today – cpb – updates on open positions

Campbell Brothers opening

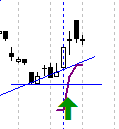

CPB: I set a trigger to enter Campbell Brothers over the weekend, on entry into the rectangle you can see in the attached diagram.

Campbell Brothers has been in an uptrend over the medium term, however ranging over the shorter term. The item of interest that peaked my interest in this share was the bounce off the upwards trend line, which I am looking for a continuation of.

So, I have a couple of trades that have been open for a few days, hopefully indicative of some trends setting in – not that I’ll know till I can look back and know. The writeups below are brief updates on a few of my open positions. you can find the entry conditions by looking of the relevant tags on the menu.

ARU: Only opened recently, strong increase on open – definite rejection of a higher high, but no stops hit.

aru

CHC: Charter Hall group, again only recently entered, and signs of stalling as the overhead resistance is approached. Keep a close eye.

chc

MCC: Continued to rise nicely since opening. Today looks like a push into, and maybe through upper resistance. Keep the trailing stop loss, keep watching.

mcc

MML: Medusa Mining also rose nicely. Another one to hit upper resistance, lets see if we press through. Hold position.

mml

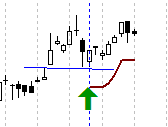

OKN: Pyramided in to this trade based on the sudden increase in price, and the share promptly declined soon after. As it stayed above the increasing trend line I stayed in. In some cases I would have exited on the fall through the ATR based stop loss (brown line), however based on the strong uptrend I held in using the trendline as the ultimate stop due to the sudden spike which I missed capitalising on as I was working on end of day prices.

okn

For anyone interested – one more week to get into the ASX sharemarket game. I’m considering myself, but I don’t know if I can afford any more time, given I post this blog, consider my trades and hold down a job!

For tonights reading I trawled through some content from Tradergav – another Aus trader with a blog. I read his discussion on a tweets conversation that he has here which is around the risk / reward metrics. Since doing discretionary trading I have not been tracking my statistics as carefully as I was up to a year ago, as I normally tracked these for my System A (which had no triggers this week – again!) and other mechanical systems I have toyed with. Maybe thats my next project, as I have done enough in the last year to give some sort of finding. I had one -3R trade from memory last year and that hurt. If I go past -2R I pause trading and ‘have a good hard look at myself’ to determine why I ended up there. I must say I haven’t beaten 8R in over a year though, and you do (well I do) like to get one every so often, both for financial reasons, as well as to help with the psychology of this.

Signing off,

Leave a comment