Archive for the ‘okn’ Tag

today – okn close

OKN: Closed my position in Oakton today at $3.40, for an overall loss of 3.89%.

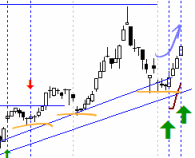

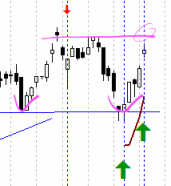

This has been a predictable outcome as the share made a higher low (light blue sketch), but failed to make a higher high (purple sketch). The share then bounced off the ATR stop loss line, and ended up falling through it yesterday, also falling through the trendline at the same time.

Looking at my post when I pyramided in (here) I was clearly bullish, firing off the three white candles – but I did what I said I’d do – I stuck to the plan.

Issue with this trade – I pyramided in too early. I should have waited for the higher hig, which I did not do – I jumped the gun a bit.

Looks like Oakton is getting set up for a short. I’ll keep an eye – although we might just see some consolidation.

today – open okn, all

Oakton pyramid entry

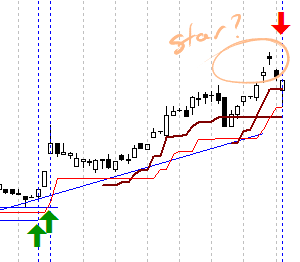

OKN: Pyramided into my Oakton position by increasing my holding with a purchase at $3.78.

It looks like my earlier entry tookthe bounce cleanly which is already encouraging. This has hiked my stop loss as can be seen in the diagram, which lead to me increasing my holding. Three white candles is generally fairly bullish, and the market over the last few days has been strong. Now to sit back – and follow the plan!

all open

ALL: Today I took out another position in Aristocrat Leisure at $4.60.

The last position here lost me 6%. Nup – I don’t reckon I’m chasing the share to get even for my loss – but you never know exactly what the subconcious is thinking!

The entry is clearly again based on the break of a downtrend, which happened yesterday with the formation of the big white candle. My plan was to get in on a rising share today, but it appears that the latter days trade was not in my favour – there is a dark cloud across the price chart. This is not normally a strong signal as the main candle body is well above the close from yesterday. Un inspiring volume though… hmmm listening to my words here I don’t feel strong about this entry – but never the less – in now, so stick with the plan.

today – buy okn, wan

Oakton re-entry

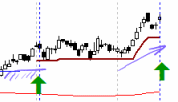

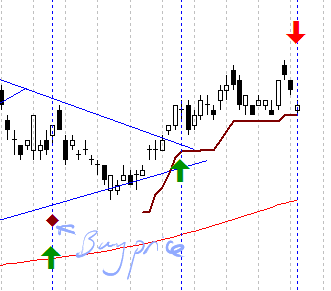

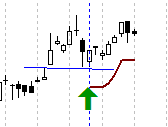

OKN: Opened a position in Oakton today at 3.40.

I exited the last Oakton trade when I hit a double top, which has now been clearly penetrated (smashed?) giving a strong run up to a the high for the year so far.

The share appears to be in an uptrend (higher highs, lower lows), so I have bought in where the share seems to be finding support.

Reasons against taking the trade? The high point in the chart is a nice example of a shooting star, a typical reversal signal. The top of that shooting star is clos-ish to the most recent significant highest high in August 2008. This may cap my upside, but if that is penetrated, then this is a good trade. Lets see where this goes.

Downside is limited due to closeness to next support line, and upwards trend line.

wan - another re-entry

WAN: Opened a position in West Australian News today at 7.80. Volume has been good the last two days, and days have been closing at or near daily tops for a while now – in spite of the large number of down days recently in the general market.

Looking for a bounce on the current upwards trendline – and hopefully not too much resistance at the recent high. Looking at todays chart looks like it may be a distinct possibility.

As I sign off for the night, the US markets are opening well, so if this pushes through resistance tomorrow this may be one to watch.

Even though it is new media.. so as a keeper this doesn’t make sense to me!

today – close riv, okn – buy fxj

riversdale exit

RIV: Closed position in Riversdale Mining today at 5.9 for a 10% loss. This has not been a great trade – so I’ll write it up first and hopefully learn from errors. Riversdale has historically been fairly volatile, and one that I like to follow. Thinking it would break through resistance some time ago I entered a position in the share – which subsequently did break out for a whole two days. Anyway, share bounced off resistance twice after that and I didn’t exit…

I don’t have a decisive non-performance exit target for these trades, which I really should have – I tend to be very arbitrary when it comes to stagnant shares. Anyway, I’ve exited this now, so lets watch it take off 😉

oakton close

OKN: Closed my position in Oakton today at 2.92 for an 8.6% gain. Reason for exiting this position was based on the following two factors:

- Share bounced off recent resistance / not making new highs

- Share market very strong today, and relatively so for the last couple of sessions – several shares making new highs – but not this one

Note that the share did not trigger my stop loss, but considering the rest of the market was rising, I thought it best to drop the position for now. Drive my collateral to better positions… like….

fairfax - extending

FXJ: Is print media dead? Don’t know but I pyramided into my Fairfax position today at 1.665.

