Archive for the ‘aru’ Tag

today – close aru

aru close

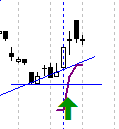

ARU: closed the position today for a 18% loss (ouch!!). That hurt, but within the bounds of the plan – just.

According to the normal plan I exited relatively well. I had an exit set after yesterdays (well – fridays) close. I set a close on opening at 0.57, thinking I’d stem the loss if the share opened down – well, it opened much further down than I expected. When I hadn’t seen the close go towards the end of the day, I did an exit at the market price so as not to let the loss get larger.

So the trade didn’t go well. Looking at the graph there are two circled areas that could be used as exits – the one that I took, and the earlier one about three days ago where the share fell through the uptrend – a preferable exit I’d suggest.

Looking at my entry from the trade opening I note my main stated reason against the trade: “I have entered just shy of an earlier area of resistance, so may have limited potential”. To that I should really have also added: “and the share is in a short term downtrend”.

I am ok with this trade, as I did stick to the plan – but in future I should keep an eye out for other trendlines – not just the first one I see.

(Edited post – I don’t know why – must be tired – I have switched ROC for ARU a few times in this post – updates to symbol made, not values!)

today – cpb – updates on open positions

Campbell Brothers opening

CPB: I set a trigger to enter Campbell Brothers over the weekend, on entry into the rectangle you can see in the attached diagram.

Campbell Brothers has been in an uptrend over the medium term, however ranging over the shorter term. The item of interest that peaked my interest in this share was the bounce off the upwards trend line, which I am looking for a continuation of.

So, I have a couple of trades that have been open for a few days, hopefully indicative of some trends setting in – not that I’ll know till I can look back and know. The writeups below are brief updates on a few of my open positions. you can find the entry conditions by looking of the relevant tags on the menu.

ARU: Only opened recently, strong increase on open – definite rejection of a higher high, but no stops hit.

aru

CHC: Charter Hall group, again only recently entered, and signs of stalling as the overhead resistance is approached. Keep a close eye.

chc

MCC: Continued to rise nicely since opening. Today looks like a push into, and maybe through upper resistance. Keep the trailing stop loss, keep watching.

mcc

MML: Medusa Mining also rose nicely. Another one to hit upper resistance, lets see if we press through. Hold position.

mml

OKN: Pyramided in to this trade based on the sudden increase in price, and the share promptly declined soon after. As it stayed above the increasing trend line I stayed in. In some cases I would have exited on the fall through the ATR based stop loss (brown line), however based on the strong uptrend I held in using the trendline as the ultimate stop due to the sudden spike which I missed capitalising on as I was working on end of day prices.

okn

For anyone interested – one more week to get into the ASX sharemarket game. I’m considering myself, but I don’t know if I can afford any more time, given I post this blog, consider my trades and hold down a job!

For tonights reading I trawled through some content from Tradergav – another Aus trader with a blog. I read his discussion on a tweets conversation that he has here which is around the risk / reward metrics. Since doing discretionary trading I have not been tracking my statistics as carefully as I was up to a year ago, as I normally tracked these for my System A (which had no triggers this week – again!) and other mechanical systems I have toyed with. Maybe thats my next project, as I have done enough in the last year to give some sort of finding. I had one -3R trade from memory last year and that hurt. If I go past -2R I pause trading and ‘have a good hard look at myself’ to determine why I ended up there. I must say I haven’t beaten 8R in over a year though, and you do (well I do) like to get one every so often, both for financial reasons, as well as to help with the psychology of this.

Signing off,

today – aru – strong day

aru entry

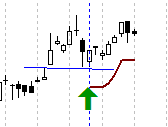

ARU: I opened a position in Arafura today as tweeted earlier. From the diagram you can see I entered based on a bounce on the upwards trendline at the Green arrow. I picked the entry during last nights chart viewing, and its a share I traded recently after finding on my brokers live heat map. The volume has been high – especially around the time of the last trade.

Reasons for entry:

- bounce on trendline

- appeared to start recovery a day or so earlier than other comparable shares

- active sector

- high increase today

Reasons counting against entry:

- I have entered just shy of an earlier area of resistance, so may have limited potential

- Not very high volume today

- I’m unconvinced about market direction (however today was a good day!)

Lets see how this one plays out.

Onto other matters. Generally when trading, I have come to accept that I am not that good at correctly reading the interpretation of macro changes in supply and demand – I figure those much smarter than me do that, and many others really just have an opinion 😉 If its a fact, its not debatable – anything else is an opinion! Taking that into consideration I came away feeling educated after reading this article from MyStockVoice on the building of a massive oil pipeline across Europe.

Turkey and four EU member states have signed a historic deal in Ankara allowing work to start on the Nabucco natural gas pipeline, which is aimed at allowing the European Union to tap directly into non-European gas reserves.

Its when I read things like this that I become aware of my limitations regarding picturing the long term outcomes of such activity – yup I realise some observations are clear, but, again – just my opinion.

So why mention this? Really, thats why I revert to technical analysis of shares and other financial vehicles, because it simplifies my thinking process so I can make decisions, and move on those decisions.

Till next time…

Leave a comment

Leave a comment