Archive for the ‘roc’ Tag

today – close roc, iif

roc close

ROC: Closed Roc Oil position today for a 3% loss. Followed plan fairly well, but actually suspect the plan was not a good as it could have been. The share has bounced off the rising trendline a few times over the course of the year, and I should possibly have exited a couple of days earlier when the trendline was breached.

Anyway – all in all not a bad trade.

iif close

IIF: Closed my position in ING Industrial Fund today for an 11% gain (down on the 43% it was sitting at a few days ago!).

Anyway – stick to the plan – a profits a profit. I will continue to watch this share as the volume seems to confirm the price action particularly well on this share – and its my view that the volume confirmation isn’t as strong on Australian shares as I see on US shares.

today – pna – roc

pna entry

PNA: Made a pyramid entry into PNA today at $0.39.

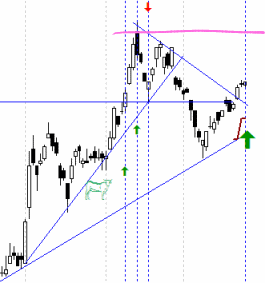

As you can see from the pic I have an open position from whilst the share was falling – this is because I previously closed my PNA position, but took up the offer to buy additional shares from teh company via a placement offer. As the placement offer was small, I held them figuring I would sell in time when I could increase the parcel size. Either way, nice break through short term descending trendline, but can expect resistance only a short way up.

roc entry

ROC: Entered again at 0.79 on an encouraging break of the short term downtrend. This is actually a setup I am seeing in a number of my stocks I am following at the moment, all based off the general market sentiment.

In my inbox today I have a few articles of interest – This one from Casey Research – “The 20 year Bear Market“, and other ones talking about ‘shrugging off the ASX 4000 level’. The Casey report, which I’d encourage you to go read, has this inspiring (!) quote:

The summary outlook, according to Howe, is that we are in the very early stages of a 20-year period of economic and institutional upheaval – an era denominated by a crisis during which we’ll likely witness the tearing down and reconstruction of many aspects of society as we know it.

My personal indicator – in the last couple of days I’ve had 3 approaches from people – “you play with the stock market don’t you – should I buy something now… what should I buy”. Hmmmm…. people are thinking of parting with cash again, lets see how things go. And no – I don’t suggest anyone to buy anything – thats up to them 😉

Now, off to work…

today – roc – mcc

Another down day, and my longs are getting picked off one by one.

roc

ROC signaled an exit on yesterdays close of day price, so closed long position that I pyramided into just the other day, for a 4% loss. (Actually not really true, loss is greater as I don’t take into account transaction costs for the purposes of the blog, and this had high costs due to the multiple entries). As I look at the graph (see to the right), it has fallen to the next support region…

mcc trade

MCC also signaled exit on yesterdays close, so exited on a tidy 23% gain. Again closed near support today. OK trade though this one. I am a bit disappointed in the entry, as I bought in ‘hoping’ to push through the resistance, rather than waiting for confirmation.

This could be short term weakness (likely to be?) but to trade well, cut the losses – go by the chart – and re-enter short or long when the next opportunity arises.

today – kzl – roc

well, as documented yesterday I had to make a decision about KZL. I exited part way through the day at a 19% loss, based on the great fall yesterday. 19% loss hurts when I’m working my current plan. Some of this may be recovered if I take up the offer for the share placement..whatever happens, this has brought out a flaw in my trading plan… my plan says exit when I fall through a stop loss, however my stop loss does not have a rule to move it based on a fall based on what amounts to a ‘return of capital’ which this share placement appears to reflect in essence. I’ll think about this some more over time, but don’t want to make a rash decision.. some study is in order.

The other action today was a pyramiding entry into ROC. ROC passed through resistance two days ago and is travelling on strong volume over the last month, and next resistance level is at ~$1.10.

Gold – I commented yesterday on a potential h&s formation on the hourly chart. Further analysis looks positive today, but then flicking to a daily chart, it is not obvious that there is a ‘defined’ right shoulder – as one would want for a positive trade.

Leave a comment

Leave a comment