have to comment on this article in the Wall Street Journal. Fancy that – we have price volatility and there is a view that traders should be stopped – I wonder if there will be more talks like I heard a while ago referring to retail traders effectively losing the right to buy, and therefore leaving all the transactions to funds to manage. Hmmmm…. me thinks I could comment on those with vested interests maybe trying to protect their patch. Oh well – maybe this discussion will just go away.

chc 9-7-09

CHC: exited today after falling through stop loss for a 13% loss. Looking at this trade I had a number of opportunities to exit the trade that I did not take – and the unfortunate bit is that I would have been in a better financial position if I had. It was clear the price was falling on the big black candle the week after I opened the trade, after which the price has declined every day. I do note however that the price has not fallen as fast as my other positions that were closed out earlier.

The actual error I made in this trade is however my exit today. The stop loss was actually triggered the day before yesterday, and I failed to exit cleanly… a slow exit….I thought I might be able to get an extra cent so put my sell order in at a level that was never filled – leading to a worse position to exit from today.

The learning -> when the stop is hit, take it – don’t second guess it.

mml 9-7-09

MML: entered a long position in Medusa Mining today. The reasons for entry are:

- looking for the gap a couple of days ago to become support

- share price is at all time highs

- my ATR based exit formula seems to be tracking to the price fairly nicely

- volume has been healthy over the last few months

Note – all my entry and exit prices are sent on twitter as I note that they have taken place. Sometimes I don’t know if a transaction has taken place as I don’t know until I get email confirmation, due to the fact that I can’t observe the intraday prices in general.

Any queries of comments to me, feel free to post…

today – mnd – tap – fmg

Lost a few positions as indicated yesterday from my close of day prices.

TAP close

TAP: Closed the position for a 10.2% loss. If I stuck to the trendline I would have exited the day after I pyramided in my position, but I was using a trailing ATR based stop loss, which kept me in a little longer. The close two days ago missed the stop loss by 2c so waited to see if it bounced – which it didn’t.

MND: Closed this position for a 9 % loss. Based on ATR based stop loss combined with perceived support point.

FMG: Closed this position for a 14% loss. Based on ATR based stop loss combined with perceived support point.

So – ultimately not a good set of trades as far as portfolio performance goes, but good in terms of following my plan.

today – cxs

Chemgenex trade

CXS: today closed a position in CXS for a 4% loss. For a share that ha gone up nicley over the last few months, that hurts a bit. I got stopped out at 60c, which is helpful – if it hadn’t fallen so far I planned to exit when the share fell below the upwards trend line.

The original entry was selected for two reasons: firstly an intraday breakout through the resistance line, and secondly because of the very high volume that time – the share came to my attention through a ‘heat’ style market map.

Gotta say – the years not getting off to a very good start!!

Looking through my graphs tonight, I’ve trigged a few stops and given the action on the US markets tonight I guess we may gap down on opening – so I expect to experiance some pain tommorrow.

On another note – the System A scan on the weekend returned nothing.

today – ewc

ewc open

EWC: re-entered this stock today, bought on stop I set yesterday after I was stopped out of the previous position. I may have entered too early, but I suspect that will be guided more strongly by the overall market sentiment, which appears to be playing a stronger grip over shares over the last couple of days. As usual, entry is easy – now to manage the trade.

new financial year – ewc – trade frequency

I have spent a small amount of time reviewing my trading statistics for the previous financial year tonight. There is one thing that strikes me straight off – and that’s the raw number of trades I have performed. More than any other year, and I do have a few years of stats to look at. Whilst I fundamentally knew it, it still grabs the attention when reviewed – the transaction count trebles over other periods. This is to expected I suppose as in a bull market, my System A and other trades I do are more system driven, and they ‘hug’ the trade better, generating more profit, less costs, less activity – simpler overall trade process.

Once System A stops firing I start to trade patterns – taking more lossy trades, more transactions, more hunting – more time intensive technical research. Again it begs the question – would I have been better off sitting on the sidelines whilst this Bear market played (plays?) out. I can say confidently I took some great trades when the market was turning 3 months ago – and I would have missed these if I sat ‘waiting for confirmation’.

So how do I work out ‘what I would have done to pick the Bear, and stop trading until … the Bulls arrive’. I spose that can be my next project for when Systems A and B are running again. Ahhhh… research.

