Archive for the ‘general’ Category

SystemB – What it is

SystemB has evolved since I went into hibernation.

System B is a short term breakout trading system based on weekly charts. I have coded the weekly search using Amibroker. The search then locates a number of candidates, which I select from based on visual clues, typically looking for some kind of recent breakout. The universe for SystemB is open to ASX and the US, however I am generally only tracking ASX… this may of course change from time to time.

I am tempted to run it against the Singapore and Nifty stocks – but I haven’t got to that yet.

This system is intended to work in all market conditions, however clearly many are found during times of market growth, and a much smaller number in sideways periods. I look for short entries, but I have a bit more coding (as of March 2012) to get to where I am happy.

The candidate lists are typically generated on the weekend, however I may not take an entry until mid week. Exits are taken based on stop loss, or loss of momentum (my formula). System exits are interpreted on fridays close, however I may not enact them until late the next week – making it a discretionary element.

Returning from a break

Well – a break from writing and posting.

I have done a lot of reading, and a bit of trading. Its been rough. Looking at others blogs, news articles, conversations and so on – I get the feeling I am not alone in that thought.

I wont bore anyone who may read this with the highlights / lowlights of the last couple of years.

I will say that the last couple of months have treated my account nicely. I am not alone I suspect – as they say “a rising tide floats all the boats”. The year before that… well I managed not to sink the boat. Risk management. Cut losing trades. Hunt for moving shares. Try things and experiment on charts. That is a reasonable summary of what I did.

Looking at the blogroll on my site, I see that a number of others have moved on – some silently, some with a farewell. I know I have spoken to some traders over a coffee who have been battered and bruised. Then there are the ones who survive in all markets. That’s where I am aiming to get to. Its good to have a goal they say 😉

Moving forward it’s not my plan to post my open positions, some may say that’s cheating. I’ll only post the ones I open, until next I have a break. As previously stated, follow for education. If I go to sleep I can’t promise I’ll post my closes!

ok – that was a porky above – I will give you some highlights. I visited other countries for work and pleasure (Vietnam, Hong Kong, parts of Oz). I worked on a significant project here in Australia with the government that may in the long term affect how we all interact with them. I have worked on contracts and technical implementation of interesting company infrastructure. I’ve had good trades and bad trades. My daughter has moved for a term of school to live in the mountains and go hiking. My son is learning about capitalism – he has a job in a fast food joint serving chicken. I have tested some systems (amibroker) and coded some systems (c++ / amibroker / metastock). I’ve moved into a house with my girlfriend, survived corporate downsizings and worked on a project that touched every state school here in Victoria. Its been fun.

So – who knows if I will have enough time to write!

weekly notes, system A results

Just a brief note tonight. Performance over the last week has not been ideal, however I have been in a sort of caretaker mode for the last few weeks, as I have a few things on:

- Getting my head around new share charting / analysis software (Amibroker)

- Managing current trades

- My actual day job – very busy lately, in the process of winning a major project – very stimulating

Its been important to stick to stops in these quieter times, and when doing my portfolio update for tonight (posted a few minutes ago) I note that I missed an exit Friday as I didn’t check Thursday night because of work. So – my salary job has cost me my trading $$!

This weeks System A report showed up two entries: ASX:CNT, ASX:JBH. I will enter a fresh position in JBH based on my system trigger this week.

Where are we at?

So where are we at?

All Ords last friday

To the right is a graph of the ASX All ordinaries from the close of trade last friday. Last thursday was a rough day on the ASX, and resulted in me getting kicked out of a bunch of positions, as seen in my previous post.

Friday itself was a nice up day, but a day when I sat on the sidelines and watched. (Well actually – I worked on my real job and wondered if getting out Thursday was the right thing!).

I now see Friday was a rough day on the US markets, and I liked the way The Fly wrote about it here – making the link with Halloween. He says he took on losses. I know last week cost me, but not nearly as much as it could have.

