Archive for the ‘cpb’ Tag

today – open mcc, close cpb

MCC: Opened a position in Macarthur Coal today at $10.20. The share made a new high for the year when I was entering, but has since subsided into the close of the day. Volume was good today (double yesterday), so all in all a reasonable looking entry.

Counting against this entry is the observation that this share looks to have lost some of its momentum over the last 3 months or so – maybe this new high will change that… maybe it wont.

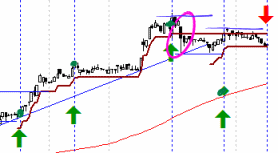

CPB: Closed my position in Campbell Brothers today at 26.99 for a 15% profit by the time you take into account all the entries I made when pyramiding.

You can see in the pink circle the effect of the capital raising, which has stalled the price action in its tracks. The fourth entry, shown as the low down green blob is the entry point of the shares collected via the capital raising.

Fairly straight forward trade, stuck to the plan for the first bit, a momentary panic when I had to think how I would react to the capital raising, and then (new plan under the arm) I traded the second half according to my updated plan.

To date I have not updated my plan with how to deal with this situation, as I wont hit it too often, and looking at a few over the years, I have had some capital raisings that have treated me well – and some have been a disaster. You can see above the plan in this case simply involved resetting my ATR based stop loss when the price stabilised.

today – close ozl, capital raising cpb, iif

ozl exit

OZL: Closed my position in Oz Minerals today at $1.19 for a 7%loss.

I opened this share on what looked to me to be a busted dip from an ascending triangle. Looks like it wasn’t so much busted as indicative… This is the second dip below the uptrend now, so didn’t wait for the close once it was clear it wasn’t coming back. This may have only dropped because the market is taking a dip at the moment, which is successfully moving me more towards a cash position.

Campbell Bros

CPB: Well – does this count as an entry? I have taken on the Campbell Brothers capital raising today, which sets me back $22 a share. There was some news about a takeover by CPB that went through today, and the share price has firmed up a little – making this apparently a good thing to do at the moment. If you look here you will see that I was struggling with whether to take up the offer – which has thrown me into a place of not taking a stop. I’ve decided to manage this by re-triggering my stop loss curve following the recent break. This counts as a discretionary change to my plan for this trade. We’ll find out if that makes sense when I close…

IIF fund raising

IIF: Not an entry or exit – another Capital raising!!! Now this one is worse than the Campbell Brothers one – if you look at the curve I was looking like I may be exiting today as yesterdays price formed a hammer closing just above the stop loss – which didn’t happen – the market for IIF was closed today due to the announcement. Now I have to go through that analysis again for this company. Maybe a re-calibration of the stop loss at the very least.

Learning – increased time in a share seems to increase the chance of the company reaching into your pocket for some cash via a capital raising!

week closeout – the evidence you see

So I feel I should close out the discussion I started with myself at the end of last week… see this post.…

ASX 200 last friday

This is the ASX top 200 at the end of the week. The circle is around last Fridays trade when I wrote that last post, about the ‘voices I heard’ – and you can see where this week closed.

The close last Friday formed a short term low – an excellent buying opportunity in retrospect – but exactly a week later we are into the highest high in just on a year.

So how did I cope?

- I largely ignored the voices, and went with my plan – with the minor change of lowering R, which results in smaller position sizes. This has not cost me anything, and I’m happy that this is a safe idea.

- I took out a couple of protective put options against the ASX200 to act as insurance against a drop. The values where at 4600 and 4500 points, the current value of the ASX200 is 4750 which means I expect these options expire worthless, so I have an overall loss this week based on the price of the options.

- Hesitation – whilst I did largely ignore the voices, ensuring that they did not affect my trades was a concern. The voices can cause you to pass up trades you should take, or exit early from trades you are already in. I reckon I did lose a few brain cycles wondering if I was holding off some decisions because of hesitating when pondering the views of others.

Looking over the week, I did find some opportunities. I entered Sino Gold (SGX) and Oz Minerals (OZL) although early days so will have to wait n see how these play out.

The one trade that I seriously question my actions in is the Campbell Brothers (CPB) trade. Definitely a weakening in that position this week, and I don’t want it to subside much further as I will have to exercise my stop.

Looking forward?

View based on the end of the week, going forward? There is an ever so minor contraction in the red colored MAs in the graph, which indicates to me a slightly altering view in the eyes of the longer term investors. Combine that with the increasing volatility and I would say I need to be sharp as a nail on my stop losses, and ready to exit in a hurry.

Did you grab an opportunity this week? Post a comment and let me know.

today – open sgx – thoughts on cpb

sgx open

SGX: Opened a position in Sino Gold today at $7.25. Selected this position today based on the high movement causing it to show up on my heat map early in the day.

