Archive for the ‘System A’ Category

recent trades, close mms, bptkmb, open mvp

So the impact of the Greeks is taking out my positions, slowly but surely. Been a busy week at work so I haven’t been posting my updates promptly, but I am seriously having to gauge whether I drop all positions, or hang in there. SXY seems to have fallen so far I would be entering again looking for a rebound… possibly a really bad idea though…

BPTKMB: I had my position closed yesterday in my warrant position Beach Energy at $1.20 for a 50% loss under System B. The stop was the exit price on the barrier warrant, which returns the intrinsic value to me in a week or so. As I bought in at a low price, and the warrant exit price aligned with my stop loss on a System A trade.

BPTKMB: I had my position closed yesterday in my warrant position Beach Energy at $1.20 for a 50% loss under System B. The stop was the exit price on the barrier warrant, which returns the intrinsic value to me in a week or so. As I bought in at a low price, and the warrant exit price aligned with my stop loss on a System A trade.

You can see how the price fell after exit day in the picture to the right so that stop loss worked well for me – noting that my position size was quite small so a 50% loss is not a significant cause for concern.

MMS: I closed a position recently in Macmillan Shakespeare at $10.51 for a 1% loss. This was a good trade in regards to a good clear entry, and the exit was clearly defined. MMS has been a good share in relation to strong moves, so I may be back in it shortly – let’s see how it pans out.

MMS: I closed a position recently in Macmillan Shakespeare at $10.51 for a 1% loss. This was a good trade in regards to a good clear entry, and the exit was clearly defined. MMS has been a good share in relation to strong moves, so I may be back in it shortly – let’s see how it pans out.

MVP: I opened a position in Medical Developments at $0.75 using System A. This is a risky position due to the greater market moves – although this share has been growing consistently and strongly for some time. You can see todays movement in the share price and the dip was fairly strong – however the price seems to have stalled at a resistance level.

MVP: I opened a position in Medical Developments at $0.75 using System A. This is a risky position due to the greater market moves – although this share has been growing consistently and strongly for some time. You can see todays movement in the share price and the dip was fairly strong – however the price seems to have stalled at a resistance level.

last friday – close sai, waa, nwh, bru

The last week has been flat to down, and my portfolio has taken a bit of a bit. I was kicked out of a few trades friday, as listed below. There are others that should be closed, however I don’t usually close too many positions in one hit as I have noticed that it leaves me too underexposed

The last week has been flat to down, and my portfolio has taken a bit of a bit. I was kicked out of a few trades friday, as listed below. There are others that should be closed, however I don’t usually close too many positions in one hit as I have noticed that it leaves me too underexposed

WAA: I closed my position today in WAM Active at $1.07 for a 7% loss under SystemB. The share fell rapidly following my entry, however I didn’t release immediately as it’s a weekly trading system. The exit was triggered at the end of last week, but under the rules I can exit anytime this week – I waited until friday to see if the market would increase at all. Funnily enough, the share recovered friday so my loss was slightly lower than expected.

BRU: I closed a position today in Buru Enegy at $2.69 for a 14% loss under SystemB. This was my second entry, looking for a bounce at the point of entry. The position didn’t play out as expected, so I exited quickly. Given the loss, not quickly enough – but within plan nonetheless. I really did miss a good move in Buru, which seems to have occurred slap-bang between my two trades.

BRU: I closed a position today in Buru Enegy at $2.69 for a 14% loss under SystemB. This was my second entry, looking for a bounce at the point of entry. The position didn’t play out as expected, so I exited quickly. Given the loss, not quickly enough – but within plan nonetheless. I really did miss a good move in Buru, which seems to have occurred slap-bang between my two trades.

NWH: I closed my position today in NRW Holdings at $3.58 for a 13% loss under SystemB. I seem to have picked a top again by buying into it!

NWH: I closed my position today in NRW Holdings at $3.58 for a 13% loss under SystemB. I seem to have picked a top again by buying into it!

This entry has actually disappointed me – looking at the entry point, there is no clear breakout – I really just bought in on a high volume and dominant candle. This is what I am supposed to be avoiding in System B, so I actually have to call this a poor trade – even though I executed my exit strategy correctly.

SAI: I closed part of my position today in SAI Global at $4.68 for a 10% loss under SystemB .

SAI: I closed part of my position today in SAI Global at $4.68 for a 10% loss under SystemB .

