Archive for the ‘all’ Tag

today – ALL

ALL: Closed my position in Aristocrat Leisure today at 4.08 for an 11% loss.

Bought the share after a bounce thinking it would continue to bounce – however price fell, until today it passed the previous low, so time to bail. Lower low = down trend… always did, always will.

WTF: Had an entry trigger fire at close of market for Wotif.com and a buy order placed. The position was pulled as I had insufficient funds (due to purchase yesterday) so this trade did not eventuate. This would have pyramided me into WTF, so I might keep an eye on it and take an entry tomorrow.

Noticing today a few of my trades are not holding ground. Me thinks I need to do some self analysis on the weekend to see whats going on… Is it me or the market?

today – open okn, all

Oakton pyramid entry

OKN: Pyramided into my Oakton position by increasing my holding with a purchase at $3.78.

It looks like my earlier entry tookthe bounce cleanly which is already encouraging. This has hiked my stop loss as can be seen in the diagram, which lead to me increasing my holding. Three white candles is generally fairly bullish, and the market over the last few days has been strong. Now to sit back – and follow the plan!

all open

ALL: Today I took out another position in Aristocrat Leisure at $4.60.

The last position here lost me 6%. Nup – I don’t reckon I’m chasing the share to get even for my loss – but you never know exactly what the subconcious is thinking!

The entry is clearly again based on the break of a downtrend, which happened yesterday with the formation of the big white candle. My plan was to get in on a rising share today, but it appears that the latter days trade was not in my favour – there is a dark cloud across the price chart. This is not normally a strong signal as the main candle body is well above the close from yesterday. Un inspiring volume though… hmmm listening to my words here I don’t feel strong about this entry – but never the less – in now, so stick with the plan.

today – close shv, all

shv close

SHV: Closed my position in Select Harvests today at $4.10, for a loss of 3.53%. Due to the double entry on the day the share took off, I had an average entry price of $4.22.

This trade got off to a belting start, and took off just nicely. Unfortunately it formed a rather obvious double top, which has been completely formed with todays close, so got out.

A better exit may have been to call the double top when it as clear, which was roughly mid last week, however I held in there for the stop loss to be hit.

Reviewing the graph I suspect there is still a trade to be had here, but I’ll go back to observing, and make another entry if the condition arises.

Still – happy with the entry, and I am on the fence as to whether I should have taken the earlier exit, as I would have at least exited with a small profit. Not to worry – I stuck to the plan, so thats good enough for me.

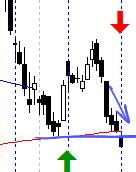

Aristocrat close

ALL: Closed my position in Aristocrat leisure today at $4.75 for a 6% loss. Like the one above, I am a bit disappointed in this one – I thought the chart had it all (see the entry write up here) but it was not to be.

The stop was triggered in fridays trade, with the exit taken mid morning today, missing the open as I just hate market orders. Gapping down on a Monday opening is not good for an exit.

Note the high volume today, and the bearish doji today. This does look like a typical reversal signal, and funnily enough (even though I have never mentioned fibonacci here before) the doji close is pretty much on the 0.618 retracement.

In this case I actually think that this share is at a bounce point and may well recover from here… so I may well enter again shortly.

The month so far…

Remember analysis is neither right nor wrong at the time of entry – only well reasoned. The market tells you when you close the trade whether you were right or wrong. That’s because, well, the market is NEVER wrong.

This means I have a month of only losing trades at the moment, with another 3 sitting within in bee sting of their stop loss points – but some that are open are hanging in there nicely.

today – open ALL – close IFM

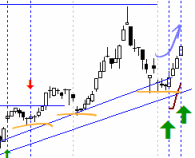

ifm close

IFM: Closed my position in Infomedia today at 0.38 for a 2.5% loss. And this is annoying. Small loss, but this one frustrates me.

This is my worst exit in a while – 3 clear exit signals where given to me, but I held on thinking I might at least close out even. BIG MISTAKE.

The price fell through my trailing stop loss (first circle in the picture), then on the third day hit the uptrend line I had on my chart – and fell through that too. The price then tracked along the bottom of the trendline before taking a dive again yesterday.

Yes I still reckon the share may recover – but that is irrelevant – I didn’t stick to the plan….I should exit, observe from the sidelines and jump back in when the conditions are right.

I have been lucky actually – if this was the market about a year ago, a break below that trendline and the buyers would have been heading for the exits leaving me with a rapidly falling stock price and the commensurate hole in the pocket. It must be a bull market – they reckon anyone can make money in a bull market – and I got out lightly here.

Repeat … trade the plan … repeat … trade the plan …

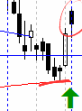

all open

ALL: Opened a position in Aristcrat Leisure today for the first time in years, at 5.06.

I was drawn towards the share from the market heat map, which showed higher price movement than usual. A review of the daily chart showed:

- break through downwards trendline yesterday

- new mid term high today

- 200 day SMA turned up about a month ago

- good volume

On top of this the share was in a consolidation pattern for some time – so lets see if it shakes off the shackles of the bottoming process.

Whatever happens – follow the plan!

Leave a comment

Leave a comment