Anyway, back to the chart above. This whole business interests me because its about patterns… patterns that repeat, and patterns that don’t. I like these two curvy squiggles I have drawn. Can I trade them? Too early to say, but I do see repetition. Break to the up – go the bulls, break through the bottom, and I might get to see how the other half lives for a while.

Today is not a day for picking a direction. I see a setup. I wanna wait to hear which way everyone is going, so I can follow.

Mike at 5000trades, someone I might start to think of as the poet of the Australian markets and an interesting read because I have seen him take the opposing view to myself, is going for the sell this week.

Risk v Reward

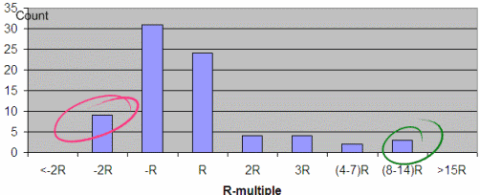

This is a graph of my R-multiples this year so far.

R multiples

I am particularly proud of one particular point of this graph. I have no losses or greater than 2R – then again, gotta love a bull market. I tend to get a loss of greater than 2R when I miss market days through travel, I have a position that crashes a stop loss or some other unplanned reason.

The -1R and +1R trades almost cancel out, which leaves me in a positive position due almost entirely to the existence of a few trades in the 10R range. They are the trades that make this all worthwhile. Without my 32 -R trades, I may not have taken those high perfomring trades.

I take the loss, so I get to keep playing to take the win.

As stated previously, not all trades get to this blog, but once opened here and twittered, I close them out here.

Monday market opens in 3 minutes – and I don’t care, coz I’m not watching today.

Au revoir!

today – close AMP, REH, WAN, AQA

Thats a lot of closures.

So, like everyone, I have interests outside that which I primarily write about here. Without wanting to digress too much, I have been out sparring tonight. I copped a slight knock to the jaw, and saw the followup hook coming in for the 1-2. Despite the knock, I kept the guard up and avoided the big punch. That’s what we train – keep your guard up, and try to read the opponent – sometimes you will get it right, and sometimes you will get hit. When you get hit – keep the guard up, feel for the next one!!

I’ve taken a few shots this month, as the portfolio update next weekend will attest. So – back to training – keep the guards up, take a shot when you can and accept you can’t catch everything. But never get hit so hard you can’t continue. After a few losses in a row, all bar one below 10%, I feel like its the end of a round. Splash water in the face, take a breather on the weekend and get back in there.

On with the show…

amp - taking a dive

AMP: Closed my position in AMP at $5.96 for an 8% loss. Now looking at the entry when I opened this trade, it was such a good looking trigger. The setup was linked to financials doing well, and then a nice breakout. I held on through the retracement.. and passed on my trendline stop loss waiting for … what? The support I expected did not exist. Stop triggered last night, and exit taken in early trade today. Now I have a more bearish outlook than a few weeks ago, taking the earlier exit looks like a no-brainer. hmmmm 20-20 hindsight. Of note is a flattening of the longer term MA (in orange). Lets step back from this a bit. Not a bad trade, but could have been better.

reh - small gain

REH: Exited this today at $24 for a 4% gain. This trade was always on a bit of a knife edge. I found to be a bit illiquid for my liking… and I knew that sentiment was not strong once I had a position. A couple of times in the last two weeks I have been the only seller of Reece – and no one has wanted to take my shares off my hands. Now things are grim, I thought I should close this out rather than get caught out – so I did, and it looks from the chart that others followed me out the door.

I really should remember to keep an eye on liquidity – this has happened to me twice this year now (note to self).

WAN - reading the papers

WAN: Closed my position in West Australian News today at $7.57 for an 8% gain. Now this is a better trade – I’m happier with this.

I was confident in my entry, as it was ‘text book’, departure from a steady uptrend to the high side, with good liquidity.

