Archive for July, 2009|Monthly archive page

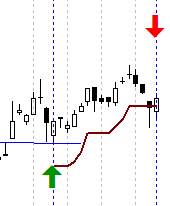

trade idea bhp-10

The big Australian has a small dip.

bhp - a small dip

In the last post I saw a decision point on the short term horizon – a view that proved correct.

Looking at the graph today, 2 positions need to be commented on.

The long trade (the paper trade) is still open, however the profit is being eroded as it dips towards the stop loss line.

The short trade (which is actually in play, not just on paper) is currently profitable. It is fairly highly leveraged due to the use of the warrant which is very close to the money, but that just means I go for a very small position to fit with my portfolio allocation model. I think this only has a little way to go, and will maintain a tight stop and set a profit target.

Cheerio,

today – close MML, open MRE

mml close

MML: Closed this morning for a 7% profit. Followed my stop loss, exited nicely today on market open order set last night. Planned the trade – traded the plan. I was fortunate for the last price increase yesterday!

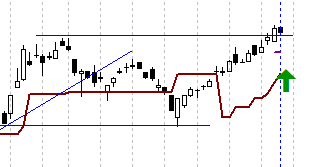

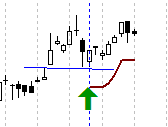

mre open

MRE: Opened today at $1.03 at market open. I chose the share based on a recent strong uptrend that was in place, to be replaced by this trading range that has been in place for the last couple of months. Yesterday the price came out the top of the range triggering an entry for me.

Both orders were placed out of market hours.

today – close ewc, open ifm

ewc close

EWC: Closed today in two peices as the price fell after the first sale – my tweet said a lightening in position, but soon after I closed the full position – for a gain of 3%. Note the similarity of the last few days to the graph in yesterdays post for the closing of the CHC position. Anyway, did not quite break the stop loss, but considering the acceleration of some parts of the market, combined with the ‘lower low’, I thought it prudent to cut the trade.

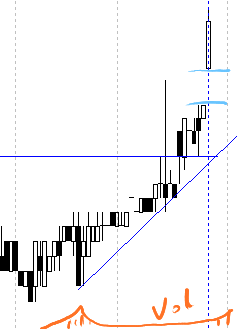

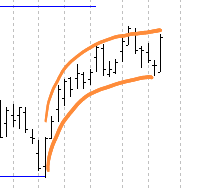

ifm monthly

IFM: Opened a position in Infomedia today at 0.37 – just look at the monthly graph to the right. From the monthly graph the telling signs that have caught my interest are the low and declining volume over the last 6 months, combined with a volume spike just prior to the share price pushing aggressively through the down trend. Below is the daily graph.

The share was located on a heat map by my broker with high volume today. I have sketched in the volume on the bottom of the graph.

ifm (Infomedia) today

Reasons for entry:

- volume spike about a month ago to start uptrend

- volume spike today

- gap up

- impressive break of monthly downtrend

The factors I can see against this entry are:

- I’d expect a retracement after this level of run-up

- Possible H&S bottom over the last months indicating that I have entered just short of the standard price projection expectation of a H&S bottom formation.

Anyway, lets see how we go.

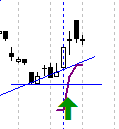

trade idea bhp-9

bhp - decisions...

More on BHP – the big Australian.

This has been a paper trade going on for a while now, and the long position is profitable.

I am however cautious about this current long market… we are now over 10 days increasing on the trot – and that doesn’t happen too often.

Does this break the rules of a paper trade? I am long the trade (in this paper trade scenario), and have a mid / long term bullish view of BHP. I do however think that the bulls have good a good trot – and at the same time as BHP is hitting a point I’d expect to see resistance. So – today I entered a short leveraged position in BHP expecting a short term dip. Not on paper – a warrant trade on BHPXOQ – I must say a risky position, and highly leveraged – so only small. Lets see how this plays out.

