Archive for the ‘sai’ Tag

last friday – close sai, waa, nwh, bru

The last week has been flat to down, and my portfolio has taken a bit of a bit. I was kicked out of a few trades friday, as listed below. There are others that should be closed, however I don’t usually close too many positions in one hit as I have noticed that it leaves me too underexposed

The last week has been flat to down, and my portfolio has taken a bit of a bit. I was kicked out of a few trades friday, as listed below. There are others that should be closed, however I don’t usually close too many positions in one hit as I have noticed that it leaves me too underexposed

WAA: I closed my position today in WAM Active at $1.07 for a 7% loss under SystemB. The share fell rapidly following my entry, however I didn’t release immediately as it’s a weekly trading system. The exit was triggered at the end of last week, but under the rules I can exit anytime this week – I waited until friday to see if the market would increase at all. Funnily enough, the share recovered friday so my loss was slightly lower than expected.

BRU: I closed a position today in Buru Enegy at $2.69 for a 14% loss under SystemB. This was my second entry, looking for a bounce at the point of entry. The position didn’t play out as expected, so I exited quickly. Given the loss, not quickly enough – but within plan nonetheless. I really did miss a good move in Buru, which seems to have occurred slap-bang between my two trades.

BRU: I closed a position today in Buru Enegy at $2.69 for a 14% loss under SystemB. This was my second entry, looking for a bounce at the point of entry. The position didn’t play out as expected, so I exited quickly. Given the loss, not quickly enough – but within plan nonetheless. I really did miss a good move in Buru, which seems to have occurred slap-bang between my two trades.

NWH: I closed my position today in NRW Holdings at $3.58 for a 13% loss under SystemB. I seem to have picked a top again by buying into it!

NWH: I closed my position today in NRW Holdings at $3.58 for a 13% loss under SystemB. I seem to have picked a top again by buying into it!

This entry has actually disappointed me – looking at the entry point, there is no clear breakout – I really just bought in on a high volume and dominant candle. This is what I am supposed to be avoiding in System B, so I actually have to call this a poor trade – even though I executed my exit strategy correctly.

SAI: I closed part of my position today in SAI Global at $4.68 for a 10% loss under SystemB .

SAI: I closed part of my position today in SAI Global at $4.68 for a 10% loss under SystemB .

I was definitely more happy with this entry than the previous one (NWH above) as it was a breach of a longer term resistance line. A nice clean entry, but it looks like rejection of the higher prices was fairly sudden and strong. I snuck a look at market depth late friday, and I noticed almost all sellers leave the market, leaving lots of buyers, and almost no sellers – I was expecting the price to suddenly jump, so I moved the remainder of my position to a higher sell price. Just prior to close a lot of sellers re-entered, keeping the price down on close. Will look to exit the balance of the position shortly.

All up – a week of losses, and general erosion of the portfolio.

today – opened … quite a few

Today I opened a number of positions – more than usual, but a few showed up in the scans.

WHCKOB: Opened a long position in Whitehaven Coal today on System B at $1.835. This is a warrant for a leveraged position – I trust this one will go a little better than my recent foray into a warrant in BPT. Whitehaven is a share I have owned on and off over time and it appears to have strength at the moment.

WHCKOB: Opened a long position in Whitehaven Coal today on System B at $1.835. This is a warrant for a leveraged position – I trust this one will go a little better than my recent foray into a warrant in BPT. Whitehaven is a share I have owned on and off over time and it appears to have strength at the moment.

(update – I replaced the diagram to the right for WHC at I had pasted in the incorrect image – it was a daily chart, rather than the weekly chart I use for System B – 18/4/12)

LMC: Opened a long position in Lemarne Corporation today on System B at $0.75. I only got a partial fill on my order, but will sit on my order and wait to get filled at the moment as the overnight market looks decidedly bearish.

LMC: Opened a long position in Lemarne Corporation today on System B at $0.75. I only got a partial fill on my order, but will sit on my order and wait to get filled at the moment as the overnight market looks decidedly bearish.

This also looks to be my riskiest position today, as it has climbed dramatically recently (the graph only shows the recent ‘flagpole’ however there was another shortly before this, on a weekly graph). Risky position, thinly traded = small position.

LSA: Opened a long position in Lachlan Star Corporation today on System B at $1.70.

LSA: Opened a long position in Lachlan Star Corporation today on System B at $1.70.

Lachlan looks like it may have formed a flag, implying that this position is halfway up the flagpole. Over time I have stopped trusting too much in chart patterns, however I haven’t totally discounted. I need to get out my Bullkowski book and check up no the probablilties and see how the various patterns track.

SPN: Opened a long position in SP Ausnet today on System B at $1.06. SPN has pushed out the top of resistance, and seems to be dipping back a bit again.

SPN: Opened a long position in SP Ausnet today on System B at $1.06. SPN has pushed out the top of resistance, and seems to be dipping back a bit again.

I’m looking for a continuation of the march forward from the top of the triangle.

AIA: Opened a long position in Auckland International Airport today on System B at $2.00.

AIA: Opened a long position in Auckland International Airport today on System B at $2.00.

Auckland Airport is having a steady increase so will look for this to maintain the forward momentum.

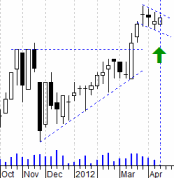

SAI: Opened a long position in SAI Global today on System B at $5.19.

SAI: Opened a long position in SAI Global today on System B at $5.19.

SAI Global can be a less than exciting share however it is now making new highs. This is usually an exciting thing for my Plan B as I am looking for continuing increases from here.

All that said – I realise this is one of my more bland updates. Too many positions and too late at night to worry about getting too flowery! Its really a case of seeing if some of them rise and return a couple of dollars to the kitty.

Night!

Leave a comment

Leave a comment