Archive for the ‘paper trade’ Category

trade idea bhp-15 – closing

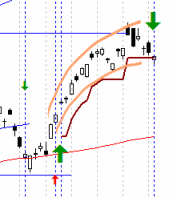

bhp - the close

Well, the BHP trade is stopped out today – see the graph to the right.

Given its a paper trade, I will assume I bailed on the fall through the stop loss line, at $37.60. Exited for a 7.7% gain.

Now – if this wasn’t a paper trade I would still be in, as the close was marginally above the stop loss (which was $37.50). So – don’t know if this is good or bad till tomorrow.

What is of interest is that todays trade has a long tail candle looking like rejection of the lower prices – so the longs may still be in the running.

all ords

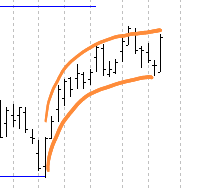

The graph to the right here is the ASX all ordinaries showing the the steady rise since earlier this year, and the rapid rise coinciding with the rise I rode on the BHP trade. Its interesting that BHP appears to be at the bottom of its channel, and the All ordinaries appears to be at the top of its channel.

Transparency

Todays reading of the interwebbything covered this post from Howard Lindzon on transparency. I’d have to say I agree with him no end – I really struggle to take at face value what I read about various companies, be it in the press, the web or even the company reports. Thats why I work with charts and price movement – often with an indicator or two thrown in.

And as for the transparency provided by twitter…? I post my (public) trades on twitter more or less when they happen, and write posts here. Is it possible for me to rig my results? Yup – I’m sure I could diddle it, but for now there is no reason for me to do this – I am reporting on myself for my benefit. Over time I will start to compare my results with managed funds, and work out if I am ‘wasting my time’ – or then again – see if I can go work for a managed fund… or.. I’m sure there are other options. Its not like my day job is really stimulating me at the moment!

trade idea bhp-14

bhp at end of week

Ahhh the BHP paper trade…

The close on friday is approaching the stop loss, but not closed below yet.

Hang in there, profitable at the moment on the long. If the bulls keep running, we can reasonably expect resistance above to break, in which case this will become a very attractive long position.

Hold.

trade idea bhp-13

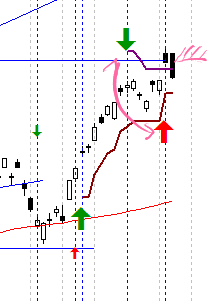

bhp today

So, not a good day for my portfolio today, a few stops hit which I’ll have to deal with tomorrow – looks like a late fall in some stocks.

To review the position on this paper trade – as stated yesterday the short position closed out (at the upwards red arrow) for a loss of capital of ~50%, not too bad, as it was only a small position, so this still ~2% of portfolio loss.

The long trade is still open. Not looking good today due to the strong black candle falling from resistance, however I will not exit – I will wait for confirmation by closing below the stop loss line.

On another note, did some web surfing tonight and stumbled across some interesting posts.

I quite enjoyed this post about getting divorced from discretionary trading by the Milktrader – well written, and something on my mind. Since I started this blog I have been discretionary trading whilst I wait for my Systems to start generating signals.

Another article of his goes on to talk about ‘trading rules‘, and his thoughts on them (text from Milktrader):

There is personal stuff at stake. Anyone who preaches to you that you need to stop it and get a plan is really preaching to themselves. They are healing a wound, or trying to convince themselves that they no longer participate in the egregious activity of trading without one.

I find this very interesting, and I encourage you to read his article. Part of the reason for this blogs being is to assert a level of rigour over me and my actions. I lost a chunk of money a few years ago now, as well as a chunk with everyone else with the financial crisis over the last couple of years.

- My best trades (profitable, stress level) have been discretionary

- My most consistent returns over time have been system / rules related

- My worst trades have been either discretionary and system related when I have broken my portfolio allocation rules, and when holding losing trades.

As someone famous once said “Know Thyself”

trade idea bhp-12

well – lost out on the short trade today. The short trade was in a warrant with a hurdle at 29 which was clearly penetrated today, closing my position.

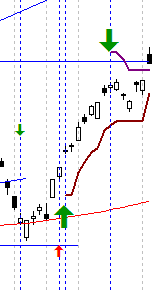

bhp today

But the long trade is still looking good. A definite penetration of resistance in early trade was quickly stopped in its tracks to stop around the resistance line.