Too confusing now – two positions in one thread…?

today – chc

chc close

CHC: closed the position today, for a small 4% loss – not exactly according to the plan either.

I have noticed the general ‘positivity’ of the markets over the last few days, and in my chart scan tonight I noticed 2 things:

- A number of my shares are under performing the market in the last 5 sessions

- A number of them have the same pattern for the last few days – that which can be seen in this CHC graph.

If the market is taking off , and this is only known with hindsight, I appear to be backing a few shares that haven’t taken this last weeks spurt. Trimming CHC is a move to limit my exposure to the particular graph formation you can see above – even though it hasn’t actually hit the stop loss.

So, I came to a couple of conclusions over the weekend – if the markets are taking off, I need to focus more on which shares I trade (ie: limit the number of open positions) and target the moving parts of the market. Over the last few months, and obviously the two months I have been documenting some of my moves, I have been discretionary trading – going off ‘hot spots’ in the market from a heat map, combined with general chart formations. I must say its been treating me well – the last few months have nearly got me back my losses for the last financial year (no – not since the start of the dive yet!).

When System A (my own coded system in c++ so I don’t need to think) is running, it manages my number of positions to an extent, so issues like that above don’t happen too often when the bulls are running.

On another note – System A scan on the weekend – still nothing!

trade idea bhp-8

my on going paper trade of BHP – making me wish I backed this one… but anyway, on with the next installment.

bhp last friday, daily

Looking at the chart to the right, BHP has come up strongly from the bounce off support which showed my short position failed. Since then, the share has made strong movements to the upside, in line with the ASX all ordinaries.

The price is now just shy of possible resistance from the recent minor high seen to the left of the graph. Should that resistance prove weak we can expect BHP to push strongly upwards. Too close to the point now to enter – wait for confirmation of a penetration to the upside.

Should resistance be found, it would be wise to sit out and see the strength of the move to the downside.

today – pna – roc

pna entry

PNA: Made a pyramid entry into PNA today at $0.39.

As you can see from the pic I have an open position from whilst the share was falling – this is because I previously closed my PNA position, but took up the offer to buy additional shares from teh company via a placement offer. As the placement offer was small, I held them figuring I would sell in time when I could increase the parcel size. Either way, nice break through short term descending trendline, but can expect resistance only a short way up.

roc entry

ROC: Entered again at 0.79 on an encouraging break of the short term downtrend. This is actually a setup I am seeing in a number of my stocks I am following at the moment, all based off the general market sentiment.

In my inbox today I have a few articles of interest – This one from Casey Research – “The 20 year Bear Market“, and other ones talking about ‘shrugging off the ASX 4000 level’. The Casey report, which I’d encourage you to go read, has this inspiring (!) quote:

The summary outlook, according to Howe, is that we are in the very early stages of a 20-year period of economic and institutional upheaval – an era denominated by a crisis during which we’ll likely witness the tearing down and reconstruction of many aspects of society as we know it.

My personal indicator – in the last couple of days I’ve had 3 approaches from people – “you play with the stock market don’t you – should I buy something now… what should I buy”. Hmmmm…. people are thinking of parting with cash again, lets see how things go. And no – I don’t suggest anyone to buy anything – thats up to them 😉

Now, off to work…

trade idea bhp-7

Ahhhh – no trades today, so continue the BHP paper trade.

bhp today

Looking at the chart the share is continuing to rise. The bottom of the black candle is still above yesterdays close. Hang in there.

As for the rest of the portfolio, all looking ok today, a few of the stops have moved up.

Volatility

I have commented a couple of times lately that I have found that my trading increases in times of increased volatility, and as things start to trend I lower the number of trades. This is not a concious decision, rather it is a result of my trading style. Adam Warner at the “Daily Options Report” has posted a comment in the last week or so about volatility. He’s basically saying that volatility is dropping off – and numbers don’t lie – go have a read.

… regardless of the reason, numbers don’t lie, and we still have the unresolved issue of options volatility overpriced vs. stock volatility.

