trade idea bhp-15 – closing

bhp - the close

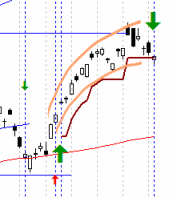

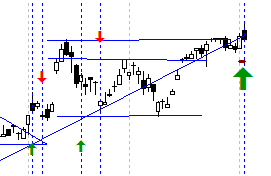

Well, the BHP trade is stopped out today – see the graph to the right.

Given its a paper trade, I will assume I bailed on the fall through the stop loss line, at $37.60. Exited for a 7.7% gain.

Now – if this wasn’t a paper trade I would still be in, as the close was marginally above the stop loss (which was $37.50). So – don’t know if this is good or bad till tomorrow.

What is of interest is that todays trade has a long tail candle looking like rejection of the lower prices – so the longs may still be in the running.

all ords

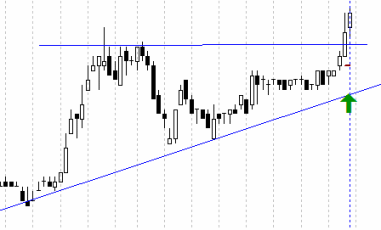

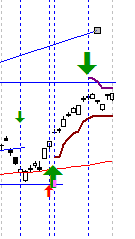

The graph to the right here is the ASX all ordinaries showing the the steady rise since earlier this year, and the rapid rise coinciding with the rise I rode on the BHP trade. Its interesting that BHP appears to be at the bottom of its channel, and the All ordinaries appears to be at the top of its channel.

Transparency

Todays reading of the interwebbything covered this post from Howard Lindzon on transparency. I’d have to say I agree with him no end – I really struggle to take at face value what I read about various companies, be it in the press, the web or even the company reports. Thats why I work with charts and price movement – often with an indicator or two thrown in.

And as for the transparency provided by twitter…? I post my (public) trades on twitter more or less when they happen, and write posts here. Is it possible for me to rig my results? Yup – I’m sure I could diddle it, but for now there is no reason for me to do this – I am reporting on myself for my benefit. Over time I will start to compare my results with managed funds, and work out if I am ‘wasting my time’ – or then again – see if I can go work for a managed fund… or.. I’m sure there are other options. Its not like my day job is really stimulating me at the moment!

trade idea bhp-14

bhp at end of week

Ahhh the BHP paper trade…

The close on friday is approaching the stop loss, but not closed below yet.

Hang in there, profitable at the moment on the long. If the bulls keep running, we can reasonably expect resistance above to break, in which case this will become a very attractive long position.

Hold.

today – open iif

iif open

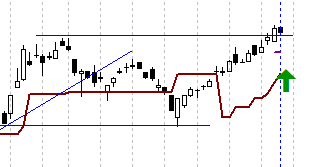

IIF: Opened a position with the ING Industrial units today at 0.325.

This is the second trade in IIF over the last few months – the lat one just before I started this blog. I found it originally from a heat map scan in April when it was showing a very good volume in the market at that time. The volume was down a little over the last 2-3 week s, with a good increase over the last two days, spiking nicely on friday. The entry was effected during the days trade when the price traded over 0.325 after noon (set the trade night before as I am doing a lot lately).

The graph is not really a true ascending triangle as there is really only one bounce off the top resistance line, rather than the two I would prefer. Still, a strong looking pattern, so will ride this one through.

System A: Did the weekend scan this afternoon – the system still is not firing, so will carry on discretionary trading.

Portfolio tracking:

So here’s a question for anyone who reads this – I’m after suggestions for tracking my portfolio on this blog… as you can see on the link buttons I’ve made a start, but it seems like it will take a while for me to keep it updated – I’m looking for an easy way to do this. I’ve got ideas… but…

Anyway, the bulls seems to be taking a breather – but my graphs think they are still running. Lets see what this week has in store for us!!

trade idea bhp-13

bhp today

So, not a good day for my portfolio today, a few stops hit which I’ll have to deal with tomorrow – looks like a late fall in some stocks.

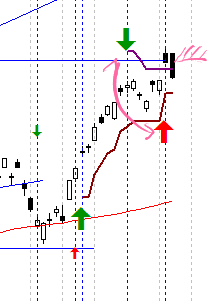

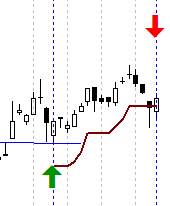

To review the position on this paper trade – as stated yesterday the short position closed out (at the upwards red arrow) for a loss of capital of ~50%, not too bad, as it was only a small position, so this still ~2% of portfolio loss.

The long trade is still open. Not looking good today due to the strong black candle falling from resistance, however I will not exit – I will wait for confirmation by closing below the stop loss line.

On another note, did some web surfing tonight and stumbled across some interesting posts.

