Archive for the ‘tol’ Tag

today – close tol short

TOL: Closed my short position with Toll Holdings today at $8.41 giving a 5% loss.

As this was a short trade, it was done with CFDs. For me this means a tight stop which triggers off intraday trading, rather than the end of day. Ultimately it works out as a close anyway as the day close was above the stop loss.

As we approach Christmas and the holiday period I am slowly working my positions out of the market, so I wont have much exposure when I come to take a bit of a holiday.

today – tol short

TOL: Opened a short position in Toll Holdings today at 8.00. I wrote this up a tad in yesterdays post, entry based largely on the black candle formed on friday – an effect it appears of the Dubai situation.

The Dubai situation seems to have been a flash in the pan, however it does look to me like it shows the quickness to react of the markets to shock – a bit of a shock and the market drops 3%. The 3% was basically recovered today – however I haven’t looked in detail at the stocks – I can’t say whether the 3% was put back on the same stocks that lost it – and that in itself will be worth knowing.

Either way, a small position to test the market for shorts. The recent price action could almost be said to be a head n shoulders, although not as nice as you would see in a text book. Lets see how this plays out.

today – mcc – other notes

MCC: Closed my position in Macarthur Coal today at 9.33 for a 9% loss.

Closed as the share made a lower high, and definite weakness has shown since the long term high was made when I entered the position. Looking at my entry when I opened the trade, I did note that momentum appeared to be dropping over the last few months – which seems to have held true this last week.

In general the market is struggling over the last few sessions as seems to be getting a lot of write ups around the traps. Time for me to look harder at my recent trades and trying to find some improvements.

When looking for improvement, there are heaps of resources to read, study and analyse – both in my library, the internet, the bookshop and of course examination of the charts I pay data subscribers to maintain. Reviewing past trades is a great place to start. Looking at the blog by the Trading Goddess there is a posting with ‘10,000 hours’, which describes the skills the greatest traders have – read it here. 10,000 hours is a term describing the number of hours it takes a person to learn a skill. This is a concept used by Mr Bighit at 5000 trades.

Review an earlier trade

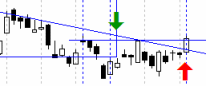

TOL: recently exited, and I mentioned that I would review the trade with a view towards re-entry.

So I was looking at this recently in terms of breaking through the resistance at the tree recent tops. A few more days of data and the graph looks more like we’ve had a head and shoulders, at the top of the recent rise – and the last days trade is a break of the neck-line. Head and Shoulders or not – we have a lower low, lower high – so downtrend emerging. A look at the momentum shows that dropping also.

All in all – I closed the last entry stating that I still believed my original analysis that I entered on and was looking to go long again. Looks like the bears have this one, and shorts are the way to go.

The ASX 200

The graph above is the ASX 200 as of friday. This does look like a change may be developing. I have followed these rising curves for a while now, however looking at the last day or so – we might have fallen out of the third rising curve… which whilst not meaning much, is a tap on the shoulder for me… lower lows, lower highs, change in character.

I note I have hit another stop over the weekend, and I am very close to a few others. With the US market being down 2% on friday, I suspect I’m about to get hammered. Shorts may be the way to go.

Know yourself

I have now done a search over my recent trades. You can tell I have been a bit lazy (in effect anyway, busy on non trading activities) as I have been trading what I can best describe as a small share universe. I am in and out of the same shares fairly constantly lately.

Possibly because of the ‘easy market’ we’ve been tracking since March or so…? Ease seems to have bred complacency in me. I’m not scanning the whole market – I’m going with what I know. Looking through a lot of charts today, I am trading sections of the market, and the upward trends and volatility are happening elsewhere.

So – know thyself – recognise the laziness coming into the trades, and plan to fix it. I can’t speak for the future – I may keep going as I am going until I get a chance to sit down and change direction, or I might just wind back the market commitment until I can get time to review the whole market and picking an area (and a direction) to chase.

Wrapping up

In summary – a rambly sort of post, covering a few areas. The rambly nature itself probably indicates my distracted nature at the moment. Sooo many distractions, Christmas shopping, major project on the go at my real job, getting used to new charting software.

Anyway – if anything here is of interest please post a comment below, or feel free to subscribe!

today – close tol, open aqp

AQP: Opened a position in Aquarius Platinum today at $6.64.

Entered the position is the share has made a new high, and if previous history is anything to go by (and when trading on a technical basis there is nothing else to work with!) this share will be volatile, and can move significant distances rapidly. In this case I have gone with a stop loss that is spaced a bit further than usual, as I don’t want to get ‘bounced out’. Lets see how this one goes.

TOL: Closed my position in Toll Holdings today at 0.22, for a 10% loss – this was in the warrant tolwmb.

As you can see, the share has bounced off resistance 3 times now, so its hard to say how this share will continue. For my analysis on entry see my writeup here. I still have confidence in my original analysis, so I will look into how to continue this trade – subject to conditions of course. Every trade has to be a discrete event. I will look at my options around entry based on warrants / options or CFDs – however I wont say much now as I don’t have the time to research this next entry as yet… tomorrow maybe…?

The exit was taken today as the warrant was due to expire in 2 days, and I really don’t want to get caught looking to exercise a warrant. A 10% loss on a warrant is not bad at all, given the leverage I was playing with.

Remember – stick to your stops!

today – open tol, iif

iif open

IIF: Opened a position again today in the ING Industrial Fund at $0.52. The share still seems to be climbing nicely, so re-entering to see if I can grab a few more $$ from its rising.

Looking at the picture to the right there appears to be bullish rejection over the last 3 days or so, hopefully forming support just below my entry -so a tight stop is in order for this trade.

tol open

TOL: Opened a position indirectly in Toll holdings today – indirectly taken out by using a warrant in Toll – tolwmb at 0.245. A warrant was taken because I want to leverage the position, and the warrants aren’t heavily enough traded for my liking.

Looking at the daily graph to the right, Toll has a reasonable short term uptrend in place.

Things actually get interesting for me though when I look at the weekly chart below.

Toll weekly

I’m looking at this as a fairly nicely formed inverse head and shoulders pattern, which sounds to me like a fairly solid bottoming formation. The share fell into the left side of the H&S during the GFC, so I’m looking to ride this up.

My biggest risk in this trade? That the warrant will expire before the real movement happens. I have paid a fair bit for time decay in the warrant, so the share does have to increase significantly by November for my strategy to be sound. For the purposes of risk determination, when entering warrants I consider the whole investment as R for my risk / reward calculations.

Anyway, off to bed, with happy dreams about $AUD/USD longs and Gold longs!

Comments (2)

Comments (2)