Looking at the share from February to July this year I think I can see a cup n saucer shape with a strong drop off on the volume during the handle – then again you can see anything if you look hard enough!

Regardless of cup n saucer formations or other names, I feel like I can see a well defined bottom that the price is rising out of, combined with a 200 period sma that has only just turned up – hence the pyramided position.

This full picture can be seen on chart.ly.

today – close aoe, open okn

aoe close

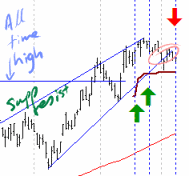

AOE: Closed my position in Arrow Energy today at $4.42 for a 2.7% loss.

In this case I have not waited for my stop loss because of ‘bad feelings’ which are based on what I am seeing on the daily price graph. Marked in the picture you can see the all time high marked. On breaching this barrier I would expect the price to stall before moving on – which it has. Looking however at the rising wedge, the top barrier is a line that was an upwards trending support line – however recently this line seems to have become a resistance line, which may hinder upward movement.

At the top of the wedge, the price seems to have come out to the downside, so for now I’m reigning this one in.

That said – it may move on, and I’ll keep an eye in case I choose to re-enter.

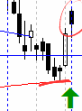

okn open

OKN: Pyramided into my Oakton position today at $2.94. Oakton has risen nicely in the few short days since I took an initial position. I am however sitting just below resistance so will need to see if we can push through that.

Looking over my last Oakton trade, its the same level of resistance that shook me out just a couple of weeks ago.

Anyway, off to watch the gold price that pushed through the $1000 barrier earlier today and is now trying to get itself pushed back beneath it!

today – open okn

okn open

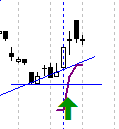

OKN: Opened a position in Oakton today soon after market open at $2.55.

Oakton has been good to me recently – not that thats a good reason alone to trade it. I entered coz there was a gap up on open, forming a bounce on a previous support line – which earlier was a resistance line.

In other markets, Gold is breaking out and the Aus dollar seems to have stalled against the USD.

Au revoir!

today – close okn, pna, open mol

okn close

OKN: Closed my position in Oakton at 2.72, for another in a series of trades on this stock. I must say, the usual mixed blessings – but on the upside I’m always happy with a 35% return on a 9R trade. I watched this trade carefully as it was my largest holding at present, and was ready to exit after the big black candle about two weeks ago – but after a fast recovery in early trade I decided to hang in there.

With the evening star two days ago, I thought I shouldn’t push my luck when I received an alert that my secondary limit was touched in early trade today, so the position was closed. I saw the recovery following my exit – and like all these things, only the future will tell me if I should have actually pyramided in rather than exited today!

That said – I don’t get too many 9R trades, so I’ll reward myself with an Ice cream after dinner to celebrate!

MOL: Opened a position in this stock today, basically buying a dip in this stock which has been very volatile lately – a small position as its moving a bit faster than I may be able to watch….

pna close

PNA: Closed my position in Pan Australian today for a 16% increase – and as for OKN above its with the usual misgivings.

The original entry (not documented in this blog) is marked with a diamond in the graph to the right as I received the shares as part of a share placement that I took up when I had an earlier holding. Followed the plan for this trade well, but now I look at the graph in my editor I can see a clear support forming at the bottom of todays candle which has held over the last 3 weeks – not to be ignored. Nevertheless I see it now and I missed it when glancing at the chart over the last few days.

Looking over tonights graphs I can see some interesting buys on retracements forming, and some exits on falls through stop losses – lets see what tomorrow holds.

today – cpb – updates on open positions

Campbell Brothers opening

CPB: I set a trigger to enter Campbell Brothers over the weekend, on entry into the rectangle you can see in the attached diagram.

Campbell Brothers has been in an uptrend over the medium term, however ranging over the shorter term. The item of interest that peaked my interest in this share was the bounce off the upwards trend line, which I am looking for a continuation of.

So, I have a couple of trades that have been open for a few days, hopefully indicative of some trends setting in – not that I’ll know till I can look back and know. The writeups below are brief updates on a few of my open positions. you can find the entry conditions by looking of the relevant tags on the menu.

