today – close mcc, mre

mcc close

MCC: Closed the position in Macarthur Coal at 8.30 for 11% gain. Followed this plan well – MCC has been good to me (not that it cares a toss about me!) and I will continue to watch. Trailing stop loss plan has been effective for this, but I did expect to get the target at the medium term resistance you can see marked in the diagram

mre close

MRE: Closed the position in Minara Resources today at $0.92 for an 11% loss. This is unfortunate as the share was a winner for a fair period of time before it dipped into loss territory. I passed off on the first exit point (penciled in green) as the share fell below the trendline I had drawn – this has proven to be a mistake. I took the exit today after the share closed last night below my stop loss line.

Anyway ttfn – a hard to read week this week – I can see some long and short positions. Lets see what happens in the US tonight and I may place some positions before going to my real job in the morning.

friday – close cey

cey close

CEY: Closed my Centennial Coal position on friday at $3.40 for a 17.9% profit. I decided to take a close where I figure some resistance will kick in – and it seems to have over the last 5 sessions or so.

Reasons for exit – close below rising trend line / bounce down from upper resistance / slow down in speed of price increase.

On another note – System A still not returning anything! Surely it must kick in soon.

Anyway, time for bed. My trading frequency is dropping – I wonder if this means the market is a tad stable at the moment. I’ve noticed the the increase speed of the portfolio is slowing also.

today – enter pyramid aoe

aoe pyramid

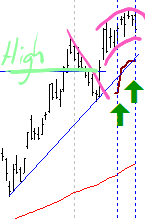

AOE: increased my position in Arrow Energy today, with an entry set last night when the market was closed.

Looking at the graph now, entry is less than ideal as with the dip today appears to be forming a small scale rounding top – but not to worry, I’ve got a reasonably tight stop in place. Combine that with the fact the price is close to the long term high, and seeing signs of resistance here is not unreasonable.

Looking at my stats, my transaction rate is down a bit at the moment (good I reckon) but a number of shares are moving close to their stops. So – set a few triggers, and back to my real job.

today – open cey, thought on bhp

pyramid into CEY

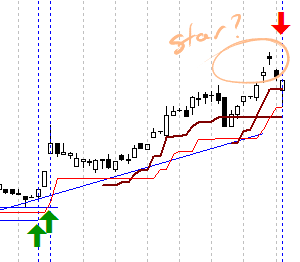

CEY: Increased my position in Centennial Coal today. This was a pyramid entry at $3.53. I set an entry trigger over the weekend to fire when the upper resistance level was breached – but as you can see, resistance held and the price fell after my entry.

Still, the share has been performing well and volume is strong. I’m looking for a climb to the upside tomorrow or I may have to rethink this secondary entry.

bhp - triangle breakout

BHP: The big Australian is always worth watching, with good trends, gaps and all sorts of good stuff.

Of interest today is the white candle coming out of the descending triangle, looking like a very nice breakout signal. As I am still bullish on BHP I have taken this trigger to take an call option on BHP to try and capitalise on the move. If you review my BHP trades you will see its not always my most profitable instrument, however at times in the past it has rewarded me well.

bhp flag

On a hunch I have changed the position of my lines outlining the triangle and I get the diagram found to the left. All I’ve done is draw it more like a flag, and shown the measured move I am hoping to profit from. Not a perfect flag I’ll admit as I like to see it formed over a shorter period when compared to the duration of time spent forming the ‘flagpole’.

I’ve added this chart to chart.ly as I wanted to play with the tool – you can see it here.

For anyone interested – WPL (Woodside) has also broken through resistance and is looking good for a move. If I hadn’t already entered BHP I’d say its a stronger looking move.

friday – pyramid entry jbh

jbh pyramid

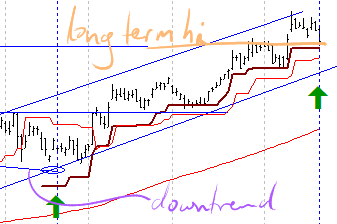

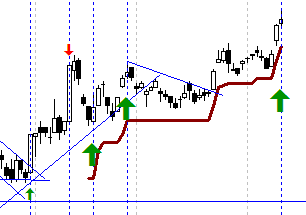

JBH: pyramided into my JB Hifi position again today, at $17.50 – this trade is looking like the ones you see in book so far (ok – yes, I do put too many lines all over the place sometimes!)

The original entry can be seen in the diagram to the right when the earlier downtrend crossed the more recent term uptrend. So far the channel has held quite nicely, and is returning nicely.

On to other things – ran System A scan – still nothing!

Weekly readings:

At the Bespoke Investment Group you can see a write up which compares the ability of their respondents to accurately pick the market direction, and compares it (un)favourably to going by the toss of a coin here.

Another interesting read at Daily Speculations (a website about – amongst other things – ballyhoo deflation!!) which talks about risk and loss aversion. This article is well written, but I did resonate with the following line (quote):

I think most investors who are not professionals have a very shallow understanding of risk.

