Archive for the ‘aoe’ Tag

today – close aoe, open okn

aoe close

AOE: Closed my position in Arrow Energy today at $4.42 for a 2.7% loss.

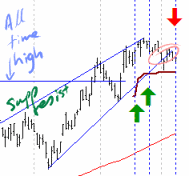

In this case I have not waited for my stop loss because of ‘bad feelings’ which are based on what I am seeing on the daily price graph. Marked in the picture you can see the all time high marked. On breaching this barrier I would expect the price to stall before moving on – which it has. Looking however at the rising wedge, the top barrier is a line that was an upwards trending support line – however recently this line seems to have become a resistance line, which may hinder upward movement.

At the top of the wedge, the price seems to have come out to the downside, so for now I’m reigning this one in.

That said – it may move on, and I’ll keep an eye in case I choose to re-enter.

okn open

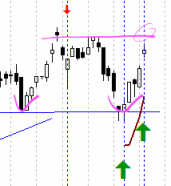

OKN: Pyramided into my Oakton position today at $2.94. Oakton has risen nicely in the few short days since I took an initial position. I am however sitting just below resistance so will need to see if we can push through that.

Looking over my last Oakton trade, its the same level of resistance that shook me out just a couple of weeks ago.

Anyway, off to watch the gold price that pushed through the $1000 barrier earlier today and is now trying to get itself pushed back beneath it!

today – enter pyramid aoe

aoe pyramid

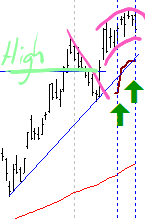

AOE: increased my position in Arrow Energy today, with an entry set last night when the market was closed.

Looking at the graph now, entry is less than ideal as with the dip today appears to be forming a small scale rounding top – but not to worry, I’ve got a reasonably tight stop in place. Combine that with the fact the price is close to the long term high, and seeing signs of resistance here is not unreasonable.

Looking at my stats, my transaction rate is down a bit at the moment (good I reckon) but a number of shares are moving close to their stops. So – set a few triggers, and back to my real job.

today – close roc, iif

roc close

ROC: Closed Roc Oil position today for a 3% loss. Followed plan fairly well, but actually suspect the plan was not a good as it could have been. The share has bounced off the rising trendline a few times over the course of the year, and I should possibly have exited a couple of days earlier when the trendline was breached.

Anyway – all in all not a bad trade.

iif close

IIF: Closed my position in ING Industrial Fund today for an 11% gain (down on the 43% it was sitting at a few days ago!).

Anyway – stick to the plan – a profits a profit. I will continue to watch this share as the volume seems to confirm the price action particularly well on this share – and its my view that the volume confirmation isn’t as strong on Australian shares as I see on US shares.

today – open aoe

aoe open

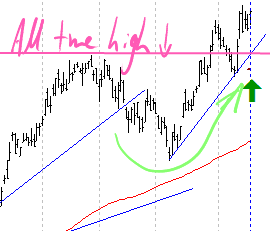

AOE: Opened a long position in AOE today at $4.45.

I have to be reasonably comfortable with this entry – the share has broken through earlier resistance to make all time highs in the last couple of weeks. The share generally trends well which should make it easy to track.

As for general observations today, the market was going strong in Australia early in the day, however got that bearish sign – a general collapse later in the session. As I look across at the opening of the US markets I can see the market opening down 1% but recovering quickly and seemingly to -0.1% then down again within the first half hour of trade. Volatility is around, and predictability seems to be dropping – for me anyway.

So what to do? Ignore the noise, focus on the charts!

Leave a comment

Leave a comment