Archive for the ‘System B’ Category

today – bru open

So todays been a good day on the ASX with a bonza climb – but not across my portfolio. I’ve had a good run with a portfolio largely outside the ASX300. Looking at the results today, I don’t know what sector went up – anyway, that’s for research after this posting.

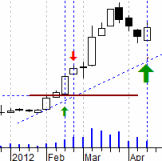

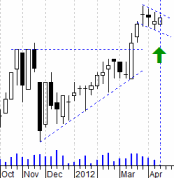

BRU: I opened a position today in Buru Energy under SystemB and the share seems to have had a good day. Clearly looking for an increase from the recent 50% retracement. The entry price was $3.11 as a CFD entry.

BRU: I opened a position today in Buru Energy under SystemB and the share seems to have had a good day. Clearly looking for an increase from the recent 50% retracement. The entry price was $3.11 as a CFD entry.

The share ahs had a good run over the last few months, climbing from 50c to about $3.80 oevr 6 months. I had a short dabble recently (as you can see in the diagram) but got stopped out quite quickly on a profit stop. This time I am giving it a bit more room to move.

LMC: On top of that, the LMC order I placed the other day had a second fill, so my position is now fully open.

today – opened … quite a few

Today I opened a number of positions – more than usual, but a few showed up in the scans.

WHCKOB: Opened a long position in Whitehaven Coal today on System B at $1.835. This is a warrant for a leveraged position – I trust this one will go a little better than my recent foray into a warrant in BPT. Whitehaven is a share I have owned on and off over time and it appears to have strength at the moment.

WHCKOB: Opened a long position in Whitehaven Coal today on System B at $1.835. This is a warrant for a leveraged position – I trust this one will go a little better than my recent foray into a warrant in BPT. Whitehaven is a share I have owned on and off over time and it appears to have strength at the moment.

(update – I replaced the diagram to the right for WHC at I had pasted in the incorrect image – it was a daily chart, rather than the weekly chart I use for System B – 18/4/12)

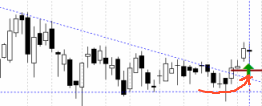

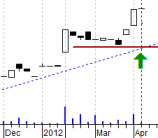

LMC: Opened a long position in Lemarne Corporation today on System B at $0.75. I only got a partial fill on my order, but will sit on my order and wait to get filled at the moment as the overnight market looks decidedly bearish.

LMC: Opened a long position in Lemarne Corporation today on System B at $0.75. I only got a partial fill on my order, but will sit on my order and wait to get filled at the moment as the overnight market looks decidedly bearish.

This also looks to be my riskiest position today, as it has climbed dramatically recently (the graph only shows the recent ‘flagpole’ however there was another shortly before this, on a weekly graph). Risky position, thinly traded = small position.

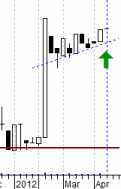

LSA: Opened a long position in Lachlan Star Corporation today on System B at $1.70.

LSA: Opened a long position in Lachlan Star Corporation today on System B at $1.70.

Lachlan looks like it may have formed a flag, implying that this position is halfway up the flagpole. Over time I have stopped trusting too much in chart patterns, however I haven’t totally discounted. I need to get out my Bullkowski book and check up no the probablilties and see how the various patterns track.

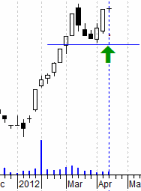

SPN: Opened a long position in SP Ausnet today on System B at $1.06. SPN has pushed out the top of resistance, and seems to be dipping back a bit again.

SPN: Opened a long position in SP Ausnet today on System B at $1.06. SPN has pushed out the top of resistance, and seems to be dipping back a bit again.

I’m looking for a continuation of the march forward from the top of the triangle.

AIA: Opened a long position in Auckland International Airport today on System B at $2.00.

AIA: Opened a long position in Auckland International Airport today on System B at $2.00.

Auckland Airport is having a steady increase so will look for this to maintain the forward momentum.

SAI: Opened a long position in SAI Global today on System B at $5.19.

SAI: Opened a long position in SAI Global today on System B at $5.19.

SAI Global can be a less than exciting share however it is now making new highs. This is usually an exciting thing for my Plan B as I am looking for continuing increases from here.

All that said – I realise this is one of my more bland updates. Too many positions and too late at night to worry about getting too flowery! Its really a case of seeing if some of them rise and return a couple of dollars to the kitty.

Night!

today – open waa, snl

Market took a dip today – must have been the first day after a public holiday – oh yeah, it was. I should analyse that and see if there is a seasonal trade in there somewhere to be profited from in the future. Anyway, on with daily summary.

WAA: Opened a long position in WAM Active Limited today on System B at $1.145. Similar to my entry into PRG recently, a previous entry in this share was stopped out, but the recent climb has taken it to a 2 year high.

WAA: Opened a long position in WAM Active Limited today on System B at $1.145. Similar to my entry into PRG recently, a previous entry in this share was stopped out, but the recent climb has taken it to a 2 year high.

Volume for the last two weeks has been healthy, which is a positive, although not a decision maker. I have noticed that this share is a slow mover, and not a lot of gain, however making new highs should not be underestimated.

SNL: I also opened a long position in Supply Network today on System B at $1.02. This share has been on an almost straight upwards trend for a while (about a year on a weekly chart) and has reached the emotional barrier of $1.

SNL: I also opened a long position in Supply Network today on System B at $1.02. This share has been on an almost straight upwards trend for a while (about a year on a weekly chart) and has reached the emotional barrier of $1.

I have been reluctant to enter this position recently as it can be thinly traded. I noticed today that I was one of the few buyers, and at one stage it appeared to be down to one seller (should I be thinking on the greater fool theory here…?).

