Archive for the ‘lsa’ Tag

today – close lsa, open tel

So the last couple of days have been a bit hectic for me and it looks I have some stops to take out. Hopefully I can get online and transact them tomorrow.

So the last couple of days have been a bit hectic for me and it looks I have some stops to take out. Hopefully I can get online and transact them tomorrow.

LSA: I closed my position today in Lachlan Star under SystemB . The share touched my stop loss on the share and so I was exited. Looking at the remaining open positions this one may have been worth keeping, as some of the others are not looking at all healthy. Oh well – drop the losers, ride the winners. Today this one isn’t a winner.

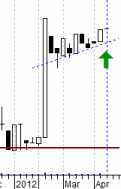

TEL: I opened a position today in Telecom NZ today under System A, the longer term trending following system. I actually missed my entry yesterday and chased price overnight to enter. I haven’t logged in during the day for a bit and this can delay the transactions.

TEL: I opened a position today in Telecom NZ today under System A, the longer term trending following system. I actually missed my entry yesterday and chased price overnight to enter. I haven’t logged in during the day for a bit and this can delay the transactions.

This share really has a nice slow steady increase – and I just hope it keeps on going the same.

The last couple of days have been a bit unusual – the US and UK markets are not showing strength, but today the ASX made some new mid term highs – a good sign for the next short period of time. Also maybe even a divergence with these other western markets.

today – opened … quite a few

Today I opened a number of positions – more than usual, but a few showed up in the scans.

WHCKOB: Opened a long position in Whitehaven Coal today on System B at $1.835. This is a warrant for a leveraged position – I trust this one will go a little better than my recent foray into a warrant in BPT. Whitehaven is a share I have owned on and off over time and it appears to have strength at the moment.

WHCKOB: Opened a long position in Whitehaven Coal today on System B at $1.835. This is a warrant for a leveraged position – I trust this one will go a little better than my recent foray into a warrant in BPT. Whitehaven is a share I have owned on and off over time and it appears to have strength at the moment.

(update – I replaced the diagram to the right for WHC at I had pasted in the incorrect image – it was a daily chart, rather than the weekly chart I use for System B – 18/4/12)

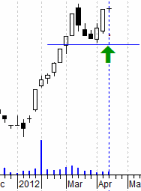

LMC: Opened a long position in Lemarne Corporation today on System B at $0.75. I only got a partial fill on my order, but will sit on my order and wait to get filled at the moment as the overnight market looks decidedly bearish.

LMC: Opened a long position in Lemarne Corporation today on System B at $0.75. I only got a partial fill on my order, but will sit on my order and wait to get filled at the moment as the overnight market looks decidedly bearish.

This also looks to be my riskiest position today, as it has climbed dramatically recently (the graph only shows the recent ‘flagpole’ however there was another shortly before this, on a weekly graph). Risky position, thinly traded = small position.

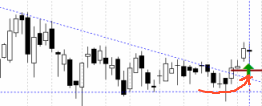

LSA: Opened a long position in Lachlan Star Corporation today on System B at $1.70.

LSA: Opened a long position in Lachlan Star Corporation today on System B at $1.70.

Lachlan looks like it may have formed a flag, implying that this position is halfway up the flagpole. Over time I have stopped trusting too much in chart patterns, however I haven’t totally discounted. I need to get out my Bullkowski book and check up no the probablilties and see how the various patterns track.

SPN: Opened a long position in SP Ausnet today on System B at $1.06. SPN has pushed out the top of resistance, and seems to be dipping back a bit again.

SPN: Opened a long position in SP Ausnet today on System B at $1.06. SPN has pushed out the top of resistance, and seems to be dipping back a bit again.

I’m looking for a continuation of the march forward from the top of the triangle.

AIA: Opened a long position in Auckland International Airport today on System B at $2.00.

AIA: Opened a long position in Auckland International Airport today on System B at $2.00.

Auckland Airport is having a steady increase so will look for this to maintain the forward momentum.

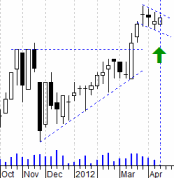

SAI: Opened a long position in SAI Global today on System B at $5.19.

SAI: Opened a long position in SAI Global today on System B at $5.19.

SAI Global can be a less than exciting share however it is now making new highs. This is usually an exciting thing for my Plan B as I am looking for continuing increases from here.

All that said – I realise this is one of my more bland updates. Too many positions and too late at night to worry about getting too flowery! Its really a case of seeing if some of them rise and return a couple of dollars to the kitty.

Night!

Leave a comment

Leave a comment