My ATR based stop loss tracked nicely and has kept me in a nice profit. Whilst I could have exited on the departure from the steeper trendline, this would translate to a futile attempt at top picking – not a winning approach as I have learnt over the years. In this case I definitely stuck to the plan, and no second guessing.

Aquila Resources

AQA: And finally AQA. I closed my position at $7.09 for a monster 14% loss just prior to close of trade today. This is a 2R loss. Even with a small position that I entered with, the loss was too big.

Look at those black candles – great at a birthday party – but not great for my bank balance! It is actually this trade that has told me I need to review everything on the weekend, and hunt some good shorts – I’m sure they’re out there. Looking through whats left of my positions, I may be taking more positions out tomorrow – but we shall see what the overnight US markets whisper to me.

And finally, a comment on a position I haven’t closed. And I still need to work out if it oughtta be. This is what a capital raising can do to my capital in the short term. But I love noticing things. Like the fall to the height of a recent peak, coinciding with the same price point as the capital raising… hmmm…

bugger - a capital raising

In closing – although I mentioned a contact sport above, I do not think of the market as an aggressor opponent – I think of it as a sparring partner. It does what it does, I do what I do, and through it all I get fitter.

So keep your guards up!

note – why you take the small loss

Sino Gold

The graph here shows a recent trade. This is EXACTLY why you take the small losses. Yes I know they get worse than this – but I am happy I took the exit when I did.

Sleep tight.

that was the week – ataa, a few positions etc

So another fairly quiet week last week. If you review my portfolio value you can see the positions I track on the blog have subsided a little in value, but not very significantly. Only change was opening a position in Aquila Resources (AQA) again. I’ve had one stop loss triggered which I will put into play today (Monday) and a this is a very late post for an end of week wrap-up I can already see the positions filling in the pre-market option… the share I am exiting looks like it will gap down on open – I’m sure this’ll be an ouch!

ATAA

So on the weekend, I joined 260 odd other traders for the Australian Technical Analysts Association 2009 National Conference. This was my second ever trading event, the other being a 2 hour visit to an expo. Following my previous visit I was all concerned about how I would react to all the noises I would hear.

So put it simply, and to avoid having to read the following – it was an excellent and exciting event – Great!

And for those still reading…

I must say the following: Thank you very much to the speakers at the conference: Dr. Howard Bandy, Louise Bedford, Jake Bernstein, Daryl Guppy, Dave Landry, Bill McLaren, John Netto, Nick Radge and Frank Watkins (alphabetical order of course). I got something useful out of each of you – whether it be humour, suggestions on keeping myself in check, and recognition that many people blow up their accounts doing this!

In reading what I have originally written below, accept the fact that I have removed the sentence ‘I found him/her very interesting’ from all of them – coz its true

Dave Landry: Made me laugh, and showed how simple it can be. He had a view of himself that I thought fit well with my Australian view on the world – exemplified by his slide showing the feedback on Amazon about one of his books. And I must add – the photo he uses of himself – it needs updating!

Dr Howard Bandy: A professor who presented us with some formulas and concepts around system testing. Roll forward testing and the difference between in sample / out of sample tests. At first I was daunted – but I have seen I can simply add this to my back testing model with some simple tweaks – excellent! Oh yeah – and he has put me onto AmiBroker – expect to see my charts get a new look n feel when I get my arms around this excellent package!

Jake Bernstein: “I’m old and I know longer care what anyone thinks” – and I do hope I am not misrepresenting him by saying this. The man showed how easy things can be. His dry presentation manner and actual demonstrable methods were good to see if for no other reason than their pure simplicity – whether I will use his ideas is a separate question – I’d have to go to my box of tools and program them in to see what I get! Oh yeah – another one who could do with updating his photo

Louise Bedford: A good jump in presentations to see some interesting psychology – you can see where her interests are and the passion she has.

