today – close tol, open aqp

AQP: Opened a position in Aquarius Platinum today at $6.64.

Entered the position is the share has made a new high, and if previous history is anything to go by (and when trading on a technical basis there is nothing else to work with!) this share will be volatile, and can move significant distances rapidly. In this case I have gone with a stop loss that is spaced a bit further than usual, as I don’t want to get ‘bounced out’. Lets see how this one goes.

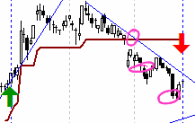

TOL: Closed my position in Toll Holdings today at 0.22, for a 10% loss – this was in the warrant tolwmb.

As you can see, the share has bounced off resistance 3 times now, so its hard to say how this share will continue. For my analysis on entry see my writeup here. I still have confidence in my original analysis, so I will look into how to continue this trade – subject to conditions of course. Every trade has to be a discrete event. I will look at my options around entry based on warrants / options or CFDs – however I wont say much now as I don’t have the time to research this next entry as yet… tomorrow maybe…?

The exit was taken today as the warrant was due to expire in 2 days, and I really don’t want to get caught looking to exercise a warrant. A 10% loss on a warrant is not bad at all, given the leverage I was playing with.

Remember – stick to your stops!

today – open jbh, close iif

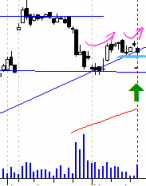

JBH: Opened a position in JB Hifi today at 22.78.

As noted in my last post, my System A has fired an entry in JB Hifi. System A is a medium/long term trend following system, that has so far only triggered on two stocks in the last 6 months. The system is only scanning the ASX200 at the moment – I really do need to sit down and tweak the system to scan other markets – but I haven’t done that yet.

I have no issues at all making this entry – this is one of the smoothest up trends in the market.

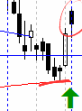

IIF: Close my position in ING Industrial Fund today as 0.45 for a 13% loss. This has been a bad trade, and exploits a gap in my system. As noted in other posts, I haven’t clearly planned what I will do when a company does a capital raising. That said, the recent capital raising in Campbell Brothers treated me well – a feat I was hoping to happen again in this share.

But it wasn’t to be. In the diagram I have drawn three circles – 3 exits I should have taken.

The obvious question is why did I exit today? Well, with the price drop thursday, the price of the share dropped below the price at which I could buy more shares from the capital raising – that can’t be good. The companies attempt to raise funds will result in selling me shares dearer than I can get them on the market. So – someone else can have my shares – trade closed.

Anyway, a few more stops being toyed with, so I’ll keep going with closing those positions…

weekly notes, system A results

Just a brief note tonight. Performance over the last week has not been ideal, however I have been in a sort of caretaker mode for the last few weeks, as I have a few things on:

- Getting my head around new share charting / analysis software (Amibroker)

- Managing current trades

- My actual day job – very busy lately, in the process of winning a major project – very stimulating

Its been important to stick to stops in these quieter times, and when doing my portfolio update for tonight (posted a few minutes ago) I note that I missed an exit Friday as I didn’t check Thursday night because of work. So – my salary job has cost me my trading $$!

This weeks System A report showed up two entries: ASX:CNT, ASX:JBH. I will enter a fresh position in JBH based on my system trigger this week.

today – open wor

WOR: Opened a position in Worley Parsons today at $27.25. Looking for a bounce on the climbing trendline.

I intended to get in on the bounce about a week ago, but missed the chance. Entered todays position on the market open.

Its a down day and slightly below the trendline, so this might be a short trade. Also there is a resistance zone a little above. Lets see how this goes.

today – open mcc, close cpb

MCC: Opened a position in Macarthur Coal today at $10.20. The share made a new high for the year when I was entering, but has since subsided into the close of the day. Volume was good today (double yesterday), so all in all a reasonable looking entry.

Counting against this entry is the observation that this share looks to have lost some of its momentum over the last 3 months or so – maybe this new high will change that… maybe it wont.

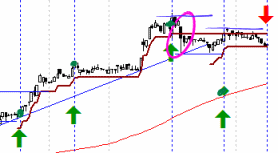

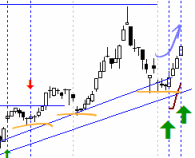

CPB: Closed my position in Campbell Brothers today at 26.99 for a 15% profit by the time you take into account all the entries I made when pyramiding.

You can see in the pink circle the effect of the capital raising, which has stalled the price action in its tracks. The fourth entry, shown as the low down green blob is the entry point of the shares collected via the capital raising.

Fairly straight forward trade, stuck to the plan for the first bit, a momentary panic when I had to think how I would react to the capital raising, and then (new plan under the arm) I traded the second half according to my updated plan.

To date I have not updated my plan with how to deal with this situation, as I wont hit it too often, and looking at a few over the years, I have had some capital raisings that have treated me well – and some have been a disaster. You can see above the plan in this case simply involved resetting my ATR based stop loss when the price stabilised.

