Archive for the ‘aqa’ Tag

today – aqa open

AQA: Opened a position in Aquila Resources today at $10.40.

Since the last bounce on the trendline about a month ago the share has moved up quite smoothly. The retracement on friday when the market dipped was not as strong as some other stocks, indicating a bit of strength in this share. The risk is measured to my usual ATR linked stop loss, however the steep trendline may provide some support.

I put a bit more time into Amibroker tonight – trying to get the hang of it. I’ve got a bit of porting to do to bring my various customisations across from Metastock. I’d say this may take a bit of time, so looking to return to full strength in a month or so…

today – close AMP, REH, WAN, AQA

Thats a lot of closures.

So, like everyone, I have interests outside that which I primarily write about here. Without wanting to digress too much, I have been out sparring tonight. I copped a slight knock to the jaw, and saw the followup hook coming in for the 1-2. Despite the knock, I kept the guard up and avoided the big punch. That’s what we train – keep your guard up, and try to read the opponent – sometimes you will get it right, and sometimes you will get hit. When you get hit – keep the guard up, feel for the next one!!

I’ve taken a few shots this month, as the portfolio update next weekend will attest. So – back to training – keep the guards up, take a shot when you can and accept you can’t catch everything. But never get hit so hard you can’t continue. After a few losses in a row, all bar one below 10%, I feel like its the end of a round. Splash water in the face, take a breather on the weekend and get back in there.

On with the show…

amp - taking a dive

AMP: Closed my position in AMP at $5.96 for an 8% loss. Now looking at the entry when I opened this trade, it was such a good looking trigger. The setup was linked to financials doing well, and then a nice breakout. I held on through the retracement.. and passed on my trendline stop loss waiting for … what? The support I expected did not exist. Stop triggered last night, and exit taken in early trade today. Now I have a more bearish outlook than a few weeks ago, taking the earlier exit looks like a no-brainer. hmmmm 20-20 hindsight. Of note is a flattening of the longer term MA (in orange). Lets step back from this a bit. Not a bad trade, but could have been better.

reh - small gain

REH: Exited this today at $24 for a 4% gain. This trade was always on a bit of a knife edge. I found to be a bit illiquid for my liking… and I knew that sentiment was not strong once I had a position. A couple of times in the last two weeks I have been the only seller of Reece – and no one has wanted to take my shares off my hands. Now things are grim, I thought I should close this out rather than get caught out – so I did, and it looks from the chart that others followed me out the door.

I really should remember to keep an eye on liquidity – this has happened to me twice this year now (note to self).

WAN - reading the papers

WAN: Closed my position in West Australian News today at $7.57 for an 8% gain. Now this is a better trade – I’m happier with this.

I was confident in my entry, as it was ‘text book’, departure from a steady uptrend to the high side, with good liquidity.

My ATR based stop loss tracked nicely and has kept me in a nice profit. Whilst I could have exited on the departure from the steeper trendline, this would translate to a futile attempt at top picking – not a winning approach as I have learnt over the years. In this case I definitely stuck to the plan, and no second guessing.

Aquila Resources

AQA: And finally AQA. I closed my position at $7.09 for a monster 14% loss just prior to close of trade today. This is a 2R loss. Even with a small position that I entered with, the loss was too big.

Look at those black candles – great at a birthday party – but not great for my bank balance! It is actually this trade that has told me I need to review everything on the weekend, and hunt some good shorts – I’m sure they’re out there. Looking through whats left of my positions, I may be taking more positions out tomorrow – but we shall see what the overnight US markets whisper to me.

And finally, a comment on a position I haven’t closed. And I still need to work out if it oughtta be. This is what a capital raising can do to my capital in the short term. But I love noticing things. Like the fall to the height of a recent peak, coinciding with the same price point as the capital raising… hmmm…

bugger - a capital raising

In closing – although I mentioned a contact sport above, I do not think of the market as an aggressor opponent – I think of it as a sparring partner. It does what it does, I do what I do, and through it all I get fitter.

So keep your guards up!

today – open aqa (again!)

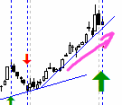

aqa 22-10-09

AQA: Opened a position in Aquila Resources today at $8.25.

As usual I’m not that fussed about the shares I enter – its what I do when I’m in there that makes me money. So in this case you can see I just drew a new trendline to use as an indicator. I’ll of course use this with my usual ATR based stop loss.

My last trade in AQA rewarded me financially as you can see here. The exit last time was due to falling through my stop loss – in a trade I was quite happy with because of the nicely planned execution. I trust I will be able to execute as elegantly again.

As for changing my trendline – I don’t get too fussed about trendlines. I have read a lot about ‘how to draw a trendline’ by many authors, and some are sticklers for detail. Me, I like to draw one, and stick with it for that trade, occasionally changing it if its a longer term trade and the chart warrants it – just never drop the stop loss that it may be indicating!

ATAA

On another note, I’m off to my first real trading conference tomorrow at the ataa event in Melbourne. Hopefully I will learn stuff, and keep the right filters in so I learn to learn what I need, without getting carried away by talk of ‘whats hot’.

Signing off – after my first trade in a while. Not because I’ve been holding off, but my stops haven’t been firing, and the cash reserves are at the limits I am comfortable with for now.

today – close aqa

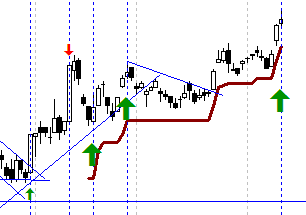

Aquila Resources close

AQA: Closed my position in Aquila Resources today at 6.71 for a 12.8% profit.

What can I say about this trade? I’m happy with it. I pyramided in 3 times – however if I had it over again the fourth entry (3rd pyramid) was a bit too eager and should have been held off.