Last week was a rare week for me. I travelled to Taiwan for a week, and basically lost touch with the market. I managed a few checks of stop losses, but not much. Why was this rare? Two reasons – I’ve never been to Taiwan before, and its the first time I have travelled without coming back to a decimated share portfolio! Woop Woop I say. I somehow managed to travel for the global tech crash, and on a mobile phone call found I had lost a bundle – that was due to, well, poor sector diversification. In other words – if it was a tech stock I had it, if it wasn’t I didn’t.

So a week of travel and no crash – a double bonus that seems to me. Now I am back, remember to recite: Stick to the Plan. Plan the trade and trade the plan.

today – open prg

PRG: Opened a long position in Programmed Maintenance Services today on System B at $2.52. A previous entry in this share was stopped out, but the recent climb has taken it to an 18 month high.

PRG: Opened a long position in Programmed Maintenance Services today on System B at $2.52. A previous entry in this share was stopped out, but the recent climb has taken it to an 18 month high.

Volume isn’t great, however I don’t use that as a significant decision factor.

On another note the ASX200 today broke through and closed over 4300 – a good sign for the bulls!

today – open brg (pyramid entry)

BRG: Opened a further position in Breville Group today using SystemB – this was a pyramid entry into an existing position. As for my previous pyramid entry that started prior to updating this blog I will simply track this entry. This entry was at $4.01.

I took the entry on a slight pullback from 4.05. I was looking to enter on penetration of the $4.00 line. This looks fairly aggressive, but the share is making all time highs, so I’ll go with it.

This is another nice looking breakout – and a long term traditional company – not a funky miner or explorer.

In other news I was bounced out of a trade in Senex today (ASX:SXY) when the price took a sudden dive on bad news. I’ve considered buying back in – but that is the sort of thing I did back in 2010 when I last used to write this blog. There seem to be plenty of opportunities at the moment, so I’ll sit on the sidelines for a couple of days and see how the price plays out.

Anyway, its bed time – night.

today – open mms

MMS: Opened a long position in Mcmillan Shakespeare today on System B at $10.65. I am no longer fully invested as a few trades got bounced out yesterday (not listed on this blog), freeing up some funds. I did a hunt last night and thought MMS looked the best of the opportunities.

The share is making long term highs, rising consistently, and shows increased volumes over the last few months.

Anyway, I’m off to bed – its a busy week, Duran Duran monday, and the Melbourne comedy Gala tonight – ace!

today – open cmj (pyramid entry)

CMJ: Opened a further position in Consolidated Media Holdings today using SystemB – this was a pyramid entry into an existing position. For the purposes of tracking here I will simply track this entry. This entry got in at $2.96.

Looking back on my entry, I suspect I should have held off for an entry ~$3.05 to avoid any round number resistance. I have taken on slightly more risk than I intended.

This is a nice looking breakout I am trading, however I don’t see this as having huge potential as it’s a media company – but, oh well, the system found it, so let’s see how we go.

today – open nwh

NWH: Opened a long position in NRW Holdings today at 4.13. This is a SystemB trade (the first written up since coming from hibernation).

You can see in the diagram that I have previously entered, and was shaken out. The system called it back onto the candidates list, and with the way the week has played out, I took this prior to week close.

I had a meeting with a customer this morning so my 4.05 buy on open wasn’t taken – it opened up. I chased price when I logged on and got the $4.13.

SystemB – What it is

SystemB has evolved since I went into hibernation.

System B is a short term breakout trading system based on weekly charts. I have coded the weekly search using Amibroker. The search then locates a number of candidates, which I select from based on visual clues, typically looking for some kind of recent breakout. The universe for SystemB is open to ASX and the US, however I am generally only tracking ASX… this may of course change from time to time.

I am tempted to run it against the Singapore and Nifty stocks – but I haven’t got to that yet.

This system is intended to work in all market conditions, however clearly many are found during times of market growth, and a much smaller number in sideways periods. I look for short entries, but I have a bit more coding (as of March 2012) to get to where I am happy.

The candidate lists are typically generated on the weekend, however I may not take an entry until mid week. Exits are taken based on stop loss, or loss of momentum (my formula). System exits are interpreted on fridays close, however I may not enact them until late the next week – making it a discretionary element.

Systems

I run a couple of systems, noted here so my other posts make some sort of sense.

System A: A long term trading system that looks for long term trends in the ASX200. Currently reviews 200 trading days for constant(ish) growth, and looks to take a position from a week to a number of months looking for share price increase. As you may guess, given the ASX over the last year, its a long time since this system signalled an entry.

System B: Not finalised. Essentially a shorter term trend following system based on ‘System A’. As ‘System A’ is written in C++, I am updating the code to remove a number of assumptions that I use in the share selection component to look for 3 month trends with other criteria similar, possibly extending outside of the ASX200. Some more coding to do – then testing. By the time I get there ‘System A’ may be running again… who knows.

So – System B has been redefined in March 2012 – see here

discretionary: ok – not really system based. Born out of the current world financial situation… what can I say. When my systems generate nothing, I revert to bits that interest me – in this case, shorts and pattern recognition. Almost all of my trades for the last 5 months have been discretionary – I get tips from a ‘heat map’ provided in real time by my broker, weekly volume increases, large candles and other signs I look for that tell me ‘there’s activity here’. Chart patterns are a favorite. Is it a cup n saucer I see formed in Fairfax today?

All systems have a money management component regarding stop setting and weighting by sector and as a whole of the portfolio. These are not detailed as I do not want to be seen to be offering any financial advice.

I am not a financial adviser, and I am not offering advice – just a guy with an interest

Leave a comment

Leave a comment