The blog entry at RatioTrader ‘No Plan, No Rules, No Success‘ seems pertinent here. Am I improving? The first step is to determine my measure of improvement. By my reckoning, the ASX All Ords lost 25.9% in the last year – so I out-performed by 15.5%. That is one measure. Do I stick to my trade plans – on the whole yes, more than last year, which was more then the year before. This is something I track. Since starting this blog, I have only one trade that I did not stick to the plan on (ok, not a long time period) but that is specifically one of the reasons I am logging this. Maybe someone might learn from this, and if not – at least I will!

Anyway more on all that later, todays trade ->

ewc close for 9% profit

EWC: Logged on to find my position in EWC had been stopped out in early trading for a 9.5% profit.

This is one of my preferred trading stocks – good breadth in moves, and sufficient turnover to be able to get in and out. On my last trade with EWC I exited using a profit target, and looking at this graph, a profit target would again have been the way to trade it – resistance around 0.72 puts a bit of a ceiling on price action for now – and in this case would have doubled my profit. Regardless – I am setting the plan and executing it, and its paying off.

Looking forward

On a more general note, the ASX has been on a good run the last 3 to 4 months, and it has treated me well. Looking over my graphs tonight, I have seen a few stocks at the same time dip – ever so slightly mind you – below their uptrends – a sign of weakness. I don’t use indicators as a general rule, but I’m tempted to grab the books and see if they are signalling overbought. I survive basically with moving averages, and sometimes OBV – I need to refer to the books for anything else, which tends to mean they don’t get used much. Shares I am thinking of here are TAP, ROC, PAN, MCC amongst others. They are all resource type stocks so maybe just that sector is coming off the boil… will look into further.

today – pyramid positions – okn – tap – mnd – aqa

Interesting action in todays market. I have taken the opportunity to extend my investments in some currently open positions, whilst keeping an eye on the overall market to not over extend myself at present.

okn - pyramid in

OKN: despite the funny action I saw recently, I have increased my position here. With a gap up on open this is looking strong. I note that the next significant resistance is at 3.00, however there are some minor resistance points before then.

TAP: The recent purchase appears to have successfully bounced off the support line for now, so am looking to strengthen my position. The morning opened well but the share seems to have formed a spinning top, so will keep an eye on it in the morning.

MND: Since entering with my first parcel, MND has subsided along a smooth short term down trend to marginally above my stop loss, at which point it has started rising again. I have taken the opportunity to increase the position on this break through the lesser downtrend, assuming that the uptrend is now to resume.

aqa pyramid entry

AQA: another share continuing to build upwards. Increased my position size, however I can see I am relatively close to a line of resistance at the top of the big white candle about 12 days ago. Lets see how we hold up.

Tomorrow – end of the Australian financial year. whta fun – then I’ll have to think about another tax return! arrgh – more paperwork 🙂

today – tap – okn

tap entry

TAP: Opened a position today. I am looking to catch a bounce from the rising trend line, which is forming the lower side of a rising wedge (orange lines). Further to this I am looking for earlier resistance to become support from about a month ago. The recent rise looked like it was breaking upper resistance, so I expect this to simply be a replacement. Due to the closeness to the support the current market weakness may help the trade to fall out the bottom.

okn entry

OKN: Opened a position in OKN also, entered as the share broke through the resistance line drawn from the peak about 6 weeks ago. Oakton has strong resistance around $2 to $2.20 so will watch how this proceeds from that area.

I did something today I don’t normally do – I looked at the actual transactions on OKN – and they look … unusual – but I’ll put that into another entry.

So – for developing traders, the Traderfeed blog asks an important question in his entry today – “How well are you mentoring yourself”. Now thats something for me to ponder. As I think I said the other day, I’m happy to buy almost anything – I just have to really manage those exits. That said, I do try to pick entries, but it doesn’t stop my activity as it used to.

today – pan

pan exit

PAN: today closed position for a 2.5% gain. Entry was triggered by close above resistance line, with exit triggered on fall below stop loss line as well as the upwards trend line. Overall, happy with the trade.

I had an open in the market today for OKN which was missed. Lets see what happens tomorrow.

today – mre

mre trade

MRE: today closed position for a 22% loss. Not a great exit – the price closed above my stop loss line, however I had a stop loss in the market which triggered during the day closing the trade. I was looking to close the position anyway as the price had fallen through the trend line I had selected.

Not good – another loss over 22% – really need to minimise those… however this does fit within the plan. I’m winding back position size due to volatility, as I aim to lose 1.5% / 2% of my capital per trade – fairly standard trading rule actually.

Have also placed some closes for tomorrow due to some instruments closing below my stop losses at the close of trade.

Leave a comment

Leave a comment