Archive for the ‘fxj’ Tag

today – close riv, okn – buy fxj

riversdale exit

RIV: Closed position in Riversdale Mining today at 5.9 for a 10% loss. This has not been a great trade – so I’ll write it up first and hopefully learn from errors. Riversdale has historically been fairly volatile, and one that I like to follow. Thinking it would break through resistance some time ago I entered a position in the share – which subsequently did break out for a whole two days. Anyway, share bounced off resistance twice after that and I didn’t exit…

I don’t have a decisive non-performance exit target for these trades, which I really should have – I tend to be very arbitrary when it comes to stagnant shares. Anyway, I’ve exited this now, so lets watch it take off 😉

oakton close

OKN: Closed my position in Oakton today at 2.92 for an 8.6% gain. Reason for exiting this position was based on the following two factors:

- Share bounced off recent resistance / not making new highs

- Share market very strong today, and relatively so for the last couple of sessions – several shares making new highs – but not this one

Note that the share did not trigger my stop loss, but considering the rest of the market was rising, I thought it best to drop the position for now. Drive my collateral to better positions… like….

fairfax - extending

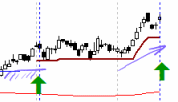

FXJ: Is print media dead? Don’t know but I pyramided into my Fairfax position today at 1.665.

Looking at the share from February to July this year I think I can see a cup n saucer shape with a strong drop off on the volume during the handle – then again you can see anything if you look hard enough!

Regardless of cup n saucer formations or other names, I feel like I can see a well defined bottom that the price is rising out of, combined with a 200 period sma that has only just turned up – hence the pyramided position.

This full picture can be seen on chart.ly.

today – open mcc, wsa, fxj

mcc open

MCC: Pyramided into my position in Maccarthur Coal. I had an entry set before the market to enter when the resistance line was penetrated. In this case it looks like resistance held, and this may prove to be a poor entry. Time will tell.

WSA: Opened a new position in Western Areas – agin bought on finding new highs just to drop back in later trade. There is an uptrend in place with this share, however it comes off the boil a bit.

wsa open

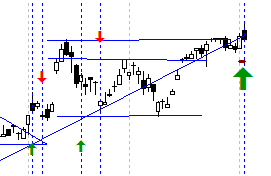

FXJ: Opened a new position in this share. The longer term graph looks like a solid base has been formed over an extended period, and now the share seems to be climbing out of it. The recent rounded bottom was mirrored in the volume (sketched in green below), with increasing volume as the price pressed through the last most higher high in mid-June. I expect this to be a better longer term performer.

fairfax open

All in all, not really happy with my entries today – the first two triggered based on a very strong market opening today, but now the trades are in – trade the plan!!

Leave a comment

Leave a comment