Archive for the ‘general’ Category

trade idea bhp-13

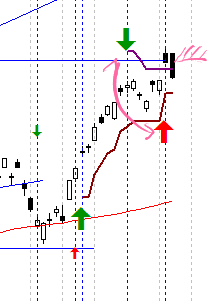

bhp today

So, not a good day for my portfolio today, a few stops hit which I’ll have to deal with tomorrow – looks like a late fall in some stocks.

To review the position on this paper trade – as stated yesterday the short position closed out (at the upwards red arrow) for a loss of capital of ~50%, not too bad, as it was only a small position, so this still ~2% of portfolio loss.

The long trade is still open. Not looking good today due to the strong black candle falling from resistance, however I will not exit – I will wait for confirmation by closing below the stop loss line.

On another note, did some web surfing tonight and stumbled across some interesting posts.

I quite enjoyed this post about getting divorced from discretionary trading by the Milktrader – well written, and something on my mind. Since I started this blog I have been discretionary trading whilst I wait for my Systems to start generating signals.

Another article of his goes on to talk about ‘trading rules‘, and his thoughts on them (text from Milktrader):

There is personal stuff at stake. Anyone who preaches to you that you need to stop it and get a plan is really preaching to themselves. They are healing a wound, or trying to convince themselves that they no longer participate in the egregious activity of trading without one.

I find this very interesting, and I encourage you to read his article. Part of the reason for this blogs being is to assert a level of rigour over me and my actions. I lost a chunk of money a few years ago now, as well as a chunk with everyone else with the financial crisis over the last couple of years.

- My best trades (profitable, stress level) have been discretionary

- My most consistent returns over time have been system / rules related

- My worst trades have been either discretionary and system related when I have broken my portfolio allocation rules, and when holding losing trades.

As someone famous once said “Know Thyself”

trade idea bhp-4, other comments

Continuing the BHP paper trade.

all ords daily today

The ASX all ordinaries today took a spike up, stopping just shy of a longer term resistance line – but given the narrow daily performance of late this is quite a move.

Checking my charts today, I saw bounce backs on a few of the shares I exited recently – not enough to re-enter them at the moment. I noted a couple of setups, but I want to see some short term new highs before entering to the long side. See how things go tomorrow.

bhp 14-7-09

So – back to the paper trade. See the BHP graph.

BHP clearly was sympathetic to the greater market move, and recovered its recent dip. A close on the stop loss indicates a close to the paper trade.

This results in a paper trading loss of ~5% (this trade was to the short side).

Going off on a tangent, my blog entry that grabbed my attention today was by howard lindzon, who is talking about ‘Being too small to fail‘ – fun short entry. Funny – the bit that really caught my attention was actually the following:

“…I am doomed to have most of my money working, ALL the time.”

My cash is working all the time, as I haven’t been under 60% invested for a few years – and if you include the margin loan, I’m more than 100% invested. This forces a behaviour I need to constantly remind myself of “Trade the plan”.

new financial year – ewc – trade frequency

I have spent a small amount of time reviewing my trading statistics for the previous financial year tonight. There is one thing that strikes me straight off – and that’s the raw number of trades I have performed. More than any other year, and I do have a few years of stats to look at. Whilst I fundamentally knew it, it still grabs the attention when reviewed – the transaction count trebles over other periods. This is to expected I suppose as in a bull market, my System A and other trades I do are more system driven, and they ‘hug’ the trade better, generating more profit, less costs, less activity – simpler overall trade process.

Once System A stops firing I start to trade patterns – taking more lossy trades, more transactions, more hunting – more time intensive technical research. Again it begs the question – would I have been better off sitting on the sidelines whilst this Bear market played (plays?) out. I can say confidently I took some great trades when the market was turning 3 months ago – and I would have missed these if I sat ‘waiting for confirmation’.

So how do I work out ‘what I would have done to pick the Bear, and stop trading until … the Bulls arrive’. I spose that can be my next project for when Systems A and B are running again. Ahhhh… research.

