Archive for the ‘mre’ Tag

today – close mcc, mre

mcc close

MCC: Closed the position in Macarthur Coal at 8.30 for 11% gain. Followed this plan well – MCC has been good to me (not that it cares a toss about me!) and I will continue to watch. Trailing stop loss plan has been effective for this, but I did expect to get the target at the medium term resistance you can see marked in the diagram

mre close

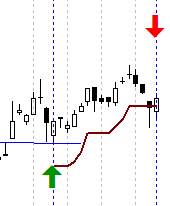

MRE: Closed the position in Minara Resources today at $0.92 for an 11% loss. This is unfortunate as the share was a winner for a fair period of time before it dipped into loss territory. I passed off on the first exit point (penciled in green) as the share fell below the trendline I had drawn – this has proven to be a mistake. I took the exit today after the share closed last night below my stop loss line.

Anyway ttfn – a hard to read week this week – I can see some long and short positions. Lets see what happens in the US tonight and I may place some positions before going to my real job in the morning.

today – close MML, open MRE

mml close

MML: Closed this morning for a 7% profit. Followed my stop loss, exited nicely today on market open order set last night. Planned the trade – traded the plan. I was fortunate for the last price increase yesterday!

mre open

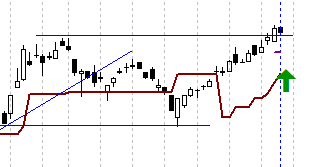

MRE: Opened today at $1.03 at market open. I chose the share based on a recent strong uptrend that was in place, to be replaced by this trading range that has been in place for the last couple of months. Yesterday the price came out the top of the range triggering an entry for me.

Both orders were placed out of market hours.

today – mre

mre trade

MRE: today closed position for a 22% loss. Not a great exit – the price closed above my stop loss line, however I had a stop loss in the market which triggered during the day closing the trade. I was looking to close the position anyway as the price had fallen through the trend line I had selected.

Not good – another loss over 22% – really need to minimise those… however this does fit within the plan. I’m winding back position size due to volatility, as I aim to lose 1.5% / 2% of my capital per trade – fairly standard trading rule actually.

Have also placed some closes for tomorrow due to some instruments closing below my stop losses at the close of trade.

Leave a comment

Leave a comment