Archive for the ‘ewc’ Tag

today – close ewc, open ifm

ewc close

EWC: Closed today in two peices as the price fell after the first sale – my tweet said a lightening in position, but soon after I closed the full position – for a gain of 3%. Note the similarity of the last few days to the graph in yesterdays post for the closing of the CHC position. Anyway, did not quite break the stop loss, but considering the acceleration of some parts of the market, combined with the ‘lower low’, I thought it prudent to cut the trade.

ifm monthly

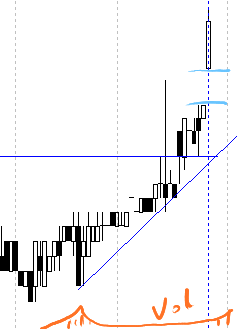

IFM: Opened a position in Infomedia today at 0.37 – just look at the monthly graph to the right. From the monthly graph the telling signs that have caught my interest are the low and declining volume over the last 6 months, combined with a volume spike just prior to the share price pushing aggressively through the down trend. Below is the daily graph.

The share was located on a heat map by my broker with high volume today. I have sketched in the volume on the bottom of the graph.

ifm (Infomedia) today

Reasons for entry:

- volume spike about a month ago to start uptrend

- volume spike today

- gap up

- impressive break of monthly downtrend

The factors I can see against this entry are:

- I’d expect a retracement after this level of run-up

- Possible H&S bottom over the last months indicating that I have entered just short of the standard price projection expectation of a H&S bottom formation.

Anyway, lets see how we go.

today – ewc

ewc open

EWC: re-entered this stock today, bought on stop I set yesterday after I was stopped out of the previous position. I may have entered too early, but I suspect that will be guided more strongly by the overall market sentiment, which appears to be playing a stronger grip over shares over the last couple of days. As usual, entry is easy – now to manage the trade.

new financial year – ewc – trade frequency

I have spent a small amount of time reviewing my trading statistics for the previous financial year tonight. There is one thing that strikes me straight off – and that’s the raw number of trades I have performed. More than any other year, and I do have a few years of stats to look at. Whilst I fundamentally knew it, it still grabs the attention when reviewed – the transaction count trebles over other periods. This is to expected I suppose as in a bull market, my System A and other trades I do are more system driven, and they ‘hug’ the trade better, generating more profit, less costs, less activity – simpler overall trade process.

Once System A stops firing I start to trade patterns – taking more lossy trades, more transactions, more hunting – more time intensive technical research. Again it begs the question – would I have been better off sitting on the sidelines whilst this Bear market played (plays?) out. I can say confidently I took some great trades when the market was turning 3 months ago – and I would have missed these if I sat ‘waiting for confirmation’.

So how do I work out ‘what I would have done to pick the Bear, and stop trading until … the Bulls arrive’. I spose that can be my next project for when Systems A and B are running again. Ahhhh… research.

The blog entry at RatioTrader ‘No Plan, No Rules, No Success‘ seems pertinent here. Am I improving? The first step is to determine my measure of improvement. By my reckoning, the ASX All Ords lost 25.9% in the last year – so I out-performed by 15.5%. That is one measure. Do I stick to my trade plans – on the whole yes, more than last year, which was more then the year before. This is something I track. Since starting this blog, I have only one trade that I did not stick to the plan on (ok, not a long time period) but that is specifically one of the reasons I am logging this. Maybe someone might learn from this, and if not – at least I will!

Anyway more on all that later, todays trade ->

ewc close for 9% profit

EWC: Logged on to find my position in EWC had been stopped out in early trading for a 9.5% profit.

This is one of my preferred trading stocks – good breadth in moves, and sufficient turnover to be able to get in and out. On my last trade with EWC I exited using a profit target, and looking at this graph, a profit target would again have been the way to trade it – resistance around 0.72 puts a bit of a ceiling on price action for now – and in this case would have doubled my profit. Regardless – I am setting the plan and executing it, and its paying off.

Looking forward

On a more general note, the ASX has been on a good run the last 3 to 4 months, and it has treated me well. Looking over my graphs tonight, I have seen a few stocks at the same time dip – ever so slightly mind you – below their uptrends – a sign of weakness. I don’t use indicators as a general rule, but I’m tempted to grab the books and see if they are signalling overbought. I survive basically with moving averages, and sometimes OBV – I need to refer to the books for anything else, which tends to mean they don’t get used much. Shares I am thinking of here are TAP, ROC, PAN, MCC amongst others. They are all resource type stocks so maybe just that sector is coming off the boil… will look into further.

today – ewc – cfe

what a lot of red in the heat map on market opening today!

With the general market drop, I had an entry point hit on EWC at 0.575, a share I have traded a number of times. Purchase is based on trendline starting early March this year through another touchpoint mid May. Given the market drop, I always get a feeling in the bottom of the stomach… I have purchased on a retracement – but by definition I am therefore not buying on immediate strength. Its counter-intuitive for me – when I want to buy something making higher highs. I’ve got my plan in place for this share, so will follow.

CFE closed at 0.335 (4% loss) to protect my overall portfolio, and avoid a margin call. This was above my stop loss for the individual share, but given the general weakness today I closed this out.

The ongoing question in the press and even at lunch with the guys I work with – are we in a bear market, or are the bulls breaking into a run? Whilst I am interested in views, I just try to trade the same way I would otherwise. I saw this article, couldn’t help notice the Aussie reference. I do wonder myself when looking at all this cash being pumped out by the various world governments whether I am watching a bubble being born.

Leave a comment

Leave a comment