The blog entry at RatioTrader ‘No Plan, No Rules, No Success‘ seems pertinent here. Am I improving? The first step is to determine my measure of improvement. By my reckoning, the ASX All Ords lost 25.9% in the last year – so I out-performed by 15.5%. That is one measure. Do I stick to my trade plans – on the whole yes, more than last year, which was more then the year before. This is something I track. Since starting this blog, I have only one trade that I did not stick to the plan on (ok, not a long time period) but that is specifically one of the reasons I am logging this. Maybe someone might learn from this, and if not – at least I will!

Anyway more on all that later, todays trade ->

ewc close for 9% profit

EWC: Logged on to find my position in EWC had been stopped out in early trading for a 9.5% profit.

This is one of my preferred trading stocks – good breadth in moves, and sufficient turnover to be able to get in and out. On my last trade with EWC I exited using a profit target, and looking at this graph, a profit target would again have been the way to trade it – resistance around 0.72 puts a bit of a ceiling on price action for now – and in this case would have doubled my profit. Regardless – I am setting the plan and executing it, and its paying off.

Looking forward

On a more general note, the ASX has been on a good run the last 3 to 4 months, and it has treated me well. Looking over my graphs tonight, I have seen a few stocks at the same time dip – ever so slightly mind you – below their uptrends – a sign of weakness. I don’t use indicators as a general rule, but I’m tempted to grab the books and see if they are signalling overbought. I survive basically with moving averages, and sometimes OBV – I need to refer to the books for anything else, which tends to mean they don’t get used much. Shares I am thinking of here are TAP, ROC, PAN, MCC amongst others. They are all resource type stocks so maybe just that sector is coming off the boil… will look into further.

a quiet day – end of the financial year

A quiet trading day today, a few of my stocks dropped a little today, with one closing 0.5 cents above a stop – so I may have something to do in the morning.

I noticed today David Jones (DJS) making a yearly high, and looking in a healthy trend, but I’ll steer clear for now. I’ve got enough to watch.

The actual news for me today is that its the end of the financial year. Its time for me to sit down, review my trades for the year as a whole, and work out what I could have done better – and if what I am doing makes sense.

My initial cut of my numbers shows that I have had a performance of -9.5% for the year -> Yup a loss of 9.5%. This includes all commissions, transaction fees, data fees, printer ink etc. My next action is to work out what the funds I was looking at this time last year did, and whether my trading was ‘an intelligent use of my time’. Of course once I do a crunch of all the numbers this result may move by a point or two, but i’ll get to the bottom of that on the weekend.

System A has not selected a trade in the last 6 months at least – but I’d expect that given its a basically long seeking system in that starts firing in a bullish market.

On another note, once I have finished the rewrite of System A for the US market I expect it to locate stocks like those in this blog from FundMyMutual. He lists 11 stocks he terms ‘The Untouchables“, amongst them VPRT (something I hold, but not documented here as I’m sticking to Australian stocks in my writings), PWRD and others.

And on to the next financial year!

weekend update

Quiet day last friday, but on the whole good for my portfolio.

Ran System A scan for next week, and still nothing. However running through the charts at the moment, there are a few good trading patterns formed and in the process of forming. Definitely some nice trends developing, however the swings are quite wide, so position sizes are small to manage the risk. Will sit out of the market for the first few hours tomorrow to see how the weeks trading starts. I’m on leave from my real job this week so hope to finsh the mods to System A.

Best trade at the moment seems to be my open position in EWC, and I’m keeping a close eye on that.

comment – funny action on OKN

definitely saw some funny action on OKN transactions today as alluded to in my earlier post. Look at the course of sales figures for the stock on the ASX today … here is an excerpt below

