Archive for the ‘jbh’ Tag

today – open jbh, close iif

JBH: Opened a position in JB Hifi today at 22.78.

As noted in my last post, my System A has fired an entry in JB Hifi. System A is a medium/long term trend following system, that has so far only triggered on two stocks in the last 6 months. The system is only scanning the ASX200 at the moment – I really do need to sit down and tweak the system to scan other markets – but I haven’t done that yet.

I have no issues at all making this entry – this is one of the smoothest up trends in the market.

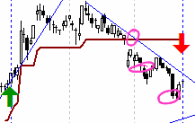

IIF: Close my position in ING Industrial Fund today as 0.45 for a 13% loss. This has been a bad trade, and exploits a gap in my system. As noted in other posts, I haven’t clearly planned what I will do when a company does a capital raising. That said, the recent capital raising in Campbell Brothers treated me well – a feat I was hoping to happen again in this share.

But it wasn’t to be. In the diagram I have drawn three circles – 3 exits I should have taken.

The obvious question is why did I exit today? Well, with the price drop thursday, the price of the share dropped below the price at which I could buy more shares from the capital raising – that can’t be good. The companies attempt to raise funds will result in selling me shares dearer than I can get them on the market. So – someone else can have my shares – trade closed.

Anyway, a few more stops being toyed with, so I’ll keep going with closing those positions…

today – close jbh

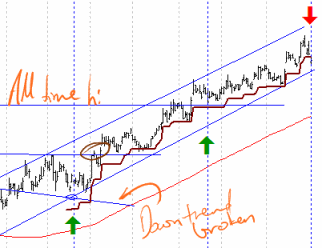

JB Hifi close

JBH: Closed my position in J.B. Hifi today at $20.40. This has given me a profit of 46% – that will help the stats.

When I look back at the entry from when I pyramided into the position I wrote at the time that this was a text book trade – which it seems to have been right until the end.

Happy with this trade – it ticks the boxes:

- Clear reason for entry (something not apparent in some of my trades)

- Followed a simple clean plan

- Broke through a downtrend, then an all time high to keep plowing into higher territory

- Good profit

And look at the smoothness of the red moving average (140 day) under the trend. A treat!

Anyway this is (was?) the longest position I have held since starting this blog that I’ve documented. Anyway its gone now – but who knows I may open it again in a couple of days…

Here’s to my dwindling portfolio, and increasing cash position!

friday – pyramid entry jbh

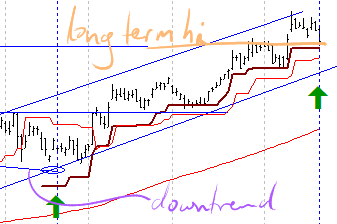

jbh pyramid

JBH: pyramided into my JB Hifi position again today, at $17.50 – this trade is looking like the ones you see in book so far (ok – yes, I do put too many lines all over the place sometimes!)

The original entry can be seen in the diagram to the right when the earlier downtrend crossed the more recent term uptrend. So far the channel has held quite nicely, and is returning nicely.

On to other things – ran System A scan – still nothing!

Weekly readings:

At the Bespoke Investment Group you can see a write up which compares the ability of their respondents to accurately pick the market direction, and compares it (un)favourably to going by the toss of a coin here.

Another interesting read at Daily Speculations (a website about – amongst other things – ballyhoo deflation!!) which talks about risk and loss aversion. This article is well written, but I did resonate with the following line (quote):

I think most investors who are not professionals have a very shallow understanding of risk.

When you sign up to trade CFD’s, options, shares and other things you have to sign all sorts of documents regarding risk – but until I lost money sometime ago the concept of risk was just that – a concept. Now its something that I find I manage no a daily basis – whether its the amount of money I have in a share, my portfolio balancing, my amount in cash – I’m constantly casting an eye across the where the money sits – and hence – where the risk sits.

anyway, time to relax before the new week starts – adios!

minor edit – 27/10/09 – realised the heading said closed instead of opened

Leave a comment

Leave a comment