Archive for the ‘System A’ Category

friday – pyramid entry jbh

jbh pyramid

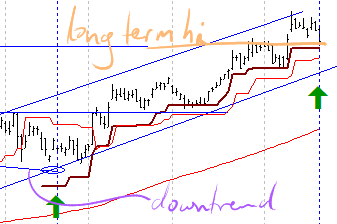

JBH: pyramided into my JB Hifi position again today, at $17.50 – this trade is looking like the ones you see in book so far (ok – yes, I do put too many lines all over the place sometimes!)

The original entry can be seen in the diagram to the right when the earlier downtrend crossed the more recent term uptrend. So far the channel has held quite nicely, and is returning nicely.

On to other things – ran System A scan – still nothing!

Weekly readings:

At the Bespoke Investment Group you can see a write up which compares the ability of their respondents to accurately pick the market direction, and compares it (un)favourably to going by the toss of a coin here.

Another interesting read at Daily Speculations (a website about – amongst other things – ballyhoo deflation!!) which talks about risk and loss aversion. This article is well written, but I did resonate with the following line (quote):

I think most investors who are not professionals have a very shallow understanding of risk.

When you sign up to trade CFD’s, options, shares and other things you have to sign all sorts of documents regarding risk – but until I lost money sometime ago the concept of risk was just that – a concept. Now its something that I find I manage no a daily basis – whether its the amount of money I have in a share, my portfolio balancing, my amount in cash – I’m constantly casting an eye across the where the money sits – and hence – where the risk sits.

anyway, time to relax before the new week starts – adios!

minor edit – 27/10/09 – realised the heading said closed instead of opened

today – open iif

iif open

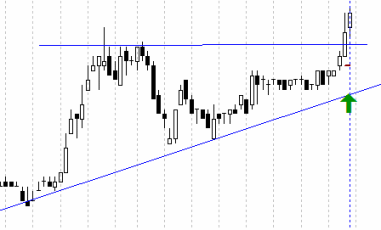

IIF: Opened a position with the ING Industrial units today at 0.325.

This is the second trade in IIF over the last few months – the lat one just before I started this blog. I found it originally from a heat map scan in April when it was showing a very good volume in the market at that time. The volume was down a little over the last 2-3 week s, with a good increase over the last two days, spiking nicely on friday. The entry was effected during the days trade when the price traded over 0.325 after noon (set the trade night before as I am doing a lot lately).

The graph is not really a true ascending triangle as there is really only one bounce off the top resistance line, rather than the two I would prefer. Still, a strong looking pattern, so will ride this one through.

System A: Did the weekend scan this afternoon – the system still is not firing, so will carry on discretionary trading.

Portfolio tracking:

So here’s a question for anyone who reads this – I’m after suggestions for tracking my portfolio on this blog… as you can see on the link buttons I’ve made a start, but it seems like it will take a while for me to keep it updated – I’m looking for an easy way to do this. I’ve got ideas… but…

Anyway, the bulls seems to be taking a breather – but my graphs think they are still running. Lets see what this week has in store for us!!

friday – mcc – weekly summary

End of another week. A good way to end the week though – for music fans Australian radio station JJJ did the ‘Hottest 100 of all time‘ – was great to listen too – and the commentary provided by the DJs as great!

mcc entry, friday

MCC: Macarthur Coal looks to have formed a small scale eve and eve double bottom. I entered this on friday with an entry target set in advance, which may have been a slightly risky entry – however it has closed above the mid point of the pattern, making this a valid double bottom formation. Based on this pattern I have an immediate target of ~$7.50. Over time I have seen resistance between 6.70-7.90. Lets see how this plays out.

Weekly scan for System A – No results.

On another note – what is the impact of negative interest rates? I found an article at the ‘Cumberland Advisors‘ website interesting regarding the Swedish central bank (the Equivalent of the Reserve Bank of Australia) moving to negative interest rates – read more here.

a quiet day – end of the financial year

A quiet trading day today, a few of my stocks dropped a little today, with one closing 0.5 cents above a stop – so I may have something to do in the morning.

I noticed today David Jones (DJS) making a yearly high, and looking in a healthy trend, but I’ll steer clear for now. I’ve got enough to watch.

The actual news for me today is that its the end of the financial year. Its time for me to sit down, review my trades for the year as a whole, and work out what I could have done better – and if what I am doing makes sense.

