Archive for the ‘pna’ Tag

today – close pna, open amp

amp open

AMP: Opened a position in AMP today at a price of 6.50.

Made the decision to enter based on the big white candle yesterday combined with yesterdays healthy volume. Set a trigger entry for 6.50 (psychological choice). Not a full size position as I wont commit a standard position until I see a break of the previous high.

Up to now I have been right out of the financial sector, which is actually performing quite well in Aus at the moment. As an aside, I did see on the news there are rumours around that companies are looking to buy AMP at the moment. Don’t know (don’t care!) if there is any fact in the news – however todays stock price movement would indicate that someones listening to the rumours!

pna close

PNA: Closed my position in PAN Australian at 0.465 leaving me with a 7% loss.

This is a good exit – hit the stop and exited quickly. Reviewing the chart, I am just above two support trendlines (one rising, one flat) which would indicate that the price may bounce – however – best exit at a small loss and re-enter should the opportunity present itself.

Ok, Ok – a good exit technically – not good financially. However I see something on my portfolio statement here at the moment (not published till the weekend) but every position is now turning a profit! That is rare for a set of positions all in the black.. Helped of course by an extraordinarily bullish market combined with aggressive killing of non performing positions.

I have added a full chart view at chart.ly – have a look.

The plan is working!

today – open pna – extend aqa – close ipl

open pna

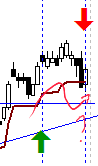

PNA: Opened a position in Pan Australian again today at $0.50.

This share has been good to me in the past, and whilst that is no reason alone for an entry, the volume is good, and the share is making higher highs – gotta be happy with that. The blue horizontal line is a long term resistance line, which has been firmly bounced off. trigger was yesterdays big white candle on strong volume.

ipl close

IPL: Closed my slow moving Incitec Pivot position today at $3.06 for a 4% gain.

The share failed to make a higher high on the recent rise, and was again flat today – not a good sign when the market as a whole has been very bullish this last couple of days. Incitec was a good earner prior to the GFC, but looks like it has lost the gloss, and so not apparently attracting enough buyers to drive the price up.

aqa - pyramids - 4 of!

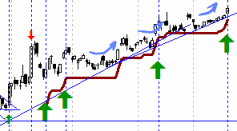

AQA: Pyramided into my Aquila resources position today at $7.53.

This is my fourth entry into Aquila resources, based firmly on the strong consistent uptrend that the share price is exhibiting. I originally entered the position with a small size as I considered it a risky entry, but after increasing 3 more times after that this is now a significant holding.

So lets see what the market holds for us tomorrow as we go into Fridays trade. the market in the US has opened strongly. Volatility is good – I have some short duration options to close in the next week, and as I’m into the last 7 days, tomorrow is the day for it.

Ciao

today – close okn, pna, open mol

okn close

OKN: Closed my position in Oakton at 2.72, for another in a series of trades on this stock. I must say, the usual mixed blessings – but on the upside I’m always happy with a 35% return on a 9R trade. I watched this trade carefully as it was my largest holding at present, and was ready to exit after the big black candle about two weeks ago – but after a fast recovery in early trade I decided to hang in there.

With the evening star two days ago, I thought I shouldn’t push my luck when I received an alert that my secondary limit was touched in early trade today, so the position was closed. I saw the recovery following my exit – and like all these things, only the future will tell me if I should have actually pyramided in rather than exited today!

That said – I don’t get too many 9R trades, so I’ll reward myself with an Ice cream after dinner to celebrate!

MOL: Opened a position in this stock today, basically buying a dip in this stock which has been very volatile lately – a small position as its moving a bit faster than I may be able to watch….

pna close

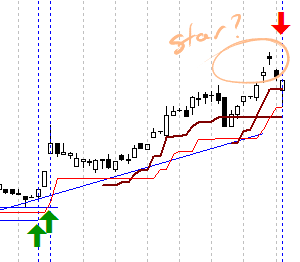

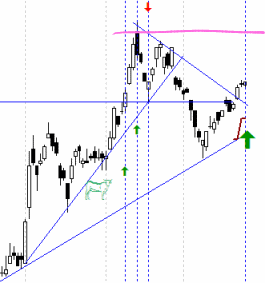

PNA: Closed my position in Pan Australian today for a 16% increase – and as for OKN above its with the usual misgivings.

The original entry (not documented in this blog) is marked with a diamond in the graph to the right as I received the shares as part of a share placement that I took up when I had an earlier holding. Followed the plan for this trade well, but now I look at the graph in my editor I can see a clear support forming at the bottom of todays candle which has held over the last 3 weeks – not to be ignored. Nevertheless I see it now and I missed it when glancing at the chart over the last few days.

Looking over tonights graphs I can see some interesting buys on retracements forming, and some exits on falls through stop losses – lets see what tomorrow holds.

today – pna – roc

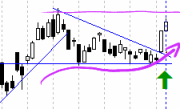

pna entry

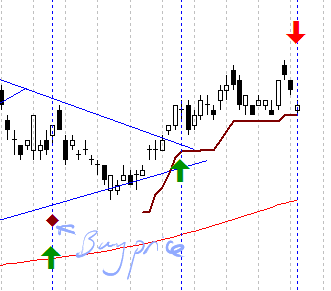

PNA: Made a pyramid entry into PNA today at $0.39.