I was definitely more happy with this entry than the previous one (NWH above) as it was a breach of a longer term resistance line. A nice clean entry, but it looks like rejection of the higher prices was fairly sudden and strong. I snuck a look at market depth late friday, and I noticed almost all sellers leave the market, leaving lots of buyers, and almost no sellers – I was expecting the price to suddenly jump, so I moved the remainder of my position to a higher sell price. Just prior to close a lot of sellers re-entered, keeping the price down on close. Will look to exit the balance of the position shortly.

All up – a week of losses, and general erosion of the portfolio.

today – close lsa, open tel

So the last couple of days have been a bit hectic for me and it looks I have some stops to take out. Hopefully I can get online and transact them tomorrow.

So the last couple of days have been a bit hectic for me and it looks I have some stops to take out. Hopefully I can get online and transact them tomorrow.

LSA: I closed my position today in Lachlan Star under SystemB . The share touched my stop loss on the share and so I was exited. Looking at the remaining open positions this one may have been worth keeping, as some of the others are not looking at all healthy. Oh well – drop the losers, ride the winners. Today this one isn’t a winner.

TEL: I opened a position today in Telecom NZ today under System A, the longer term trending following system. I actually missed my entry yesterday and chased price overnight to enter. I haven’t logged in during the day for a bit and this can delay the transactions.

TEL: I opened a position today in Telecom NZ today under System A, the longer term trending following system. I actually missed my entry yesterday and chased price overnight to enter. I haven’t logged in during the day for a bit and this can delay the transactions.

This share really has a nice slow steady increase – and I just hope it keeps on going the same.

The last couple of days have been a bit unusual – the US and UK markets are not showing strength, but today the ASX made some new mid term highs – a good sign for the next short period of time. Also maybe even a divergence with these other western markets.

today – opened sxy, gnc, bptkmb, mix

Todays been a down day on the ASX. I placed my trades last night (Sunday night) and came home to see what positions I had taken up. Always a risk as I can’t see how my positions are dealt with, and I am placing them without taking advantage of any price dips during the day.

SXY: I opened a position today in Senex Energy under SystemB . This is an entry on the weekly momentum system. The entry price was $1.145.

SXY: I opened a position today in Senex Energy under SystemB . This is an entry on the weekly momentum system. The entry price was $1.145.

You can see the earlier trade I had in Senex which was recently closed out, and very profitable. The entry today would imply that the trend may continue. Looking at the graph updated with todays price it looks like a tweezer top / double top may be forming – so I’ll keep a close eye on this one.

GNC: I opened a position today in Graincorp under SystemB in what appears to be a continuing uptrend. The entry price was $9.26.

GNC: I opened a position today in Graincorp under SystemB in what appears to be a continuing uptrend. The entry price was $9.26.

I did notice there was a warrant for this trade, however I have stuck to the main equity in this case.

BPTKMB: I opened a position today in Beach Energy under SystemA. I actually opened the position in another warrant against BPT, as I am looking for the leverage on this one. The entry price was 0.435.

BPTKMB: I opened a position today in Beach Energy under SystemA. I actually opened the position in another warrant against BPT, as I am looking for the leverage on this one. The entry price was 0.435.

In this case BPT again showed up in my trend following system and looks to have turned up from the recent low. This trade is taken on a small investment as the share is developing into a down trend (lower lows and lower highs). The recent dip seems to have come up as a result of the company running a capital raising. The capital raising seems to have knocked the price a tad.

MIX: I opened a position today in Mirvac Industrial under SystemA after a strong close at the end of last week. The entry price was $0.105.

MIX: I opened a position today in Mirvac Industrial under SystemA after a strong close at the end of last week. The entry price was $0.105.

I’ve never traded MIX before so I will have to get a feeling for its personality 🙂

Time for a sleep – I’ll update the portfolio page tomorrow.

today – or yesterday? close bpt

Well there you go – if you don’t do your homework in this game, things can go wrong – very wrong.

BPT: I was stopped out of my Beach Petroleum position a day or so ago and didn’t know.

BPT: I was stopped out of my Beach Petroleum position a day or so ago and didn’t know.

As noted in the entry on the buy, I entered this trade with a warrant (BPTBOK) to get leverage into the position. The warrant had an expiry at $1.37 – which was a level hit by BPT recently when it dipped recently when a capital fund raising was announced . In light of the target being hit, the warrant has expired and I’ve done my dough.