| Time | Price | Volume |

| 11:41:04 AM | 1.77 | 289 |

| 11:41:04 AM | 1.775 | 1 |

| 11:41:04 AM | 1.785 | 1 |

| 11:38:39 AM | 1.79 | 1 |

| 11:35:39 AM | 1.79 | 1 |

| 11:32:09 AM | 1.79 | 1 |

| 11:29:54 AM | 1.79 | 1 |

| 11:26:39 AM | 1.79 | 1 |

| 11:23:09 AM | 1.79 | 1 |

| 11:19:08 AM | 1.79 | 1 |

| 11:16:08 AM | 1.79 | 1 |

| 11:13:23 AM | 1.79 | 1 |

| 11:10:24 AM | 1.79 | 1 |

| 11:05:54 AM | 1.79 | 1 |

| 11:02:08 AM | 1.79 | 1 |

| 10:57:23 AM | 1.79 | 1 |

| 10:57:14 AM | 1.77 | 30 |

| 10:57:14 AM | 1.77 | 1560 |

| 10:52:23 AM | 1.77 | 1 |

| 10:50:03 AM | 1.76 | 35 |

| 10:50:03 AM | 1.76 | 12 |

| 10:50:03 AM | 1.76 | 959 |

| 10:49:08 AM | 1.76 | 1 |

This is of interest to me because my broker tells me that I cannot make purchases of shares in less than $500 lots. Now I know small lots go through, but if I look at the days trades, there are an awful lot of ‘single share’ transactions going through – always at the ask, and seemingly pushing the price higher. This stocks fairly lightly traded today so this does change the appearance of a tick graph. If anyone was watching the days transactions, without noting volume, they may have thought there was a lot more activity than there really is.

Then again – maybe this is entirely normal – I just haven’t seen it before. I’m the first to admit that looking at intraday data is something I generally don’t do. Any comments anyone?

disclaimer – I bought this stock today, and its fair to say that the existance or not of these transactions would not have changed my view of the market, as the decision was based on yesterdays close. That doesn’t change the fact I find it interesting.

today – pna close – book review

PNA: closed my long PNA position today for a 1% gain. I entered this position nicely on 28/4/09 bouncing from a support line. I then pyramided in at a high price, only to see the position deteriorate. My exit was triggered last friday on a close below a support line, however my exit position was not filled – my fault really as I tried to be clever and tune the exit, when I was not in a position to actually do that – leaving me to sit through the weekend with a half open position.

When a stop is hit – EXIT!

As I look at the US market starting today, the S&P500 is down more than 2% and can’t help but be reminded of the recent losses – and yet I know from my records there’s been some good gains over the last couple of months. This article is a reminder – Its ok to lose money! I know I lost money when I started when around me others were making it. Over the last year I’ve lost money – but not as much as some others have. Come July I review the annual stats – then I’ll have to go read that article again!

Following is the next installment in my reviews of trading books from my library.

“Getting Started in Chart Patterns“ by Thomas Bulkowski.

The title suggests ‘Getting started’… this book can be picked up by a beginner who has an interest in the art of reading charts. Don’t confuse this comment as one that suggests the book is for a beginner – many beginner books talk about how to place trades, differences between types of instruments and so on – this book assumes you know that.

The book specifically talks about chart trading of equities, however the concepts are obviously portable to other markets – with some care, due to his use of probabilities as they relate to his research against equity charts. Thomas’ books are valuable to me because he has done A LOT of work analysing charts and quantifying what he sees. When he talks about (for example) a Head and Shoulders pattern, he talks about the expected profit, as well as the percentage chance of getting that profit in bull and bear markets – great information! Further to that, he gives a point form list of ‘requirements’ that a chart pattern must exhibit to be classifed correctly in a particular manner.

The author remains focused throughout the text on his trading via the use of charts. A couple of times he may mention an MACD divergence or other indicator related metric – but then suggest the reader refer to other books to follow that idea through – the book remains firmly focussed on charts.

The book is written a bit conversationally in places, as the author uses simulated discussions between two traders as a tool to convey points regarding trades. Looking at the price, I must say its one of the less expensive books of its type. Whilst not to the detail of his other texts (which I’ll review at some later date) this is an excellent beginner to intermediate text.

The best thing I learnt from this text? I’ve got to say looking at ‘busted patterns’. Whilst I have been aware of them for some time, looks at the statistics – I’ll be looking for ‘busted head and shoulders’ more often!

gold

Is it just me – looks like a head n shoulders forming on gold (against USD) when I look at an hourly graph between 21 May, 12 June. Not confirmed as not closing conclusively below neckline – which makes it a squiggle as opposed to a tradeable pattern. I’ll keep watching that one.

When I look at Gold against AUD it almost looks like they are tacking each other…

Leave a comment

Leave a comment