Archive for the ‘bpt’ Tag

recent trades, close mms, bptkmb, open mvp

So the impact of the Greeks is taking out my positions, slowly but surely. Been a busy week at work so I haven’t been posting my updates promptly, but I am seriously having to gauge whether I drop all positions, or hang in there. SXY seems to have fallen so far I would be entering again looking for a rebound… possibly a really bad idea though…

BPTKMB: I had my position closed yesterday in my warrant position Beach Energy at $1.20 for a 50% loss under System B. The stop was the exit price on the barrier warrant, which returns the intrinsic value to me in a week or so. As I bought in at a low price, and the warrant exit price aligned with my stop loss on a System A trade.

BPTKMB: I had my position closed yesterday in my warrant position Beach Energy at $1.20 for a 50% loss under System B. The stop was the exit price on the barrier warrant, which returns the intrinsic value to me in a week or so. As I bought in at a low price, and the warrant exit price aligned with my stop loss on a System A trade.

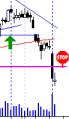

You can see how the price fell after exit day in the picture to the right so that stop loss worked well for me – noting that my position size was quite small so a 50% loss is not a significant cause for concern.

MMS: I closed a position recently in Macmillan Shakespeare at $10.51 for a 1% loss. This was a good trade in regards to a good clear entry, and the exit was clearly defined. MMS has been a good share in relation to strong moves, so I may be back in it shortly – let’s see how it pans out.

MMS: I closed a position recently in Macmillan Shakespeare at $10.51 for a 1% loss. This was a good trade in regards to a good clear entry, and the exit was clearly defined. MMS has been a good share in relation to strong moves, so I may be back in it shortly – let’s see how it pans out.

MVP: I opened a position in Medical Developments at $0.75 using System A. This is a risky position due to the greater market moves – although this share has been growing consistently and strongly for some time. You can see todays movement in the share price and the dip was fairly strong – however the price seems to have stalled at a resistance level.

MVP: I opened a position in Medical Developments at $0.75 using System A. This is a risky position due to the greater market moves – although this share has been growing consistently and strongly for some time. You can see todays movement in the share price and the dip was fairly strong – however the price seems to have stalled at a resistance level.

today – or yesterday? close bpt

Well there you go – if you don’t do your homework in this game, things can go wrong – very wrong.

BPT: I was stopped out of my Beach Petroleum position a day or so ago and didn’t know.

BPT: I was stopped out of my Beach Petroleum position a day or so ago and didn’t know.

As noted in the entry on the buy, I entered this trade with a warrant (BPTBOK) to get leverage into the position. The warrant had an expiry at $1.37 – which was a level hit by BPT recently when it dipped recently when a capital fund raising was announced . In light of the target being hit, the warrant has expired and I’ve done my dough.

Well – not quite – I have two saving blessings:

- The warrant does not expire worthless, I am refunded a residual payment, meaning I lose about 50%, not 100% of my investment

- I took the high leverage into account, thus having a small position size. This effectively has left me with a 2-3% portfolio loss, which is not unreasonable for a trading error – as opposed for a poorly managed stop.

So this trade has certainly not gone according to plan. The loss taken by the fall in BPT was within the parameters of SystemA, however I am now out of the position and the share is not in a place I would enter at this stage.

today – open bpt

BPT: Opened a long position in Beach Petroleum today – I entered with a warrant to gain some leverage. The instrument I used was a warrant BPTBOK, with an entry at $0.395 – I have the dubious honour of being the only purchaser today. This is a SystemA trade, which is a longer term trend following system (the first one of these written up since coming from hibernation).

Again this is a share that I have previously entered – in fact, this is one share that has popped up in my SystemA scan a couple of times over the last year of so – and given only two members of the ASX200 have shown up in about a year, it is a bit of a rare beast.

Note that I am using a warrant as the tradeable instrument, but for the plan I trade the underlying share, and take signals from that – hence the share price graph here.

Anyway, I’m off to bed – I need the ears to calm down – I saw Duran Duran tonight, and actually felt young in the audience.

Leave a comment

Leave a comment