Quick analysis showed a share in a 3 month uptrend, and just below medium term resistance. There have been 3 touches with the trendline I have drawn, so I’ll use it as an indicator for this trade.

Volume has been dipping over the last month and I would like to see this improve. Looking at the moving average ribbon, the investors are holding strong, and the short term traders are starting to get involved in the share again. I don’t know the reason for the gap up today – but then again, there’s not enough time for me to keep up with the news.

Probably not my best entry in a while – but now I’m in, I’ll manage the trade. Selecting the share is not the major hurdle to me, its getting out the other side well that matters.

CPB continues

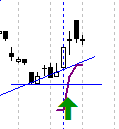

CPB: Campbell Brothers – comment on my position… I’ve been thrown that curve ball that I don’t like to get – something that my plan doesn’t really cover.

Campbell Brothers has fallen through the ATR based stop loss I set – but is still above the rising trend line by a tad. The reason seems to be that Campbell Brothers has joined the list of companies over the last few months that are asking for more money by fund raising from the markets. So – the price is artificially low, and looking at previous shares that have done this, holding seems to have been a wise move… ok, that’s not a detailed analysis and may well have to research that (doh – homework!).

So the new plan is to lower my stop loss price, which is certainly a potential hit to my profit on this trade. Technically my plan covers me if the share drops further, but it is a bit ‘grey’ at this specific point in time.

The real question here is – do I want to write a rule for how I respond to these situations? I’ll have to think how to test that.

… and look at that AUD …!

today – open cpb – again!

cpb - again!

CPB: Entered another position in Campbell Brothers today at 31.70, pyramiding my position.

The catch is that I am just off the top entry for the day, on a day of high volatility for the share. In fact the share fell through the stop loss today due to the high variation.

Rest of the portfolio took a bit of a pounding today, but no exits triggered – yet!

friday – open cpb

cpb - pyramid entry

CPB: Campbell brothers has been climbing nicely, and with the rise friday I had an entry triggered at $25 – close to the days high. Following that the price dipped at the end of the days trade.

This trade is tracking well with the still climbing market.

Where to next…?

today – cpb – updates on open positions

Campbell Brothers opening

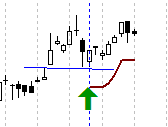

CPB: I set a trigger to enter Campbell Brothers over the weekend, on entry into the rectangle you can see in the attached diagram.

Campbell Brothers has been in an uptrend over the medium term, however ranging over the shorter term. The item of interest that peaked my interest in this share was the bounce off the upwards trend line, which I am looking for a continuation of.

So, I have a couple of trades that have been open for a few days, hopefully indicative of some trends setting in – not that I’ll know till I can look back and know. The writeups below are brief updates on a few of my open positions. you can find the entry conditions by looking of the relevant tags on the menu.

ARU: Only opened recently, strong increase on open – definite rejection of a higher high, but no stops hit.

aru

CHC: Charter Hall group, again only recently entered, and signs of stalling as the overhead resistance is approached. Keep a close eye.

chc

MCC: Continued to rise nicely since opening. Today looks like a push into, and maybe through upper resistance. Keep the trailing stop loss, keep watching.

mcc

MML: Medusa Mining also rose nicely. Another one to hit upper resistance, lets see if we press through. Hold position.

mml

OKN: Pyramided in to this trade based on the sudden increase in price, and the share promptly declined soon after. As it stayed above the increasing trend line I stayed in. In some cases I would have exited on the fall through the ATR based stop loss (brown line), however based on the strong uptrend I held in using the trendline as the ultimate stop due to the sudden spike which I missed capitalising on as I was working on end of day prices.

okn

For anyone interested – one more week to get into the ASX sharemarket game. I’m considering myself, but I don’t know if I can afford any more time, given I post this blog, consider my trades and hold down a job!

For tonights reading I trawled through some content from Tradergav – another Aus trader with a blog. I read his discussion on a tweets conversation that he has here which is around the risk / reward metrics. Since doing discretionary trading I have not been tracking my statistics as carefully as I was up to a year ago, as I normally tracked these for my System A (which had no triggers this week – again!) and other mechanical systems I have toyed with. Maybe thats my next project, as I have done enough in the last year to give some sort of finding. I had one -3R trade from memory last year and that hurt. If I go past -2R I pause trading and ‘have a good hard look at myself’ to determine why I ended up there. I must say I haven’t beaten 8R in over a year though, and you do (well I do) like to get one every so often, both for financial reasons, as well as to help with the psychology of this.

Signing off,

Leave a comment

Leave a comment