Archive for July, 2009|Monthly archive page

trade idea bhp-5

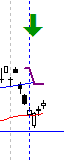

Continuing on following of the BHP paper trade. Refer to the graph below.

bhp - time to go long?

So the ASX all ordinaries is looking strong the last couple of days.

Looking at the pattern to the right its one of two things. Either

- A busted fail fall from the bottom of an upwards broadening wedge – resulting in an upwards break; or

- just a squiggle

Support was found on the lower flat line, which reisted the fall from the break of the wedge. I am now entering this to the long side, picking a paper entry of $34.90.

Lets see how we go now.

today – cey – chc

Another big day for the ASX all ordinaries.

cey - todays entry

CEY: Trigger on ASX fired on opening and placed me straight into the market. This was on my list based on the consistently strong volume over the last few months, combined with the size of the gap to the next resistance level.

CHC: good white candle today, so I’m in this one again. Better luck this time maybe? Well – just follow the plan.

General comment for the evening: I am interested in twitter, I use it – I post my trades via tweets so that I can justify to myself that I am sticking to my plan and to others that I’m not making this up. I am interested in some of the add on services to twitter (stocktwits anyone?) , but am concerned at the concept at sharing my passwords with anyone – now go read this article about the hacking of twitter. Having been a computer security consultant for a significant part of my career this concerns me. Anyway, what can you do? C’mon twitter, use some better practices. Individual users making errors is one thing – but companies?

Off for a sleep,

today – aru – strong day

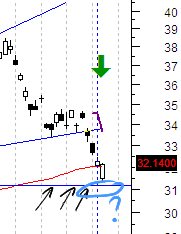

aru entry

ARU: I opened a position in Arafura today as tweeted earlier. From the diagram you can see I entered based on a bounce on the upwards trendline at the Green arrow. I picked the entry during last nights chart viewing, and its a share I traded recently after finding on my brokers live heat map. The volume has been high – especially around the time of the last trade.

Reasons for entry:

- bounce on trendline

- appeared to start recovery a day or so earlier than other comparable shares

- active sector

- high increase today

Reasons counting against entry:

- I have entered just shy of an earlier area of resistance, so may have limited potential

- Not very high volume today

- I’m unconvinced about market direction (however today was a good day!)

Lets see how this one plays out.

Onto other matters. Generally when trading, I have come to accept that I am not that good at correctly reading the interpretation of macro changes in supply and demand – I figure those much smarter than me do that, and many others really just have an opinion 😉 If its a fact, its not debatable – anything else is an opinion! Taking that into consideration I came away feeling educated after reading this article from MyStockVoice on the building of a massive oil pipeline across Europe.

Turkey and four EU member states have signed a historic deal in Ankara allowing work to start on the Nabucco natural gas pipeline, which is aimed at allowing the European Union to tap directly into non-European gas reserves.

Its when I read things like this that I become aware of my limitations regarding picturing the long term outcomes of such activity – yup I realise some observations are clear, but, again – just my opinion.

So why mention this? Really, thats why I revert to technical analysis of shares and other financial vehicles, because it simplifies my thinking process so I can make decisions, and move on those decisions.

Till next time…

trade idea bhp-4, other comments

Continuing the BHP paper trade.

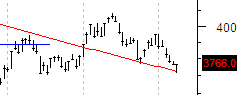

all ords daily today

The ASX all ordinaries today took a spike up, stopping just shy of a longer term resistance line – but given the narrow daily performance of late this is quite a move.

Checking my charts today, I saw bounce backs on a few of the shares I exited recently – not enough to re-enter them at the moment. I noted a couple of setups, but I want to see some short term new highs before entering to the long side. See how things go tomorrow.

bhp 14-7-09

So – back to the paper trade. See the BHP graph.

BHP clearly was sympathetic to the greater market move, and recovered its recent dip. A close on the stop loss indicates a close to the paper trade.

This results in a paper trading loss of ~5% (this trade was to the short side).

Going off on a tangent, my blog entry that grabbed my attention today was by howard lindzon, who is talking about ‘Being too small to fail‘ – fun short entry. Funny – the bit that really caught my attention was actually the following:

“…I am doomed to have most of my money working, ALL the time.”

My cash is working all the time, as I haven’t been under 60% invested for a few years – and if you include the margin loan, I’m more than 100% invested. This forces a behaviour I need to constantly remind myself of “Trade the plan”.

trade idea bhp-3

bhp next day

Continuing the BHP paper trade.

The previous day was a doji, and the next day (friday) shows a bullish day, however the candle itself shows a day of no real market comittment again – not quite a true doji.

Looking back a couple of days the pattern is similar to a morning star, a common bottoming formation. It isn’t technically a morning star due to the large price range on the day. The price movement does appear to look like a short term bottom however.