Basically what I get from his comment is that options are overpriced… I might have to take this into account, because options are a great way to trade BHP.

today – cpb – updates on open positions

Campbell Brothers opening

CPB: I set a trigger to enter Campbell Brothers over the weekend, on entry into the rectangle you can see in the attached diagram.

Campbell Brothers has been in an uptrend over the medium term, however ranging over the shorter term. The item of interest that peaked my interest in this share was the bounce off the upwards trend line, which I am looking for a continuation of.

So, I have a couple of trades that have been open for a few days, hopefully indicative of some trends setting in – not that I’ll know till I can look back and know. The writeups below are brief updates on a few of my open positions. you can find the entry conditions by looking of the relevant tags on the menu.

ARU: Only opened recently, strong increase on open – definite rejection of a higher high, but no stops hit.

aru

CHC: Charter Hall group, again only recently entered, and signs of stalling as the overhead resistance is approached. Keep a close eye.

chc

MCC: Continued to rise nicely since opening. Today looks like a push into, and maybe through upper resistance. Keep the trailing stop loss, keep watching.

mcc

MML: Medusa Mining also rose nicely. Another one to hit upper resistance, lets see if we press through. Hold position.

mml

OKN: Pyramided in to this trade based on the sudden increase in price, and the share promptly declined soon after. As it stayed above the increasing trend line I stayed in. In some cases I would have exited on the fall through the ATR based stop loss (brown line), however based on the strong uptrend I held in using the trendline as the ultimate stop due to the sudden spike which I missed capitalising on as I was working on end of day prices.

okn

For anyone interested – one more week to get into the ASX sharemarket game. I’m considering myself, but I don’t know if I can afford any more time, given I post this blog, consider my trades and hold down a job!

For tonights reading I trawled through some content from Tradergav – another Aus trader with a blog. I read his discussion on a tweets conversation that he has here which is around the risk / reward metrics. Since doing discretionary trading I have not been tracking my statistics as carefully as I was up to a year ago, as I normally tracked these for my System A (which had no triggers this week – again!) and other mechanical systems I have toyed with. Maybe thats my next project, as I have done enough in the last year to give some sort of finding. I had one -3R trade from memory last year and that hurt. If I go past -2R I pause trading and ‘have a good hard look at myself’ to determine why I ended up there. I must say I haven’t beaten 8R in over a year though, and you do (well I do) like to get one every so often, both for financial reasons, as well as to help with the psychology of this.

Signing off,

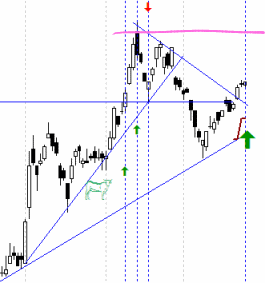

trade idea bhp-6

So, the continuing paper trade of BHP – switched from short to long last week, and to summarise now – sitting on the sidelines in this case may have been a better idea. That said – lets see what action to take next. Note of course that in this business to take ‘no action’ is itself, ‘an action’.

All ords - weekly scale

Start off with a whole market view. The ASX all ordinaries shows a very strong week that has just been, pushing to the topside of the bounded range (in orange). This has definitely helped my overall portfolio, as last week seemed to go well. Looking at my activity last week I opened 3 trades (2 on this blog) and only closed the paper BHP trade. Given my trading style this generally means the week wasn’t too volatile and maintained a direction. My trading frequency increases as stop are hit and volatility increases…

bhp - last friday - daily chart

Anyway – back to BHP. The friday switch of polarity from short to long was based on the penetration of short term resistance, combined with the re-entry into the wedge (indicated more clearly in my previous post). BHP has had a good week in line with the Australian All Ordinaries.

Friday was a bit flat – small white candle – which if I look at in a negative mental frame looks like a spinning top and may indicate a short term high. Given the look of the other recent candles, it seems that small body candles seem fairly normal.

Summary – hold position. End of day stop loss at $33.64

Leave a comment

Leave a comment