trade idea bhp-6

So, the continuing paper trade of BHP – switched from short to long last week, and to summarise now – sitting on the sidelines in this case may have been a better idea. That said – lets see what action to take next. Note of course that in this business to take ‘no action’ is itself, ‘an action’.

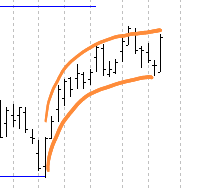

All ords - weekly scale

Start off with a whole market view. The ASX all ordinaries shows a very strong week that has just been, pushing to the topside of the bounded range (in orange). This has definitely helped my overall portfolio, as last week seemed to go well. Looking at my activity last week I opened 3 trades (2 on this blog) and only closed the paper BHP trade. Given my trading style this generally means the week wasn’t too volatile and maintained a direction. My trading frequency increases as stop are hit and volatility increases…

bhp - last friday - daily chart

Anyway – back to BHP. The friday switch of polarity from short to long was based on the penetration of short term resistance, combined with the re-entry into the wedge (indicated more clearly in my previous post). BHP has had a good week in line with the Australian All Ordinaries.

Friday was a bit flat – small white candle – which if I look at in a negative mental frame looks like a spinning top and may indicate a short term high. Given the look of the other recent candles, it seems that small body candles seem fairly normal.

Summary – hold position. End of day stop loss at $33.64

Leave a comment