When you sign up to trade CFD’s, options, shares and other things you have to sign all sorts of documents regarding risk – but until I lost money sometime ago the concept of risk was just that – a concept. Now its something that I find I manage no a daily basis – whether its the amount of money I have in a share, my portfolio balancing, my amount in cash – I’m constantly casting an eye across the where the money sits – and hence – where the risk sits.

anyway, time to relax before the new week starts – adios!

minor edit – 27/10/09 – realised the heading said closed instead of opened

today – close roc, iif

roc close

ROC: Closed Roc Oil position today for a 3% loss. Followed plan fairly well, but actually suspect the plan was not a good as it could have been. The share has bounced off the rising trendline a few times over the course of the year, and I should possibly have exited a couple of days earlier when the trendline was breached.

Anyway – all in all not a bad trade.

iif close

IIF: Closed my position in ING Industrial Fund today for an 11% gain (down on the 43% it was sitting at a few days ago!).

Anyway – stick to the plan – a profits a profit. I will continue to watch this share as the volume seems to confirm the price action particularly well on this share – and its my view that the volume confirmation isn’t as strong on Australian shares as I see on US shares.

today – open aoe

aoe open

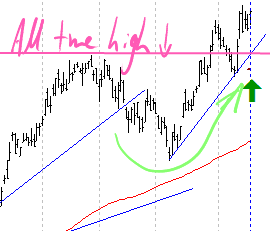

AOE: Opened a long position in AOE today at $4.45.

I have to be reasonably comfortable with this entry – the share has broken through earlier resistance to make all time highs in the last couple of weeks. The share generally trends well which should make it easy to track.

As for general observations today, the market was going strong in Australia early in the day, however got that bearish sign – a general collapse later in the session. As I look across at the opening of the US markets I can see the market opening down 1% but recovering quickly and seemingly to -0.1% then down again within the first half hour of trade. Volatility is around, and predictability seems to be dropping – for me anyway.

So what to do? Ignore the noise, focus on the charts!

today – close okn, pna, open mol

okn close

OKN: Closed my position in Oakton at 2.72, for another in a series of trades on this stock. I must say, the usual mixed blessings – but on the upside I’m always happy with a 35% return on a 9R trade. I watched this trade carefully as it was my largest holding at present, and was ready to exit after the big black candle about two weeks ago – but after a fast recovery in early trade I decided to hang in there.

With the evening star two days ago, I thought I shouldn’t push my luck when I received an alert that my secondary limit was touched in early trade today, so the position was closed. I saw the recovery following my exit – and like all these things, only the future will tell me if I should have actually pyramided in rather than exited today!

That said – I don’t get too many 9R trades, so I’ll reward myself with an Ice cream after dinner to celebrate!

MOL: Opened a position in this stock today, basically buying a dip in this stock which has been very volatile lately – a small position as its moving a bit faster than I may be able to watch….

pna close

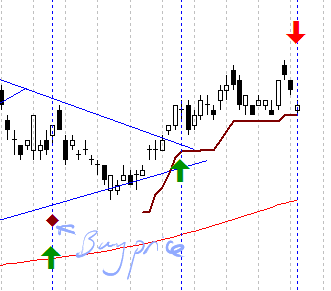

PNA: Closed my position in Pan Australian today for a 16% increase – and as for OKN above its with the usual misgivings.

The original entry (not documented in this blog) is marked with a diamond in the graph to the right as I received the shares as part of a share placement that I took up when I had an earlier holding. Followed the plan for this trade well, but now I look at the graph in my editor I can see a clear support forming at the bottom of todays candle which has held over the last 3 weeks – not to be ignored. Nevertheless I see it now and I missed it when glancing at the chart over the last few days.

Looking over tonights graphs I can see some interesting buys on retracements forming, and some exits on falls through stop losses – lets see what tomorrow holds.

friday – open cpb

cpb - pyramid entry

CPB: Campbell brothers has been climbing nicely, and with the rise friday I had an entry triggered at $25 – close to the days high. Following that the price dipped at the end of the days trade.

This trade is tracking well with the still climbing market.

Where to next…?

today – sell wsa, buy aqa

wsa closed today

WSA: My position in Western Areas was closed on market open today at a favorable price of 6.00, given I put it in to exit at 5.85 or so… giving me an 8% loss.

Exited well, exited quickly, managed the loss. Much of the market has been rising in the last couple of days, with this sticking out for not moving with the market.

AQA: Pyramided into Aquila Resources today for a third time. Rising consistently and making new highs today.

aqa buy

Will continue to watch, and stick with a stop loss based model for now, as opposed to target picking for this one – it seems to be running nicely.

My nightly review says I was lucky not to lose another couple of positions today, but I have a few sitting slightly above stops – but definitely some running nicely in there. Just a tad disappointed that I didn’t get back in MOL a while ago!

Anyway, signing off – presentations to give in my real job tomorrow, and rest is important.

Leave a Comment

Leave a Comment