Archive for the ‘ipl’ Tag

today – open pna – extend aqa – close ipl

open pna

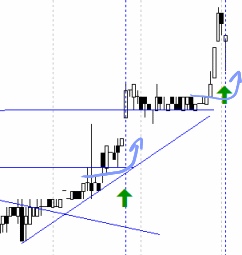

PNA: Opened a position in Pan Australian again today at $0.50.

This share has been good to me in the past, and whilst that is no reason alone for an entry, the volume is good, and the share is making higher highs – gotta be happy with that. The blue horizontal line is a long term resistance line, which has been firmly bounced off. trigger was yesterdays big white candle on strong volume.

ipl close

IPL: Closed my slow moving Incitec Pivot position today at $3.06 for a 4% gain.

The share failed to make a higher high on the recent rise, and was again flat today – not a good sign when the market as a whole has been very bullish this last couple of days. Incitec was a good earner prior to the GFC, but looks like it has lost the gloss, and so not apparently attracting enough buyers to drive the price up.

aqa - pyramids - 4 of!

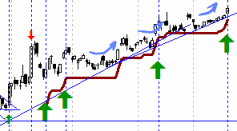

AQA: Pyramided into my Aquila resources position today at $7.53.

This is my fourth entry into Aquila resources, based firmly on the strong consistent uptrend that the share price is exhibiting. I originally entered the position with a small size as I considered it a risky entry, but after increasing 3 more times after that this is now a significant holding.

So lets see what the market holds for us tomorrow as we go into Fridays trade. the market in the US has opened strongly. Volatility is good – I have some short duration options to close in the next week, and as I’m into the last 7 days, tomorrow is the day for it.

Ciao

today – open ipl, ifm

ipl open

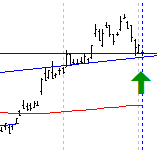

IPL: Opened a position in Incitec Pivot today at $2.95 on market opening this morning. Incitec has been a reasonably volatile mover over the last couple of years, and has been a reasonable earner for me in the past. The share has been at its highs for the year lately, and has just dipped to the previous medium term high.

I’m using this previous resistance as a potential support point – but I wont actually know for a while. This does allow a tight stop to be set however which is good from a risk management perspective.

ifm pyramid entry

IFM: Increased my position in Infomedia today by placing another buy at $0.415. The share actually took quite a dip during the days trade when the bears dragged it down in early trade, but it recovered healthily closing near the high.

Readings… Change on the Horizon?

Looking at Stockgawk, there is an interesting article where Andrew Finkle talks about his reasons why he thinks we’re about to see a reversal… a key item he mentions that I have observed is

The past few days have shown a lot of Dojis. … a Doji is a reversal day – where price gets rejected … This makes me think back to Ralph Block … who used to say “Volatility is the precursor to a change in trend.”

Looking at my recent trades (published here and my unlisted ones) I am seeing price fluctuations that, whilst bearish in the short term, seem ‘undecided’ when looked at over a slightly longer period of time. I listen to the talk at work, and its like everyone is waiting… this is not the increased excitement I was detecting just a couple of weeks ago.

So, as you may have noticed I trade more to the bull side of the market, but this is more affected by the sorts of trades I can comfortably pull off. As I have a full time day job I don’t tend to make trading decisions by day, I just act on earlier plans – but in my experience to play the short side of the market (with options / warrants / CFD’s) I need a closer contact with the market in order to maintain a chance of securing profits I might make – the speed of movement isn’t always in my favour in those areas.

So – why did his article resonate with me? Well, many have heard of the magazine front page effect, ie: when everyones talking about it, you are probably too late. I had one of those moments tonight – on the news here in Australia there was a commentator who said “Its a champagne moment for Australia” when commenting that we had effectively dodged a bullet as far as the economic crisis is concerned. I spose you had to see the gentlemans exhuberance. What I saw, combined with my recent views of the market, has me pulling my stops in on my plans, and keeping a close eye. Despite me having issues managing short trades – that doesn’t mean I don’t enact the plan!

Anyway, US market down looking undecided in the first 2 hours of trade, and I need to know how that goes before I set my entry trades for the open – if I do at all!

Leave a comment

Leave a comment