Archive for the ‘mms’ Tag

recent – close spn, ago – open mms, mth

SPN: I closed my position in SP Ausnet last tuesday at $1.00 for a 7% loss from System B. This share seemed to be tracking along nicely then took a bit of a dive – which is usual in the current market. The give away that the situation may not improve was the letter in the mail offering me more shares at $1.00 due to a capital raising. My last 3 capital raisings have lead to completely flat performance, followed by little to no price recovery – I’ll bail this and look for other opportunities.

SPN: I closed my position in SP Ausnet last tuesday at $1.00 for a 7% loss from System B. This share seemed to be tracking along nicely then took a bit of a dive – which is usual in the current market. The give away that the situation may not improve was the letter in the mail offering me more shares at $1.00 due to a capital raising. My last 3 capital raisings have lead to completely flat performance, followed by little to no price recovery – I’ll bail this and look for other opportunities.

MTH: I opened a position in Meritage on the NYSE last tuesday for System B. I haven’t done many trades on the US stock market, but I can see that changing at least a little. Running my searches across the SU markets is showing me some good looking trends, which I will try to capture over time. It would make sense to determine a portfolio mix across markets – I just need to find the time to get to that!

MTH: I opened a position in Meritage on the NYSE last tuesday for System B. I haven’t done many trades on the US stock market, but I can see that changing at least a little. Running my searches across the SU markets is showing me some good looking trends, which I will try to capture over time. It would make sense to determine a portfolio mix across markets – I just need to find the time to get to that!

MMS: I opened a position in Macmillan Shakespeare today at 11.10 for System B. It showed up in the weekend scan for the system and looked a bit promising, and the order was placed last night (Sunday night). As you can guess I didn’t really look at the market close across the world last friday – and things closed poorly. Germany down ~3.5%. Doesn’t bode well for the week… Overall this share is just peeking into a long term high – normally a good sign but will have to keep a close eye to see if the greater market sentiment drags it down.

MMS: I opened a position in Macmillan Shakespeare today at 11.10 for System B. It showed up in the weekend scan for the system and looked a bit promising, and the order was placed last night (Sunday night). As you can guess I didn’t really look at the market close across the world last friday – and things closed poorly. Germany down ~3.5%. Doesn’t bode well for the week… Overall this share is just peeking into a long term high – normally a good sign but will have to keep a close eye to see if the greater market sentiment drags it down.

AGO: I had my position closed on me in Atlas Iron today as it hit a profit target. The short trade was closed at $2.00 for a 7% gain. In this case I set $2.00 as a profit target as the price was rejected from that support level 2 weeks ago, and has given the impression that the support will hold at that point – it’s a solid round number. Either way, nice profit off a quick trade.

AGO: I had my position closed on me in Atlas Iron today as it hit a profit target. The short trade was closed at $2.00 for a 7% gain. In this case I set $2.00 as a profit target as the price was rejected from that support level 2 weeks ago, and has given the impression that the support will hold at that point – it’s a solid round number. Either way, nice profit off a quick trade.

Let’s see what the rest of the week has to show for itself!

recent trades, close mms, bptkmb, open mvp

So the impact of the Greeks is taking out my positions, slowly but surely. Been a busy week at work so I haven’t been posting my updates promptly, but I am seriously having to gauge whether I drop all positions, or hang in there. SXY seems to have fallen so far I would be entering again looking for a rebound… possibly a really bad idea though…

BPTKMB: I had my position closed yesterday in my warrant position Beach Energy at $1.20 for a 50% loss under System B. The stop was the exit price on the barrier warrant, which returns the intrinsic value to me in a week or so. As I bought in at a low price, and the warrant exit price aligned with my stop loss on a System A trade.

BPTKMB: I had my position closed yesterday in my warrant position Beach Energy at $1.20 for a 50% loss under System B. The stop was the exit price on the barrier warrant, which returns the intrinsic value to me in a week or so. As I bought in at a low price, and the warrant exit price aligned with my stop loss on a System A trade.

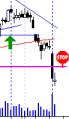

You can see how the price fell after exit day in the picture to the right so that stop loss worked well for me – noting that my position size was quite small so a 50% loss is not a significant cause for concern.

MMS: I closed a position recently in Macmillan Shakespeare at $10.51 for a 1% loss. This was a good trade in regards to a good clear entry, and the exit was clearly defined. MMS has been a good share in relation to strong moves, so I may be back in it shortly – let’s see how it pans out.

MMS: I closed a position recently in Macmillan Shakespeare at $10.51 for a 1% loss. This was a good trade in regards to a good clear entry, and the exit was clearly defined. MMS has been a good share in relation to strong moves, so I may be back in it shortly – let’s see how it pans out.

MVP: I opened a position in Medical Developments at $0.75 using System A. This is a risky position due to the greater market moves – although this share has been growing consistently and strongly for some time. You can see todays movement in the share price and the dip was fairly strong – however the price seems to have stalled at a resistance level.

MVP: I opened a position in Medical Developments at $0.75 using System A. This is a risky position due to the greater market moves – although this share has been growing consistently and strongly for some time. You can see todays movement in the share price and the dip was fairly strong – however the price seems to have stalled at a resistance level.

today – open mms

MMS: Opened a long position in Mcmillan Shakespeare today on System B at $10.65. I am no longer fully invested as a few trades got bounced out yesterday (not listed on this blog), freeing up some funds. I did a hunt last night and thought MMS looked the best of the opportunities.

The share is making long term highs, rising consistently, and shows increased volumes over the last few months.

Anyway, I’m off to bed – its a busy week, Duran Duran monday, and the Melbourne comedy Gala tonight – ace!

Leave a comment

Leave a comment