ARU: Only opened recently, strong increase on open – definite rejection of a higher high, but no stops hit.

aru

CHC: Charter Hall group, again only recently entered, and signs of stalling as the overhead resistance is approached. Keep a close eye.

chc

MCC: Continued to rise nicely since opening. Today looks like a push into, and maybe through upper resistance. Keep the trailing stop loss, keep watching.

mcc

MML: Medusa Mining also rose nicely. Another one to hit upper resistance, lets see if we press through. Hold position.

mml

OKN: Pyramided in to this trade based on the sudden increase in price, and the share promptly declined soon after. As it stayed above the increasing trend line I stayed in. In some cases I would have exited on the fall through the ATR based stop loss (brown line), however based on the strong uptrend I held in using the trendline as the ultimate stop due to the sudden spike which I missed capitalising on as I was working on end of day prices.

okn

For anyone interested – one more week to get into the ASX sharemarket game. I’m considering myself, but I don’t know if I can afford any more time, given I post this blog, consider my trades and hold down a job!

For tonights reading I trawled through some content from Tradergav – another Aus trader with a blog. I read his discussion on a tweets conversation that he has here which is around the risk / reward metrics. Since doing discretionary trading I have not been tracking my statistics as carefully as I was up to a year ago, as I normally tracked these for my System A (which had no triggers this week – again!) and other mechanical systems I have toyed with. Maybe thats my next project, as I have done enough in the last year to give some sort of finding. I had one -3R trade from memory last year and that hurt. If I go past -2R I pause trading and ‘have a good hard look at myself’ to determine why I ended up there. I must say I haven’t beaten 8R in over a year though, and you do (well I do) like to get one every so often, both for financial reasons, as well as to help with the psychology of this.

Signing off,

today – pyramid positions – okn – tap – mnd – aqa

Interesting action in todays market. I have taken the opportunity to extend my investments in some currently open positions, whilst keeping an eye on the overall market to not over extend myself at present.

okn - pyramid in

OKN: despite the funny action I saw recently, I have increased my position here. With a gap up on open this is looking strong. I note that the next significant resistance is at 3.00, however there are some minor resistance points before then.

TAP: The recent purchase appears to have successfully bounced off the support line for now, so am looking to strengthen my position. The morning opened well but the share seems to have formed a spinning top, so will keep an eye on it in the morning.

MND: Since entering with my first parcel, MND has subsided along a smooth short term down trend to marginally above my stop loss, at which point it has started rising again. I have taken the opportunity to increase the position on this break through the lesser downtrend, assuming that the uptrend is now to resume.

aqa pyramid entry

AQA: another share continuing to build upwards. Increased my position size, however I can see I am relatively close to a line of resistance at the top of the big white candle about 12 days ago. Lets see how we hold up.

Tomorrow – end of the Australian financial year. whta fun – then I’ll have to think about another tax return! arrgh – more paperwork 🙂

comment – funny action on OKN

definitely saw some funny action on OKN transactions today as alluded to in my earlier post. Look at the course of sales figures for the stock on the ASX today … here is an excerpt below

| Time | Price | Volume |

| 11:41:04 AM | 1.77 | 289 |

| 11:41:04 AM | 1.775 | 1 |

| 11:41:04 AM | 1.785 | 1 |

| 11:38:39 AM | 1.79 | 1 |

| 11:35:39 AM | 1.79 | 1 |

| 11:32:09 AM | 1.79 | 1 |

| 11:29:54 AM | 1.79 | 1 |

| 11:26:39 AM | 1.79 | 1 |

| 11:23:09 AM | 1.79 | 1 |

| 11:19:08 AM | 1.79 | 1 |

| 11:16:08 AM | 1.79 | 1 |

| 11:13:23 AM | 1.79 | 1 |

| 11:10:24 AM | 1.79 | 1 |

| 11:05:54 AM | 1.79 | 1 |

| 11:02:08 AM | 1.79 | 1 |

| 10:57:23 AM | 1.79 | 1 |

| 10:57:14 AM | 1.77 | 30 |

| 10:57:14 AM | 1.77 | 1560 |

| 10:52:23 AM | 1.77 | 1 |

| 10:50:03 AM | 1.76 | 35 |

| 10:50:03 AM | 1.76 | 12 |

| 10:50:03 AM | 1.76 | 959 |

| 10:49:08 AM | 1.76 | 1 |

This is of interest to me because my broker tells me that I cannot make purchases of shares in less than $500 lots. Now I know small lots go through, but if I look at the days trades, there are an awful lot of ‘single share’ transactions going through – always at the ask, and seemingly pushing the price higher. This stocks fairly lightly traded today so this does change the appearance of a tick graph. If anyone was watching the days transactions, without noting volume, they may have thought there was a lot more activity than there really is.

Then again – maybe this is entirely normal – I just haven’t seen it before. I’m the first to admit that looking at intraday data is something I generally don’t do. Any comments anyone?

disclaimer – I bought this stock today, and its fair to say that the existance or not of these transactions would not have changed my view of the market, as the decision was based on yesterdays close. That doesn’t change the fact I find it interesting.

Leave a comment

Leave a comment