Archive for the ‘waa’ Tag

last friday – close sai, waa, nwh, bru

The last week has been flat to down, and my portfolio has taken a bit of a bit. I was kicked out of a few trades friday, as listed below. There are others that should be closed, however I don’t usually close too many positions in one hit as I have noticed that it leaves me too underexposed

The last week has been flat to down, and my portfolio has taken a bit of a bit. I was kicked out of a few trades friday, as listed below. There are others that should be closed, however I don’t usually close too many positions in one hit as I have noticed that it leaves me too underexposed

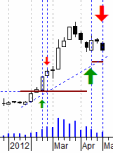

WAA: I closed my position today in WAM Active at $1.07 for a 7% loss under SystemB. The share fell rapidly following my entry, however I didn’t release immediately as it’s a weekly trading system. The exit was triggered at the end of last week, but under the rules I can exit anytime this week – I waited until friday to see if the market would increase at all. Funnily enough, the share recovered friday so my loss was slightly lower than expected.

BRU: I closed a position today in Buru Enegy at $2.69 for a 14% loss under SystemB. This was my second entry, looking for a bounce at the point of entry. The position didn’t play out as expected, so I exited quickly. Given the loss, not quickly enough – but within plan nonetheless. I really did miss a good move in Buru, which seems to have occurred slap-bang between my two trades.

BRU: I closed a position today in Buru Enegy at $2.69 for a 14% loss under SystemB. This was my second entry, looking for a bounce at the point of entry. The position didn’t play out as expected, so I exited quickly. Given the loss, not quickly enough – but within plan nonetheless. I really did miss a good move in Buru, which seems to have occurred slap-bang between my two trades.

NWH: I closed my position today in NRW Holdings at $3.58 for a 13% loss under SystemB. I seem to have picked a top again by buying into it!

NWH: I closed my position today in NRW Holdings at $3.58 for a 13% loss under SystemB. I seem to have picked a top again by buying into it!

This entry has actually disappointed me – looking at the entry point, there is no clear breakout – I really just bought in on a high volume and dominant candle. This is what I am supposed to be avoiding in System B, so I actually have to call this a poor trade – even though I executed my exit strategy correctly.

SAI: I closed part of my position today in SAI Global at $4.68 for a 10% loss under SystemB .

SAI: I closed part of my position today in SAI Global at $4.68 for a 10% loss under SystemB .

I was definitely more happy with this entry than the previous one (NWH above) as it was a breach of a longer term resistance line. A nice clean entry, but it looks like rejection of the higher prices was fairly sudden and strong. I snuck a look at market depth late friday, and I noticed almost all sellers leave the market, leaving lots of buyers, and almost no sellers – I was expecting the price to suddenly jump, so I moved the remainder of my position to a higher sell price. Just prior to close a lot of sellers re-entered, keeping the price down on close. Will look to exit the balance of the position shortly.

All up – a week of losses, and general erosion of the portfolio.

today – open waa, snl

Market took a dip today – must have been the first day after a public holiday – oh yeah, it was. I should analyse that and see if there is a seasonal trade in there somewhere to be profited from in the future. Anyway, on with daily summary.

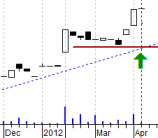

WAA: Opened a long position in WAM Active Limited today on System B at $1.145. Similar to my entry into PRG recently, a previous entry in this share was stopped out, but the recent climb has taken it to a 2 year high.

WAA: Opened a long position in WAM Active Limited today on System B at $1.145. Similar to my entry into PRG recently, a previous entry in this share was stopped out, but the recent climb has taken it to a 2 year high.

Volume for the last two weeks has been healthy, which is a positive, although not a decision maker. I have noticed that this share is a slow mover, and not a lot of gain, however making new highs should not be underestimated.

SNL: I also opened a long position in Supply Network today on System B at $1.02. This share has been on an almost straight upwards trend for a while (about a year on a weekly chart) and has reached the emotional barrier of $1.

SNL: I also opened a long position in Supply Network today on System B at $1.02. This share has been on an almost straight upwards trend for a while (about a year on a weekly chart) and has reached the emotional barrier of $1.

I have been reluctant to enter this position recently as it can be thinly traded. I noticed today that I was one of the few buyers, and at one stage it appeared to be down to one seller (should I be thinking on the greater fool theory here…?).

Last week was a rare week for me. I travelled to Taiwan for a week, and basically lost touch with the market. I managed a few checks of stop losses, but not much. Why was this rare? Two reasons – I’ve never been to Taiwan before, and its the first time I have travelled without coming back to a decimated share portfolio! Woop Woop I say. I somehow managed to travel for the global tech crash, and on a mobile phone call found I had lost a bundle – that was due to, well, poor sector diversification. In other words – if it was a tech stock I had it, if it wasn’t I didn’t.

So a week of travel and no crash – a double bonus that seems to me. Now I am back, remember to recite: Stick to the Plan. Plan the trade and trade the plan.

Leave a comment

Leave a comment