John Netto: Now this guy was interesting. He talked fast – in fact on the first day he was asked to slow down, and I think he concerned a few of the attendees on his first session with his fast talking, big position taking view of the world. But that all seemed to mellow – he did a second presentation that really drew people in, and by the time the panel discussion finished on the last day – I think he has some fans. Fully happy to talk about anything, at fast n slow speeds – the guy has something to say. Of course some of his plays are not things that low cashed traders can pull off, but it did open the eyes to what may be done in the future. Most interesting comment “I don’t drink coffee” – I spose you had to be there!

Frank Watkins: Came across from Perth to walk us through a very simple system he uses – and the recurring theme I got from him was that ‘this should be fun’, and if it isn’t – do something else. I really enjoyed his talk, and had the pleasure of a brief chat with him during the event. Maybe I just gelled with his view of the world, but his system is one I can see looking into, to see if it fits with my ‘style’. On paper it looks like a fit, when I do it.. who knows.

Darryl Guppy: Well, seen him before. He has something to say, and an engaging way of saying it. Good as always to see his view of what works and what seems to have stopped working.

Bill McLaren: Ok – I struggled with this one a bit. When he started, he has an older fashioned way of presenting. He used overheads (transparencies) rather than an overhead projector. I lost 15 minutes coming to grips with the slightly out of focus slides and writing style. Then I got over it. His presentation then took me on a journey where he showed price repetition over time I had not seen quite so clearly before. He talks Gann and other stuff I don’t really get into – but you could see very clearly that not only was he passionate, but he finds great profit in his style. Someone to see if you are not into Gann etc so you can get a feel for why others are. Lets face it, if you know a whole lot of people might do something on a particular day, you may profit from that!

Nick Radge: So – Now I have met the man! I posted on a web bulletin board when I first looked at shares somewhere around 10-12 years ago, and Nick posted back, at which time we had a bit of a ‘bulletin board’ discussion, which I printed at the time and have kept in my filing cabinet somewhere. Now I can picture the person behind that exchange so many years ago. And I must say he was a great way to wrap up the conference. He had the last spot before the panel discussion, and his passion and forcefulness of view (?) showed through. He challenged people with questions like ‘how much have you spent on expensive courses’, ‘how many books have you read’… getting to the point about, well, how many do you have to read to get it? Nick let on in the panel discussion why he was so passionate at the moment (thats my interpretation anyway) and it hit me, as a member of the audience, fairly hard. In fact it supported the view that I came to a while ago. TRADING IS NOT THAT HARD. But I don’t want it to be my life, I want it to pay for my holidays. My day job is partially a social outlet, a way of getting along with the world.

Again – thank you all. So in the words of Nick,

Its not that hard

Get over it – Get on with it

wordle view of my views

Here’s something a bit different – got this from wordle.

Its a map of the words on my blog to date – looks like I’ve had a bit to do with weeks, price, trade – I wonder if I can get anything pyschological out of this!

Think anything can be gleaned about me or my trading from this non financial feedback? Comment below and let me know!

week closeout – the evidence you see

So I feel I should close out the discussion I started with myself at the end of last week… see this post.…

ASX 200 last friday

This is the ASX top 200 at the end of the week. The circle is around last Fridays trade when I wrote that last post, about the ‘voices I heard’ – and you can see where this week closed.

The close last Friday formed a short term low – an excellent buying opportunity in retrospect – but exactly a week later we are into the highest high in just on a year.

So how did I cope?

- I largely ignored the voices, and went with my plan – with the minor change of lowering R, which results in smaller position sizes. This has not cost me anything, and I’m happy that this is a safe idea.

- I took out a couple of protective put options against the ASX200 to act as insurance against a drop. The values where at 4600 and 4500 points, the current value of the ASX200 is 4750 which means I expect these options expire worthless, so I have an overall loss this week based on the price of the options.

- Hesitation – whilst I did largely ignore the voices, ensuring that they did not affect my trades was a concern. The voices can cause you to pass up trades you should take, or exit early from trades you are already in. I reckon I did lose a few brain cycles wondering if I was holding off some decisions because of hesitating when pondering the views of others.

