Archive for the ‘wan’ Tag

today – close aqp, wan

AQP: Closed my position in Aquarius Platinum today at 6.10 for an 8% loss.

Well, I certainly seem to be picking some stinkers at the moment! I just reviewed the entry I made in this blog for the opening – and it sure looked strong. I think I successfully picked the top 😉 Anyway missed the first day after I triggered the stop loss as I was busy on other things (working on a big project at the real job) so didn’t get to review all my positions the other night. This was missed, so the sooner I sit down with Amibroker and set up my favorite indicators the better – and not usign many indicators that should be fairly easy.

WAN: Closed my position in West Australian News today at 7.65 for a 2% loss.

You can see where the share bounced off my ATR based stop loss a couple of weeks ago, and looked like it might travel up the longer term trendline. It didn’t and both stops effectively went off about the same time – the break of the rising trend, and the fll through the stop loss. Anyway closed now, and I’m slowly winding back as we go into the Christmas break.

today – buy okn, wan

Oakton re-entry

OKN: Opened a position in Oakton today at 3.40.

I exited the last Oakton trade when I hit a double top, which has now been clearly penetrated (smashed?) giving a strong run up to a the high for the year so far.

The share appears to be in an uptrend (higher highs, lower lows), so I have bought in where the share seems to be finding support.

Reasons against taking the trade? The high point in the chart is a nice example of a shooting star, a typical reversal signal. The top of that shooting star is clos-ish to the most recent significant highest high in August 2008. This may cap my upside, but if that is penetrated, then this is a good trade. Lets see where this goes.

Downside is limited due to closeness to next support line, and upwards trend line.

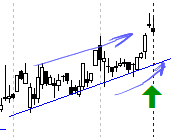

wan - another re-entry

WAN: Opened a position in West Australian News today at 7.80. Volume has been good the last two days, and days have been closing at or near daily tops for a while now – in spite of the large number of down days recently in the general market.

Looking for a bounce on the current upwards trendline – and hopefully not too much resistance at the recent high. Looking at todays chart looks like it may be a distinct possibility.

As I sign off for the night, the US markets are opening well, so if this pushes through resistance tomorrow this may be one to watch.

Even though it is new media.. so as a keeper this doesn’t make sense to me!

today – close AMP, REH, WAN, AQA

Thats a lot of closures.

So, like everyone, I have interests outside that which I primarily write about here. Without wanting to digress too much, I have been out sparring tonight. I copped a slight knock to the jaw, and saw the followup hook coming in for the 1-2. Despite the knock, I kept the guard up and avoided the big punch. That’s what we train – keep your guard up, and try to read the opponent – sometimes you will get it right, and sometimes you will get hit. When you get hit – keep the guard up, feel for the next one!!

I’ve taken a few shots this month, as the portfolio update next weekend will attest. So – back to training – keep the guards up, take a shot when you can and accept you can’t catch everything. But never get hit so hard you can’t continue. After a few losses in a row, all bar one below 10%, I feel like its the end of a round. Splash water in the face, take a breather on the weekend and get back in there.

On with the show…

amp - taking a dive

AMP: Closed my position in AMP at $5.96 for an 8% loss. Now looking at the entry when I opened this trade, it was such a good looking trigger. The setup was linked to financials doing well, and then a nice breakout. I held on through the retracement.. and passed on my trendline stop loss waiting for … what? The support I expected did not exist. Stop triggered last night, and exit taken in early trade today. Now I have a more bearish outlook than a few weeks ago, taking the earlier exit looks like a no-brainer. hmmmm 20-20 hindsight. Of note is a flattening of the longer term MA (in orange). Lets step back from this a bit. Not a bad trade, but could have been better.

reh - small gain

REH: Exited this today at $24 for a 4% gain. This trade was always on a bit of a knife edge. I found to be a bit illiquid for my liking… and I knew that sentiment was not strong once I had a position. A couple of times in the last two weeks I have been the only seller of Reece – and no one has wanted to take my shares off my hands. Now things are grim, I thought I should close this out rather than get caught out – so I did, and it looks from the chart that others followed me out the door.

I really should remember to keep an eye on liquidity – this has happened to me twice this year now (note to self).

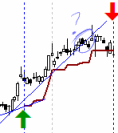

WAN - reading the papers

WAN: Closed my position in West Australian News today at $7.57 for an 8% gain. Now this is a better trade – I’m happier with this.

I was confident in my entry, as it was ‘text book’, departure from a steady uptrend to the high side, with good liquidity.

My ATR based stop loss tracked nicely and has kept me in a nice profit. Whilst I could have exited on the departure from the steeper trendline, this would translate to a futile attempt at top picking – not a winning approach as I have learnt over the years. In this case I definitely stuck to the plan, and no second guessing.

Aquila Resources

AQA: And finally AQA. I closed my position at $7.09 for a monster 14% loss just prior to close of trade today. This is a 2R loss. Even with a small position that I entered with, the loss was too big.

Look at those black candles – great at a birthday party – but not great for my bank balance! It is actually this trade that has told me I need to review everything on the weekend, and hunt some good shorts – I’m sure they’re out there. Looking through whats left of my positions, I may be taking more positions out tomorrow – but we shall see what the overnight US markets whisper to me.

And finally, a comment on a position I haven’t closed. And I still need to work out if it oughtta be. This is what a capital raising can do to my capital in the short term. But I love noticing things. Like the fall to the height of a recent peak, coinciding with the same price point as the capital raising… hmmm…

bugger - a capital raising

In closing – although I mentioned a contact sport above, I do not think of the market as an aggressor opponent – I think of it as a sparring partner. It does what it does, I do what I do, and through it all I get fitter.

So keep your guards up!

friday – wan open

wan open

WAN: Opened a position in West Australian News at 7.00 on friday.

This increases my exposure to media, a sector I expect to see some movement in over the next few months. Don’t know whether it’ll be bullish or bearish, and I have long since decided that I am often wrong in picking a market direction based on my views of the economics of a market. What I know is that I am long WAN and FXJ, and with the news about the breaking up of Telstra in the papers last week there is bound to be some volatility and leveling taking place.

As I run only on charts this is all just by the by. Lets see how this one plays out.

As an aside – System A still not returning candidates – I might have to review that system… or maybe it is telling me something!

Leave a comment

Leave a comment