Archive for July, 2009|Monthly archive page

trade idea – bhp

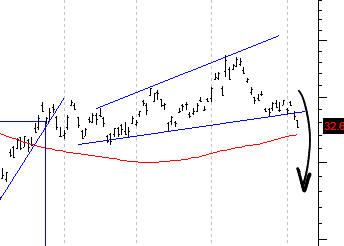

bhp - breakout (failed) ascending broadening wedge?

BHP: trade idea.

The graph to the right is BHP from today. The price action today is a confirmation of the failure of an ascending broadening wedge. From my chart patterns bible I can see that these don’t usually give a large fall, however a fall is expected. I am interested in taking this short trade, but given my view of the all ords at the moment I’ll sit out for a day or two whilst I see what the flavour is on the ASX.

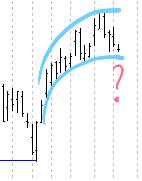

ASX All ordinaries (weekly)

Looking at the ASX:XAO (to the right) the graph is on the cusp of its next ‘decision point’ or move. If the graph were to fall out of the bands I’ve sketched I would look to short soemthing, and at the moment, BHP could fit the bill.

Of course – until I commit a cent, this is all just an idea…

Remember – wait for confirmation of a move, in line with the overall market.

today – cxs

Chemgenex trade

CXS: today closed a position in CXS for a 4% loss. For a share that ha gone up nicley over the last few months, that hurts a bit. I got stopped out at 60c, which is helpful – if it hadn’t fallen so far I planned to exit when the share fell below the upwards trend line.

The original entry was selected for two reasons: firstly an intraday breakout through the resistance line, and secondly because of the very high volume that time – the share came to my attention through a ‘heat’ style market map.

Gotta say – the years not getting off to a very good start!!

Looking through my graphs tonight, I’ve trigged a few stops and given the action on the US markets tonight I guess we may gap down on opening – so I expect to experiance some pain tommorrow.

On another note – the System A scan on the weekend returned nothing.

today – ewc

ewc open

EWC: re-entered this stock today, bought on stop I set yesterday after I was stopped out of the previous position. I may have entered too early, but I suspect that will be guided more strongly by the overall market sentiment, which appears to be playing a stronger grip over shares over the last couple of days. As usual, entry is easy – now to manage the trade.

new financial year – ewc – trade frequency

I have spent a small amount of time reviewing my trading statistics for the previous financial year tonight. There is one thing that strikes me straight off – and that’s the raw number of trades I have performed. More than any other year, and I do have a few years of stats to look at. Whilst I fundamentally knew it, it still grabs the attention when reviewed – the transaction count trebles over other periods. This is to expected I suppose as in a bull market, my System A and other trades I do are more system driven, and they ‘hug’ the trade better, generating more profit, less costs, less activity – simpler overall trade process.

Once System A stops firing I start to trade patterns – taking more lossy trades, more transactions, more hunting – more time intensive technical research. Again it begs the question – would I have been better off sitting on the sidelines whilst this Bear market played (plays?) out. I can say confidently I took some great trades when the market was turning 3 months ago – and I would have missed these if I sat ‘waiting for confirmation’.

So how do I work out ‘what I would have done to pick the Bear, and stop trading until … the Bulls arrive’. I spose that can be my next project for when Systems A and B are running again. Ahhhh… research.

The blog entry at RatioTrader ‘No Plan, No Rules, No Success‘ seems pertinent here. Am I improving? The first step is to determine my measure of improvement. By my reckoning, the ASX All Ords lost 25.9% in the last year – so I out-performed by 15.5%. That is one measure. Do I stick to my trade plans – on the whole yes, more than last year, which was more then the year before. This is something I track. Since starting this blog, I have only one trade that I did not stick to the plan on (ok, not a long time period) but that is specifically one of the reasons I am logging this. Maybe someone might learn from this, and if not – at least I will!

Anyway more on all that later, todays trade ->

ewc close for 9% profit

EWC: Logged on to find my position in EWC had been stopped out in early trading for a 9.5% profit.

This is one of my preferred trading stocks – good breadth in moves, and sufficient turnover to be able to get in and out. On my last trade with EWC I exited using a profit target, and looking at this graph, a profit target would again have been the way to trade it – resistance around 0.72 puts a bit of a ceiling on price action for now – and in this case would have doubled my profit. Regardless – I am setting the plan and executing it, and its paying off.

Looking forward

On a more general note, the ASX has been on a good run the last 3 to 4 months, and it has treated me well. Looking over my graphs tonight, I have seen a few stocks at the same time dip – ever so slightly mind you – below their uptrends – a sign of weakness. I don’t use indicators as a general rule, but I’m tempted to grab the books and see if they are signalling overbought. I survive basically with moving averages, and sometimes OBV – I need to refer to the books for anything else, which tends to mean they don’t get used much. Shares I am thinking of here are TAP, ROC, PAN, MCC amongst others. They are all resource type stocks so maybe just that sector is coming off the boil… will look into further.

a quiet day – end of the financial year

A quiet trading day today, a few of my stocks dropped a little today, with one closing 0.5 cents above a stop – so I may have something to do in the morning.

I noticed today David Jones (DJS) making a yearly high, and looking in a healthy trend, but I’ll steer clear for now. I’ve got enough to watch.

The actual news for me today is that its the end of the financial year. Its time for me to sit down, review my trades for the year as a whole, and work out what I could have done better – and if what I am doing makes sense.

My initial cut of my numbers shows that I have had a performance of -9.5% for the year -> Yup a loss of 9.5%. This includes all commissions, transaction fees, data fees, printer ink etc. My next action is to work out what the funds I was looking at this time last year did, and whether my trading was ‘an intelligent use of my time’. Of course once I do a crunch of all the numbers this result may move by a point or two, but i’ll get to the bottom of that on the weekend.

System A has not selected a trade in the last 6 months at least – but I’d expect that given its a basically long seeking system in that starts firing in a bullish market.

On another note, once I have finished the rewrite of System A for the US market I expect it to locate stocks like those in this blog from FundMyMutual. He lists 11 stocks he terms ‘The Untouchables“, amongst them VPRT (something I hold, but not documented here as I’m sticking to Australian stocks in my writings), PWRD and others.

And on to the next financial year!

Comments (1)

Comments (1)