Archive for the ‘paper trade’ Category

trade idea bhp-5

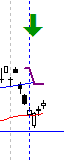

Continuing on following of the BHP paper trade. Refer to the graph below.

bhp - time to go long?

So the ASX all ordinaries is looking strong the last couple of days.

Looking at the pattern to the right its one of two things. Either

- A busted fail fall from the bottom of an upwards broadening wedge – resulting in an upwards break; or

- just a squiggle

Support was found on the lower flat line, which reisted the fall from the break of the wedge. I am now entering this to the long side, picking a paper entry of $34.90.

Lets see how we go now.

trade idea bhp-4, other comments

Continuing the BHP paper trade.

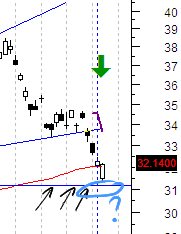

all ords daily today

The ASX all ordinaries today took a spike up, stopping just shy of a longer term resistance line – but given the narrow daily performance of late this is quite a move.

Checking my charts today, I saw bounce backs on a few of the shares I exited recently – not enough to re-enter them at the moment. I noted a couple of setups, but I want to see some short term new highs before entering to the long side. See how things go tomorrow.

bhp 14-7-09

So – back to the paper trade. See the BHP graph.

BHP clearly was sympathetic to the greater market move, and recovered its recent dip. A close on the stop loss indicates a close to the paper trade.

This results in a paper trading loss of ~5% (this trade was to the short side).

Going off on a tangent, my blog entry that grabbed my attention today was by howard lindzon, who is talking about ‘Being too small to fail‘ – fun short entry. Funny – the bit that really caught my attention was actually the following:

“…I am doomed to have most of my money working, ALL the time.”

My cash is working all the time, as I haven’t been under 60% invested for a few years – and if you include the margin loan, I’m more than 100% invested. This forces a behaviour I need to constantly remind myself of “Trade the plan”.

trade idea bhp-3

bhp next day

Continuing the BHP paper trade.

The previous day was a doji, and the next day (friday) shows a bullish day, however the candle itself shows a day of no real market comittment again – not quite a true doji.

Looking back a couple of days the pattern is similar to a morning star, a common bottoming formation. It isn’t technically a morning star due to the large price range on the day. The price movement does appear to look like a short term bottom however.

Keep open, watch tomorrow.

trade idea bhp-2

bhp today - daily

Continuing the paper trade on BHP from this post.

Todays action looks like a spinning top, suggeesting indecision in the price. This is reflective of the ASX today.

Maintain the position.

trade idea bhp-2

Continuing the paper trade on BHP from this post. Entered yesterday a short position at $32.15 (notionally).

bhp 8-7-09

The price dipped today in line with the general market, but then recovered better than many others. The price seems to have bounced from the support (arrows), and will continue to watch to see if this holds.

Current conditions are: Stop Loss at $33.68, target $27 (earlier support).

BHP is a large company on the ASX so will also keep an eye on the All Ordinaries (xao) as they appear highly correlated since early March this year.

Review of other stocks in the market tonight has shown me a number with long tails, demonstrating bearish rejection later in the session. If this continues into tomorrow, this may well be a brief trade!

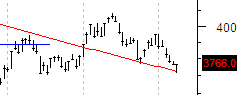

all ords today

Looking at todays All Ordinaries bearish rejection is clearly seen, although in the medium term the outlook is still bearish. As always I whould wait for a confirmation before entering a long position.

A number of my other shares that I follow lately also exhibited bearish rejection, and are on or near lines of support.

S0 – How to trade the position in reality? I contacted my broker (Commonwealth Securities) and despite short trading being allowable on the ASX, they are currently not offering it yet (no explanation given). This leaves me with OTC CFDs, ASX CFDs, options and warrants.

Over the last year I have found that warrants are a reasonable instrument for small positions – but only with some providers. With a long dated warrant I get the benefits of a CFD without the margin calls – but watch out for the barrier! Some of the providers seem to remove the buy/sell positions at times of high volatility, so I avoid those companies.

Options are also a good instrument, but I have found I only really get a good price if I have time during the day to manage the entry – which given my day job rarely happens.

So for the purposes of simulation, I am going with a long dated warrant – say BHPXOQ.

To be continued…

trade idea – bhp

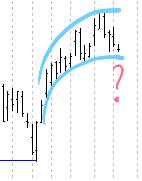

bhp - breakout (failed) ascending broadening wedge?

BHP: trade idea.

The graph to the right is BHP from today. The price action today is a confirmation of the failure of an ascending broadening wedge. From my chart patterns bible I can see that these don’t usually give a large fall, however a fall is expected. I am interested in taking this short trade, but given my view of the all ords at the moment I’ll sit out for a day or two whilst I see what the flavour is on the ASX.

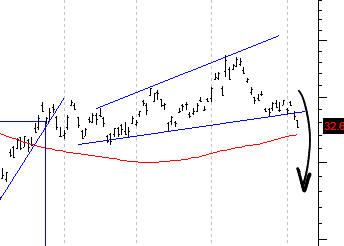

ASX All ordinaries (weekly)

Looking at the ASX:XAO (to the right) the graph is on the cusp of its next ‘decision point’ or move. If the graph were to fall out of the bands I’ve sketched I would look to short soemthing, and at the moment, BHP could fit the bill.

Of course – until I commit a cent, this is all just an idea…

Remember – wait for confirmation of a move, in line with the overall market.

Leave a comment

Leave a comment