Should resistance be penetrated it could be expected to become support, and the long trade will continue – otherwise we could be approaching its limit in a dip over the next day or two.

trade idea bhp-11

bhp - 3/8/09

At a point of hesitation.

Both positions are firmly within their relevant stop loss boundaries. The bulls appear at a slight advantage based on the rise late today.

Hold both short and long positions.

trade idea bhp-10

The big Australian has a small dip.

bhp - a small dip

In the last post I saw a decision point on the short term horizon – a view that proved correct.

Looking at the graph today, 2 positions need to be commented on.

The long trade (the paper trade) is still open, however the profit is being eroded as it dips towards the stop loss line.

The short trade (which is actually in play, not just on paper) is currently profitable. It is fairly highly leveraged due to the use of the warrant which is very close to the money, but that just means I go for a very small position to fit with my portfolio allocation model. I think this only has a little way to go, and will maintain a tight stop and set a profit target.

Cheerio,

trade idea bhp-9

bhp - decisions...

More on BHP – the big Australian.

This has been a paper trade going on for a while now, and the long position is profitable.

I am however cautious about this current long market… we are now over 10 days increasing on the trot – and that doesn’t happen too often.

Does this break the rules of a paper trade? I am long the trade (in this paper trade scenario), and have a mid / long term bullish view of BHP. I do however think that the bulls have good a good trot – and at the same time as BHP is hitting a point I’d expect to see resistance. So – today I entered a short leveraged position in BHP expecting a short term dip. Not on paper – a warrant trade on BHPXOQ – I must say a risky position, and highly leveraged – so only small. Lets see how this plays out.

Too confusing now – two positions in one thread…?

trade idea bhp-8

my on going paper trade of BHP – making me wish I backed this one… but anyway, on with the next installment.

bhp last friday, daily

Looking at the chart to the right, BHP has come up strongly from the bounce off support which showed my short position failed. Since then, the share has made strong movements to the upside, in line with the ASX all ordinaries.

The price is now just shy of possible resistance from the recent minor high seen to the left of the graph. Should that resistance prove weak we can expect BHP to push strongly upwards. Too close to the point now to enter – wait for confirmation of a penetration to the upside.

Should resistance be found, it would be wise to sit out and see the strength of the move to the downside.

trade idea bhp-7

Ahhhh – no trades today, so continue the BHP paper trade.

bhp today

Looking at the chart the share is continuing to rise. The bottom of the black candle is still above yesterdays close. Hang in there.

As for the rest of the portfolio, all looking ok today, a few of the stops have moved up.

Volatility

I have commented a couple of times lately that I have found that my trading increases in times of increased volatility, and as things start to trend I lower the number of trades. This is not a concious decision, rather it is a result of my trading style. Adam Warner at the “Daily Options Report” has posted a comment in the last week or so about volatility. He’s basically saying that volatility is dropping off – and numbers don’t lie – go have a read.

… regardless of the reason, numbers don’t lie, and we still have the unresolved issue of options volatility overpriced vs. stock volatility.

Basically what I get from his comment is that options are overpriced… I might have to take this into account, because options are a great way to trade BHP.

trade idea bhp-6

So, the continuing paper trade of BHP – switched from short to long last week, and to summarise now – sitting on the sidelines in this case may have been a better idea. That said – lets see what action to take next. Note of course that in this business to take ‘no action’ is itself, ‘an action’.

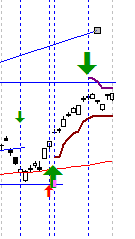

All ords - weekly scale

Start off with a whole market view. The ASX all ordinaries shows a very strong week that has just been, pushing to the topside of the bounded range (in orange). This has definitely helped my overall portfolio, as last week seemed to go well. Looking at my activity last week I opened 3 trades (2 on this blog) and only closed the paper BHP trade. Given my trading style this generally means the week wasn’t too volatile and maintained a direction. My trading frequency increases as stop are hit and volatility increases…

bhp - last friday - daily chart

Anyway – back to BHP. The friday switch of polarity from short to long was based on the penetration of short term resistance, combined with the re-entry into the wedge (indicated more clearly in my previous post). BHP has had a good week in line with the Australian All Ordinaries.

Friday was a bit flat – small white candle – which if I look at in a negative mental frame looks like a spinning top and may indicate a short term high. Given the look of the other recent candles, it seems that small body candles seem fairly normal.

Summary – hold position. End of day stop loss at $33.64

Leave a comment

Leave a comment