Looking over the week, I did find some opportunities. I entered Sino Gold (SGX) and Oz Minerals (OZL) although early days so will have to wait n see how these play out.

The one trade that I seriously question my actions in is the Campbell Brothers (CPB) trade. Definitely a weakening in that position this week, and I don’t want it to subside much further as I will have to exercise my stop.

Looking forward?

View based on the end of the week, going forward? There is an ever so minor contraction in the red colored MAs in the graph, which indicates to me a slightly altering view in the eyes of the longer term investors. Combine that with the increasing volatility and I would say I need to be sharp as a nail on my stop losses, and ready to exit in a hurry.

Did you grab an opportunity this week? Post a comment and let me know.

end of week – close hst – the noises you hear

HST close

HST: Closed my position in Hastie Group on friday at $2.05 for a 9% loss.

So – what can I say apart from – Quickly in, quickly out. You can see the entry I did when opening the position here. I note that I even said that the share has a sign of weakness on the day prior to me opening the position. Quick exit as both increasing trendline and ATR based stop losses triggered.

Given the activity in the Australian market in the latter part of the week, and the US (3.5% drop on the last 3 days of the week) I am tempted to reign in my R size a bit for this week, as this will move me into more of a cash position, as I am currently long stocks in many sectors in the Australian market – many of which you can see on my portfolio page.

XJO – ASX200.

ASX 200

Looking at the picture to the left you can see the graph finishing on friday for the ASX200. The trendlines are a collection of SMAs, a la the Guppy MMA. I don’t use these for triggering, but I do use them for a ‘market feeler’. Looking at the graph, there is a sharp drop through the short term MAs, but no effect on the longer MAs – there is still strength in the long term trend.

My take away from this is that we’ve hit October! The month of dismay at many times in history in the markets, the month the bears often tear up the prices. Will this happen this year? Don’t know – but I do know a lot of people seem to be expecting the bears to do their damage. So will the noisy crowd get it right or wrong? Looking at the graph above, the long termers are holding strong, and the short termers are stumbling. Look back at March this year – it took months for people to agree that the bulls were pushing things up.

To deal with this I’ll do what I always do – stick to the plan. Drop my R a bit as mentioned above, and take the exits that come my way.

I know one thing I will do this week – take out a market protective put option – I just have to choose one first.

The Noises

I did something this weekend I hardly ever do – I met with traders… I went to the Trading and Investment Expo in Melbourne. I only saw a few things – everyone just wanted to sell me another broking service, or some financial planning – neither of which I am after. There were some advisory services on offer – some with excellent results they can quote me – but until I see some of them in action, I still consider myself a sceptic.

Anyway – back to the noises. I actually ended up speaking to some traders. something I think I can say I have never done in my life before. So far I have read books, bought shares n other bits and pieces, skimmed magazines and looked at chart after chart after chart. I reckon I have had to talk to the kids, read books, watch tv since then – just to get some of their views out of my head. When I left the expo I was thinking – ‘they’re right, we’re all going down this week, I’m going to have to exit my longs, and take some shorts’.

Fast forward to tonight. From the above – yes market weakness. Yes bearish signs. Yes history is against it. But from my charts – one stop loss hit. Some shares are in interesting buying positions. I’ll stick to my graphs, and my assessment.

Maybe next Sunday I’ll be writing about why I should listen to the crowd – but not yet 🙂 I’ll read their footsteps, but be cautious of their words.

I’ll leave with this… I watched a presentation by Daryl Guppy who talked about some setups he likes to hunt, and how to trade them. I did enjoy this, and its the first time I’ve seen him present – I’ve only read his materials in the past. What I got out of this was that he did not comment on the current market situation – everything was in terms of ‘so – what is the opportunity’.

So – What is the opportunity this week?

Please feel free to comment if you read this far 😉

Leave a comment

Leave a comment