As you can see from the pic I have an open position from whilst the share was falling – this is because I previously closed my PNA position, but took up the offer to buy additional shares from teh company via a placement offer. As the placement offer was small, I held them figuring I would sell in time when I could increase the parcel size. Either way, nice break through short term descending trendline, but can expect resistance only a short way up.

roc entry

ROC: Entered again at 0.79 on an encouraging break of the short term downtrend. This is actually a setup I am seeing in a number of my stocks I am following at the moment, all based off the general market sentiment.

In my inbox today I have a few articles of interest – This one from Casey Research – “The 20 year Bear Market“, and other ones talking about ‘shrugging off the ASX 4000 level’. The Casey report, which I’d encourage you to go read, has this inspiring (!) quote:

The summary outlook, according to Howe, is that we are in the very early stages of a 20-year period of economic and institutional upheaval – an era denominated by a crisis during which we’ll likely witness the tearing down and reconstruction of many aspects of society as we know it.

My personal indicator – in the last couple of days I’ve had 3 approaches from people – “you play with the stock market don’t you – should I buy something now… what should I buy”. Hmmmm…. people are thinking of parting with cash again, lets see how things go. And no – I don’t suggest anyone to buy anything – thats up to them 😉

Now, off to work…

today – pna close – book review

PNA: closed my long PNA position today for a 1% gain. I entered this position nicely on 28/4/09 bouncing from a support line. I then pyramided in at a high price, only to see the position deteriorate. My exit was triggered last friday on a close below a support line, however my exit position was not filled – my fault really as I tried to be clever and tune the exit, when I was not in a position to actually do that – leaving me to sit through the weekend with a half open position.

When a stop is hit – EXIT!

As I look at the US market starting today, the S&P500 is down more than 2% and can’t help but be reminded of the recent losses – and yet I know from my records there’s been some good gains over the last couple of months. This article is a reminder – Its ok to lose money! I know I lost money when I started when around me others were making it. Over the last year I’ve lost money – but not as much as some others have. Come July I review the annual stats – then I’ll have to go read that article again!

Following is the next installment in my reviews of trading books from my library.

“Getting Started in Chart Patterns“ by Thomas Bulkowski.

The title suggests ‘Getting started’… this book can be picked up by a beginner who has an interest in the art of reading charts. Don’t confuse this comment as one that suggests the book is for a beginner – many beginner books talk about how to place trades, differences between types of instruments and so on – this book assumes you know that.

The book specifically talks about chart trading of equities, however the concepts are obviously portable to other markets – with some care, due to his use of probabilities as they relate to his research against equity charts. Thomas’ books are valuable to me because he has done A LOT of work analysing charts and quantifying what he sees. When he talks about (for example) a Head and Shoulders pattern, he talks about the expected profit, as well as the percentage chance of getting that profit in bull and bear markets – great information! Further to that, he gives a point form list of ‘requirements’ that a chart pattern must exhibit to be classifed correctly in a particular manner.

The author remains focused throughout the text on his trading via the use of charts. A couple of times he may mention an MACD divergence or other indicator related metric – but then suggest the reader refer to other books to follow that idea through – the book remains firmly focussed on charts.

The book is written a bit conversationally in places, as the author uses simulated discussions between two traders as a tool to convey points regarding trades. Looking at the price, I must say its one of the less expensive books of its type. Whilst not to the detail of his other texts (which I’ll review at some later date) this is an excellent beginner to intermediate text.

The best thing I learnt from this text? I’ve got to say looking at ‘busted patterns’. Whilst I have been aware of them for some time, looks at the statistics – I’ll be looking for ‘busted head and shoulders’ more often!

friday – aqp – chc – fmg – pna

Friday was a busy day for me at work, and as I got home friday night, I found my portfolio had changed shape due to some of the trades I placed earlier.

AQP exit - UGLY!

I closed my position in AQP for a 20% loss – OUCH! And the graph is ugly. When I look at it now, after the pain of the loss has past, the price was clearly ranging. When the share went through my stop loss at ‘1’ I should have exited immediately – instead I held thinking it might recover… big mistake… Never second guess the plan when its in place, take the exit signal when it comes, and re-enter if conditions suit. Now to go write that out 5 times! Anyway, learn from it – and move on.

CHC entry

Entered a long CHC position today, and as entries go, I am happy so far. Pushed through what looks to me like the upper line of a flag on Thursday close, and rose all day friday – and look at the volume.

Having done this for a while, I came to my own personal view some time ago that I can pretty much buy anything – as long as I manage my exit well. I can get out with a small loss if I enter badly – but keep it to a small loss. That said, I’m always happy with an entry like the one in the picture… I’ll see how this plays out.

Entered a long FMG position. On close the days trade looks like a spinning top which is disheartening, but does not trigger an immediate exit. Will keep a close eye.

Exited a long PNA position, but I’ll write this up when I fully exit, as I didn’t fill the order.

System A: Ran my scan – which is designed to run on weekends – still comes up blank! It still doesn’t like this market.

Final thought for the week – this was an active week, more transacions than I usually like to make in a week, which is making the management of the positions more time consuming. And it appears that even the professionals struggled with making anything of this week – read what The Kirk report had to say – he’s expecting a bit more to work with next week.

Leave a comment

Leave a comment