Archive for the ‘close’ Tag

today – close ewc, open ifm

ewc close

EWC: Closed today in two peices as the price fell after the first sale – my tweet said a lightening in position, but soon after I closed the full position – for a gain of 3%. Note the similarity of the last few days to the graph in yesterdays post for the closing of the CHC position. Anyway, did not quite break the stop loss, but considering the acceleration of some parts of the market, combined with the ‘lower low’, I thought it prudent to cut the trade.

ifm monthly

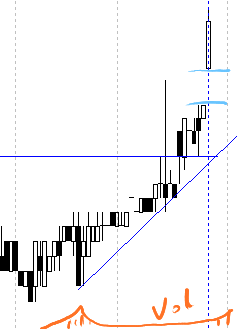

IFM: Opened a position in Infomedia today at 0.37 – just look at the monthly graph to the right. From the monthly graph the telling signs that have caught my interest are the low and declining volume over the last 6 months, combined with a volume spike just prior to the share price pushing aggressively through the down trend. Below is the daily graph.

The share was located on a heat map by my broker with high volume today. I have sketched in the volume on the bottom of the graph.

ifm (Infomedia) today

Reasons for entry:

- volume spike about a month ago to start uptrend

- volume spike today

- gap up

- impressive break of monthly downtrend

The factors I can see against this entry are:

- I’d expect a retracement after this level of run-up

- Possible H&S bottom over the last months indicating that I have entered just short of the standard price projection expectation of a H&S bottom formation.

Anyway, lets see how we go.

today – chc

chc close

CHC: closed the position today, for a small 4% loss – not exactly according to the plan either.

I have noticed the general ‘positivity’ of the markets over the last few days, and in my chart scan tonight I noticed 2 things:

- A number of my shares are under performing the market in the last 5 sessions

- A number of them have the same pattern for the last few days – that which can be seen in this CHC graph.

If the market is taking off , and this is only known with hindsight, I appear to be backing a few shares that haven’t taken this last weeks spurt. Trimming CHC is a move to limit my exposure to the particular graph formation you can see above – even though it hasn’t actually hit the stop loss.

So, I came to a couple of conclusions over the weekend – if the markets are taking off, I need to focus more on which shares I trade (ie: limit the number of open positions) and target the moving parts of the market. Over the last few months, and obviously the two months I have been documenting some of my moves, I have been discretionary trading – going off ‘hot spots’ in the market from a heat map, combined with general chart formations. I must say its been treating me well – the last few months have nearly got me back my losses for the last financial year (no – not since the start of the dive yet!).

When System A (my own coded system in c++ so I don’t need to think) is running, it manages my number of positions to an extent, so issues like that above don’t happen too often when the bulls are running.

On another note – System A scan on the weekend – still nothing!

Leave a comment

Leave a comment