The only shame is the price collapse at the end of the day taking my 20% profit to ~13% in a day – too bad – followed the plan though.

On top of this I closed a few positions today in my non documented trades – for the record I followed the plans correctly. Did a scan of the market, and not seeing any strong entry signals in the last day – in general things didn’t go well on the ASX today.

Apparently the market doesn’t give a sh!t about me – I read it at Chart Shark. He seems to write very clearly a number of things I keep repeating to myself, and post about here. From the entry:

- What Can You Control?

- The only thing you can control is yourself. You can not control the market, but more importantly, the market can not control you. Only you control when you enter and exit the market.

I recommend you go read his article and absorb it. I will leave with this closing comment from Chart Shark – “The market will do what the market will do, with or without you.”

today – open pna – extend aqa – close ipl

open pna

PNA: Opened a position in Pan Australian again today at $0.50.

This share has been good to me in the past, and whilst that is no reason alone for an entry, the volume is good, and the share is making higher highs – gotta be happy with that. The blue horizontal line is a long term resistance line, which has been firmly bounced off. trigger was yesterdays big white candle on strong volume.

ipl close

IPL: Closed my slow moving Incitec Pivot position today at $3.06 for a 4% gain.

The share failed to make a higher high on the recent rise, and was again flat today – not a good sign when the market as a whole has been very bullish this last couple of days. Incitec was a good earner prior to the GFC, but looks like it has lost the gloss, and so not apparently attracting enough buyers to drive the price up.

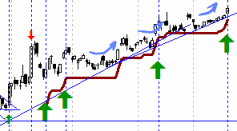

aqa - pyramids - 4 of!

AQA: Pyramided into my Aquila resources position today at $7.53.

This is my fourth entry into Aquila resources, based firmly on the strong consistent uptrend that the share price is exhibiting. I originally entered the position with a small size as I considered it a risky entry, but after increasing 3 more times after that this is now a significant holding.

So lets see what the market holds for us tomorrow as we go into Fridays trade. the market in the US has opened strongly. Volatility is good – I have some short duration options to close in the next week, and as I’m into the last 7 days, tomorrow is the day for it.

Ciao

today – sell wsa, buy aqa

wsa closed today

WSA: My position in Western Areas was closed on market open today at a favorable price of 6.00, given I put it in to exit at 5.85 or so… giving me an 8% loss.

Exited well, exited quickly, managed the loss. Much of the market has been rising in the last couple of days, with this sticking out for not moving with the market.

AQA: Pyramided into Aquila Resources today for a third time. Rising consistently and making new highs today.

aqa buy

Will continue to watch, and stick with a stop loss based model for now, as opposed to target picking for this one – it seems to be running nicely.

My nightly review says I was lucky not to lose another couple of positions today, but I have a few sitting slightly above stops – but definitely some running nicely in there. Just a tad disappointed that I didn’t get back in MOL a while ago!

Anyway, signing off – presentations to give in my real job tomorrow, and rest is important.

today – pyramid positions – okn – tap – mnd – aqa

Interesting action in todays market. I have taken the opportunity to extend my investments in some currently open positions, whilst keeping an eye on the overall market to not over extend myself at present.

okn - pyramid in

OKN: despite the funny action I saw recently, I have increased my position here. With a gap up on open this is looking strong. I note that the next significant resistance is at 3.00, however there are some minor resistance points before then.

TAP: The recent purchase appears to have successfully bounced off the support line for now, so am looking to strengthen my position. The morning opened well but the share seems to have formed a spinning top, so will keep an eye on it in the morning.

MND: Since entering with my first parcel, MND has subsided along a smooth short term down trend to marginally above my stop loss, at which point it has started rising again. I have taken the opportunity to increase the position on this break through the lesser downtrend, assuming that the uptrend is now to resume.

aqa pyramid entry

AQA: another share continuing to build upwards. Increased my position size, however I can see I am relatively close to a line of resistance at the top of the big white candle about 12 days ago. Lets see how we hold up.

Tomorrow – end of the Australian financial year. whta fun – then I’ll have to think about another tax return! arrgh – more paperwork 🙂

today – aqa

opened AQA long today on fallback to a trendline.

A few down days in a row now – lets see how we finish up for friday. I have a couple of long positions to open in the market for tomorrow, a bit off market, based on support lines. If support fails under the friday weight on these I can see me closing a number of positions come Monday.

My Plan A and B systems are based on end of day data and are supposed to be traded that way. Something I am noticing at the moment is that in my ‘discretionary trades’, which are largely pattern and or breakout related, I am getting stopped out during the day. I am then finding the prices are recovering by day end – meaning I would not have closed that position. Looks like I have some pattern testing to do to see the impact of that process on my results. My ‘real’ job has me very busy at the moment, including after hours… still, I have to find the time.

today – tap – aqa

closed TAP today, fell through stop loss, giving me a 7.5% loss. Entry seemed promising, but fell back from resistance on day I entered (2/June/09).

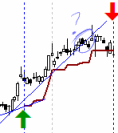

aqa measured move

closed AQA today. Closed on a profit target, on a 27% gain – didn’t expect it this soon. See the inserted pic. As always when a profit target is met, I am unsure if I should trade that way, as my ‘normal’ approach is to let them run till they fall back through a stop loss. Back to the drawing board to see if I re-enter.

Points of interest – downward channel looked to be busted to the downside, so was looking to enter to the upside on the day is came out the top. I picked the exit as just below $6 as I expected that to be a point of resistance.

My other point of pain and pondering – KZL. It came back on the market today to a 20% drop which went straight through my stop loss (not CFD so not automatic). So now I have to evaluate if I am in a reasonable position to maintain the trade. Will go and think about this some more….

Both trades discretionary. Market looks very bullish.

Leave a comment

Leave a comment