Well – not quite – I have two saving blessings:

- The warrant does not expire worthless, I am refunded a residual payment, meaning I lose about 50%, not 100% of my investment

- I took the high leverage into account, thus having a small position size. This effectively has left me with a 2-3% portfolio loss, which is not unreasonable for a trading error – as opposed for a poorly managed stop.

So this trade has certainly not gone according to plan. The loss taken by the fall in BPT was within the parameters of SystemA, however I am now out of the position and the share is not in a place I would enter at this stage.

today – open bpt

BPT: Opened a long position in Beach Petroleum today – I entered with a warrant to gain some leverage. The instrument I used was a warrant BPTBOK, with an entry at $0.395 – I have the dubious honour of being the only purchaser today. This is a SystemA trade, which is a longer term trend following system (the first one of these written up since coming from hibernation).

Again this is a share that I have previously entered – in fact, this is one share that has popped up in my SystemA scan a couple of times over the last year of so – and given only two members of the ASX200 have shown up in about a year, it is a bit of a rare beast.

Note that I am using a warrant as the tradeable instrument, but for the plan I trade the underlying share, and take signals from that – hence the share price graph here.

Anyway, I’m off to bed – I need the ears to calm down – I saw Duran Duran tonight, and actually felt young in the audience.

today – open sfh

SFH: Opened a position in Specialty Fashion today at $1.47. Hmmm… a share I’ve never owned before, and have in fact never heard of…

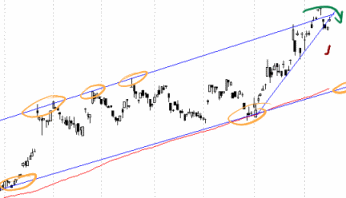

I selected this position today as it showed up as a high mover on my market heat map today. I pulled up the longer term chart and was able to draw an uptrend thats been more or less in place since February this year… which makes it one of the early ones to break out.

What against it? Well I don’t use indicators much, but I do cast an eye over them now and then. This share is showing declining momentum over the last three months – not unusual given this is happening a it in the current market. That said – I will follow my usual plan, and see what comes out the other end.

As an aside: System A had no new entries this week.

today – open jbh, close iif

JBH: Opened a position in JB Hifi today at 22.78.

As noted in my last post, my System A has fired an entry in JB Hifi. System A is a medium/long term trend following system, that has so far only triggered on two stocks in the last 6 months. The system is only scanning the ASX200 at the moment – I really do need to sit down and tweak the system to scan other markets – but I haven’t done that yet.

I have no issues at all making this entry – this is one of the smoothest up trends in the market.

IIF: Close my position in ING Industrial Fund today as 0.45 for a 13% loss. This has been a bad trade, and exploits a gap in my system. As noted in other posts, I haven’t clearly planned what I will do when a company does a capital raising. That said, the recent capital raising in Campbell Brothers treated me well – a feat I was hoping to happen again in this share.

But it wasn’t to be. In the diagram I have drawn three circles – 3 exits I should have taken.

The obvious question is why did I exit today? Well, with the price drop thursday, the price of the share dropped below the price at which I could buy more shares from the capital raising – that can’t be good. The companies attempt to raise funds will result in selling me shares dearer than I can get them on the market. So – someone else can have my shares – trade closed.

Anyway, a few more stops being toyed with, so I’ll keep going with closing those positions…

weekly notes, system A results

Just a brief note tonight. Performance over the last week has not been ideal, however I have been in a sort of caretaker mode for the last few weeks, as I have a few things on:

- Getting my head around new share charting / analysis software (Amibroker)

- Managing current trades

- My actual day job – very busy lately, in the process of winning a major project – very stimulating

Its been important to stick to stops in these quieter times, and when doing my portfolio update for tonight (posted a few minutes ago) I note that I missed an exit Friday as I didn’t check Thursday night because of work. So – my salary job has cost me my trading $$!

This weeks System A report showed up two entries: ASX:CNT, ASX:JBH. I will enter a fresh position in JBH based on my system trigger this week.

system A fires – first time in ages

My trend following System A fired for the first time in ages today. And it only came up with the one – Centamin Egypt (CNT).

Looking at the chart, it is not what I’d call an ideal entry!

CNT is climbing a rising channel, and is just on the bounce from the top of that channel.

There are a couple of reasons I am going to skip this first entry from my system:

- I can’t get it on margin, and cash reserves are light

- It looks like its about to dip, so going short might make sense – but this stock seems unborrowable – so can’t short it.

Anyway – now that the system has fired, I expect a few more options to arise over the next week. For more about System A look here.

Leave a comment

Leave a comment