Keep open, watch tomorrow.

friday – mcc – weekly summary

End of another week. A good way to end the week though – for music fans Australian radio station JJJ did the ‘Hottest 100 of all time‘ – was great to listen too – and the commentary provided by the DJs as great!

mcc entry, friday

MCC: Macarthur Coal looks to have formed a small scale eve and eve double bottom. I entered this on friday with an entry target set in advance, which may have been a slightly risky entry – however it has closed above the mid point of the pattern, making this a valid double bottom formation. Based on this pattern I have an immediate target of ~$7.50. Over time I have seen resistance between 6.70-7.90. Lets see how this plays out.

Weekly scan for System A – No results.

On another note – what is the impact of negative interest rates? I found an article at the ‘Cumberland Advisors‘ website interesting regarding the Swedish central bank (the Equivalent of the Reserve Bank of Australia) moving to negative interest rates – read more here.

trade idea bhp-2

bhp today - daily

Continuing the paper trade on BHP from this post.

Todays action looks like a spinning top, suggeesting indecision in the price. This is reflective of the ASX today.

Maintain the position.

today – mml – chc

Market still choppy and a bit ugly at the moment. Driving me out – how long this lasts is anyone’s guess.

Before getting into tonights commentary, I have to comment on this article in the Wall Street Journal. Fancy that – we have price volatility and there is a view that traders should be stopped – I wonder if there will be more talks like I heard a while ago referring to retail traders effectively losing the right to buy, and therefore leaving all the transactions to funds to manage. Hmmmm…. me thinks I could comment on those with vested interests maybe trying to protect their patch. Oh well – maybe this discussion will just go away.

chc 9-7-09

CHC: exited today after falling through stop loss for a 13% loss. Looking at this trade I had a number of opportunities to exit the trade that I did not take – and the unfortunate bit is that I would have been in a better financial position if I had. It was clear the price was falling on the big black candle the week after I opened the trade, after which the price has declined every day. I do note however that the price has not fallen as fast as my other positions that were closed out earlier.

The actual error I made in this trade is however my exit today. The stop loss was actually triggered the day before yesterday, and I failed to exit cleanly… a slow exit….I thought I might be able to get an extra cent so put my sell order in at a level that was never filled – leading to a worse position to exit from today.

The learning -> when the stop is hit, take it – don’t second guess it.

mml 9-7-09

MML: entered a long position in Medusa Mining today. The reasons for entry are:

- looking for the gap a couple of days ago to become support

- share price is at all time highs

- my ATR based exit formula seems to be tracking to the price fairly nicely

- volume has been healthy over the last few months

Note – all my entry and exit prices are sent on twitter as I note that they have taken place. Sometimes I don’t know if a transaction has taken place as I don’t know until I get email confirmation, due to the fact that I can’t observe the intraday prices in general.

Any queries of comments to me, feel free to post…

trade idea bhp-2

Continuing the paper trade on BHP from this post. Entered yesterday a short position at $32.15 (notionally).

bhp 8-7-09

The price dipped today in line with the general market, but then recovered better than many others. The price seems to have bounced from the support (arrows), and will continue to watch to see if this holds.

Current conditions are: Stop Loss at $33.68, target $27 (earlier support).

BHP is a large company on the ASX so will also keep an eye on the All Ordinaries (xao) as they appear highly correlated since early March this year.

Review of other stocks in the market tonight has shown me a number with long tails, demonstrating bearish rejection later in the session. If this continues into tomorrow, this may well be a brief trade!

all ords today

Looking at todays All Ordinaries bearish rejection is clearly seen, although in the medium term the outlook is still bearish. As always I whould wait for a confirmation before entering a long position.

A number of my other shares that I follow lately also exhibited bearish rejection, and are on or near lines of support.

S0 – How to trade the position in reality? I contacted my broker (Commonwealth Securities) and despite short trading being allowable on the ASX, they are currently not offering it yet (no explanation given). This leaves me with OTC CFDs, ASX CFDs, options and warrants.

Over the last year I have found that warrants are a reasonable instrument for small positions – but only with some providers. With a long dated warrant I get the benefits of a CFD without the margin calls – but watch out for the barrier! Some of the providers seem to remove the buy/sell positions at times of high volatility, so I avoid those companies.

Options are also a good instrument, but I have found I only really get a good price if I have time during the day to manage the entry – which given my day job rarely happens.

So for the purposes of simulation, I am going with a long dated warrant – say BHPXOQ.

To be continued…

today – mnd – tap – fmg

Lost a few positions as indicated yesterday from my close of day prices.

TAP close

TAP: Closed the position for a 10.2% loss. If I stuck to the trendline I would have exited the day after I pyramided in my position, but I was using a trailing ATR based stop loss, which kept me in a little longer. The close two days ago missed the stop loss by 2c so waited to see if it bounced – which it didn’t.

MND: Closed this position for a 9 % loss. Based on ATR based stop loss combined with perceived support point.

FMG: Closed this position for a 14% loss. Based on ATR based stop loss combined with perceived support point.

So – ultimately not a good set of trades as far as portfolio performance goes, but good in terms of following my plan.

Leave a comment

Leave a comment