I quite enjoyed this post about getting divorced from discretionary trading by the Milktrader – well written, and something on my mind. Since I started this blog I have been discretionary trading whilst I wait for my Systems to start generating signals.

Another article of his goes on to talk about ‘trading rules‘, and his thoughts on them (text from Milktrader):

There is personal stuff at stake. Anyone who preaches to you that you need to stop it and get a plan is really preaching to themselves. They are healing a wound, or trying to convince themselves that they no longer participate in the egregious activity of trading without one.

I find this very interesting, and I encourage you to read his article. Part of the reason for this blogs being is to assert a level of rigour over me and my actions. I lost a chunk of money a few years ago now, as well as a chunk with everyone else with the financial crisis over the last couple of years.

- My best trades (profitable, stress level) have been discretionary

- My most consistent returns over time have been system / rules related

- My worst trades have been either discretionary and system related when I have broken my portfolio allocation rules, and when holding losing trades.

As someone famous once said “Know Thyself”

trade idea bhp-12

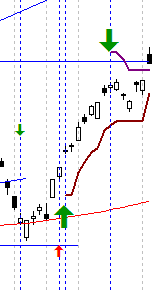

well – lost out on the short trade today. The short trade was in a warrant with a hurdle at 29 which was clearly penetrated today, closing my position.

bhp today

But the long trade is still looking good. A definite penetration of resistance in early trade was quickly stopped in its tracks to stop around the resistance line.

Should resistance be penetrated it could be expected to become support, and the long trade will continue – otherwise we could be approaching its limit in a dip over the next day or two.

today – open mcc, wsa, fxj

mcc open

MCC: Pyramided into my position in Maccarthur Coal. I had an entry set before the market to enter when the resistance line was penetrated. In this case it looks like resistance held, and this may prove to be a poor entry. Time will tell.

WSA: Opened a new position in Western Areas – agin bought on finding new highs just to drop back in later trade. There is an uptrend in place with this share, however it comes off the boil a bit.

wsa open

FXJ: Opened a new position in this share. The longer term graph looks like a solid base has been formed over an extended period, and now the share seems to be climbing out of it. The recent rounded bottom was mirrored in the volume (sketched in green below), with increasing volume as the price pressed through the last most higher high in mid-June. I expect this to be a better longer term performer.

fairfax open

All in all, not really happy with my entries today – the first two triggered based on a very strong market opening today, but now the trades are in – trade the plan!!

trade idea bhp-11

bhp - 3/8/09

At a point of hesitation.

Both positions are firmly within their relevant stop loss boundaries. The bulls appear at a slight advantage based on the rise late today.

Hold both short and long positions.

today – close aru

aru close

ARU: closed the position today for a 18% loss (ouch!!). That hurt, but within the bounds of the plan – just.

According to the normal plan I exited relatively well. I had an exit set after yesterdays (well – fridays) close. I set a close on opening at 0.57, thinking I’d stem the loss if the share opened down – well, it opened much further down than I expected. When I hadn’t seen the close go towards the end of the day, I did an exit at the market price so as not to let the loss get larger.

So the trade didn’t go well. Looking at the graph there are two circled areas that could be used as exits – the one that I took, and the earlier one about three days ago where the share fell through the uptrend – a preferable exit I’d suggest.

Looking at my entry from the trade opening I note my main stated reason against the trade: “I have entered just shy of an earlier area of resistance, so may have limited potential”. To that I should really have also added: “and the share is in a short term downtrend”.

I am ok with this trade, as I did stick to the plan – but in future I should keep an eye out for other trendlines – not just the first one I see.

(Edited post – I don’t know why – must be tired – I have switched ROC for ARU a few times in this post – updates to symbol made, not values!)

trade idea bhp-10

The big Australian has a small dip.

bhp - a small dip

In the last post I saw a decision point on the short term horizon – a view that proved correct.

Looking at the graph today, 2 positions need to be commented on.

The long trade (the paper trade) is still open, however the profit is being eroded as it dips towards the stop loss line.

The short trade (which is actually in play, not just on paper) is currently profitable. It is fairly highly leveraged due to the use of the warrant which is very close to the money, but that just means I go for a very small position to fit with my portfolio allocation model. I think this only has a little way to go, and will maintain a tight stop and set a profit target.

Cheerio,

today – close MML, open MRE

mml close

MML: Closed this morning for a 7% profit. Followed my stop loss, exited nicely today on market open order set last night. Planned the trade – traded the plan. I was fortunate for the last price increase yesterday!

mre open

MRE: Opened today at $1.03 at market open. I chose the share based on a recent strong uptrend that was in place, to be replaced by this trading range that has been in place for the last couple of months. Yesterday the price came out the top of the range triggering an entry for me.

Both orders were placed out of market hours.

Leave a Comment

Leave a Comment