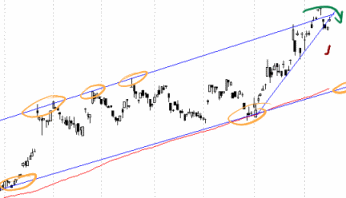

system A fires – first time in ages

My trend following System A fired for the first time in ages today. And it only came up with the one – Centamin Egypt (CNT).

Looking at the chart, it is not what I’d call an ideal entry!

CNT is climbing a rising channel, and is just on the bounce from the top of that channel.

There are a couple of reasons I am going to skip this first entry from my system:

- I can’t get it on margin, and cash reserves are light

- It looks like its about to dip, so going short might make sense – but this stock seems unborrowable – so can’t short it.

Anyway – now that the system has fired, I expect a few more options to arise over the next week. For more about System A look here.

today – open okn, all

Oakton pyramid entry

OKN: Pyramided into my Oakton position by increasing my holding with a purchase at $3.78.

It looks like my earlier entry tookthe bounce cleanly which is already encouraging. This has hiked my stop loss as can be seen in the diagram, which lead to me increasing my holding. Three white candles is generally fairly bullish, and the market over the last few days has been strong. Now to sit back – and follow the plan!

all open

ALL: Today I took out another position in Aristocrat Leisure at $4.60.

The last position here lost me 6%. Nup – I don’t reckon I’m chasing the share to get even for my loss – but you never know exactly what the subconcious is thinking!

The entry is clearly again based on the break of a downtrend, which happened yesterday with the formation of the big white candle. My plan was to get in on a rising share today, but it appears that the latter days trade was not in my favour – there is a dark cloud across the price chart. This is not normally a strong signal as the main candle body is well above the close from yesterday. Un inspiring volume though… hmmm listening to my words here I don’t feel strong about this entry – but never the less – in now, so stick with the plan.

today – open wtf

wtf open

WTF: Opened a position in Wotif.com today at $6.01 on open when my buy trigger fired and placed an order for me.

I had the trigger set to fire when the share went through the flat resistance line drawn across the earlier high, which coincides with the earlier highs about 2 years ago. These earlier highs are not penetrated at this stage so this may be an early entry, but I spose I’ll know that when I close the trade.

The outlying chart formation is roughly a broadening ascending wedge, still in formation as there has only been two traversals of the wedge, and 3 is preferred to actually qualify. The ‘inner formation’ is a very rough ascending triangle – again not ideal as not enough bounces from trend lines – but the bit I do like about this is that the last dip before the end of the triangle has not made it to the trendline and bounced on out. Often a good sign.

(The keen pattern follower will actually say my ascending triangle is not one at all, that its closer to an inverted head n shoulders, and I myself would say its a squiggle – but I’m calling it this, because as stated a few times earlier I am not too fussed about entries. Its what I do after the entry that counts.)

The disappointing thing about the the days trade was that the volume was low for this share – maybe the only entries were a couple of us that had triggers fired. Also a doji style formation was made, generally indicating indecision. For a breakout from an ascending triangle in general you want good breakout volume to have confirmation of the breakout.

So – in closing – remember to take those stops when they come, as I intend to do with this and all my trades.

today – buy okn, wan

Oakton re-entry

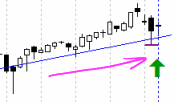

OKN: Opened a position in Oakton today at 3.40.

I exited the last Oakton trade when I hit a double top, which has now been clearly penetrated (smashed?) giving a strong run up to a the high for the year so far.

The share appears to be in an uptrend (higher highs, lower lows), so I have bought in where the share seems to be finding support.

Reasons against taking the trade? The high point in the chart is a nice example of a shooting star, a typical reversal signal. The top of that shooting star is clos-ish to the most recent significant highest high in August 2008. This may cap my upside, but if that is penetrated, then this is a good trade. Lets see where this goes.

Downside is limited due to closeness to next support line, and upwards trend line.

wan - another re-entry

WAN: Opened a position in West Australian News today at 7.80. Volume has been good the last two days, and days have been closing at or near daily tops for a while now – in spite of the large number of down days recently in the general market.

Looking for a bounce on the current upwards trendline – and hopefully not too much resistance at the recent high. Looking at todays chart looks like it may be a distinct possibility.

As I sign off for the night, the US markets are opening well, so if this pushes through resistance tomorrow this may be one to watch.

Even though it is new media.. so as a keeper this doesn’t make sense to me!

today – open FLT

Flight Centre Open

FLT: Opened a position in Flight Centre today at $16.10.

Flight centre has been in a fairly slow but steady uptend for a while now, and on the more general increase since stocks turned around some time ago.

Due to the closeness to the trendline I am able to set a fairly tight stop, which suits me just fine at the moment, given the bearish tendencies of the market for the last few days (until today anyway).

Looks like I’m still going long again.

Comments (1)

Comments (1)