My initial cut of my numbers shows that I have had a performance of -9.5% for the year -> Yup a loss of 9.5%. This includes all commissions, transaction fees, data fees, printer ink etc. My next action is to work out what the funds I was looking at this time last year did, and whether my trading was ‘an intelligent use of my time’. Of course once I do a crunch of all the numbers this result may move by a point or two, but i’ll get to the bottom of that on the weekend.

System A has not selected a trade in the last 6 months at least – but I’d expect that given its a basically long seeking system in that starts firing in a bullish market.

On another note, once I have finished the rewrite of System A for the US market I expect it to locate stocks like those in this blog from FundMyMutual. He lists 11 stocks he terms ‘The Untouchables“, amongst them VPRT (something I hold, but not documented here as I’m sticking to Australian stocks in my writings), PWRD and others.

And on to the next financial year!

weekend update

Quiet day last friday, but on the whole good for my portfolio.

Ran System A scan for next week, and still nothing. However running through the charts at the moment, there are a few good trading patterns formed and in the process of forming. Definitely some nice trends developing, however the swings are quite wide, so position sizes are small to manage the risk. Will sit out of the market for the first few hours tomorrow to see how the weeks trading starts. I’m on leave from my real job this week so hope to finsh the mods to System A.

Best trade at the moment seems to be my open position in EWC, and I’m keeping a close eye on that.

friday – aqp – chc – fmg – pna

Friday was a busy day for me at work, and as I got home friday night, I found my portfolio had changed shape due to some of the trades I placed earlier.

AQP exit - UGLY!

I closed my position in AQP for a 20% loss – OUCH! And the graph is ugly. When I look at it now, after the pain of the loss has past, the price was clearly ranging. When the share went through my stop loss at ‘1’ I should have exited immediately – instead I held thinking it might recover… big mistake… Never second guess the plan when its in place, take the exit signal when it comes, and re-enter if conditions suit. Now to go write that out 5 times! Anyway, learn from it – and move on.

CHC entry

Entered a long CHC position today, and as entries go, I am happy so far. Pushed through what looks to me like the upper line of a flag on Thursday close, and rose all day friday – and look at the volume.

Having done this for a while, I came to my own personal view some time ago that I can pretty much buy anything – as long as I manage my exit well. I can get out with a small loss if I enter badly – but keep it to a small loss. That said, I’m always happy with an entry like the one in the picture… I’ll see how this plays out.

Entered a long FMG position. On close the days trade looks like a spinning top which is disheartening, but does not trigger an immediate exit. Will keep a close eye.

Exited a long PNA position, but I’ll write this up when I fully exit, as I didn’t fill the order.

System A: Ran my scan – which is designed to run on weekends – still comes up blank! It still doesn’t like this market.

Final thought for the week – this was an active week, more transacions than I usually like to make in a week, which is making the management of the positions more time consuming. And it appears that even the professionals struggled with making anything of this week – read what The Kirk report had to say – he’s expecting a bit more to work with next week.

Systems

I run a couple of systems, noted here so my other posts make some sort of sense.

System A: A long term trading system that looks for long term trends in the ASX200. Currently reviews 200 trading days for constant(ish) growth, and looks to take a position from a week to a number of months looking for share price increase. As you may guess, given the ASX over the last year, its a long time since this system signalled an entry.

System B: Not finalised. Essentially a shorter term trend following system based on ‘System A’. As ‘System A’ is written in C++, I am updating the code to remove a number of assumptions that I use in the share selection component to look for 3 month trends with other criteria similar, possibly extending outside of the ASX200. Some more coding to do – then testing. By the time I get there ‘System A’ may be running again… who knows.

So – System B has been redefined in March 2012 – see here

discretionary: ok – not really system based. Born out of the current world financial situation… what can I say. When my systems generate nothing, I revert to bits that interest me – in this case, shorts and pattern recognition. Almost all of my trades for the last 5 months have been discretionary – I get tips from a ‘heat map’ provided in real time by my broker, weekly volume increases, large candles and other signs I look for that tell me ‘there’s activity here’. Chart patterns are a favorite. Is it a cup n saucer I see formed in Fairfax today?

All systems have a money management component regarding stop setting and weighting by sector and as a whole of the portfolio. These are not detailed as I do not want to be seen to be offering any financial advice.

I am not a financial adviser, and I am not offering advice – just a guy with an interest

Comments (1)

Comments (1)